GL0301 - Based on Problem 3-5A

please help will give thumbs up

please help will give thumbs up

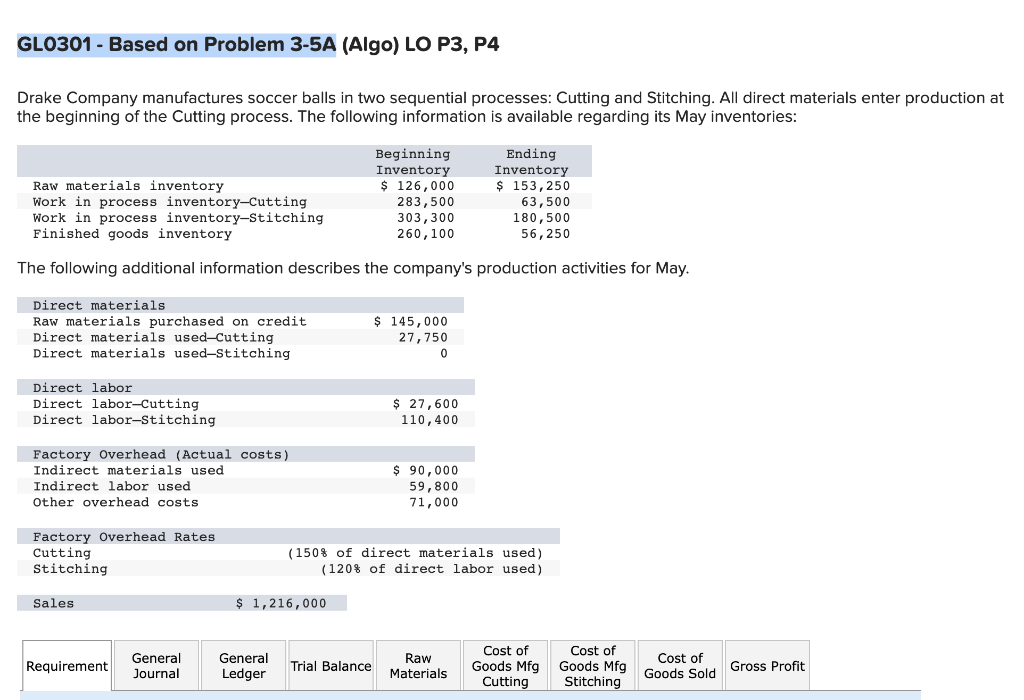

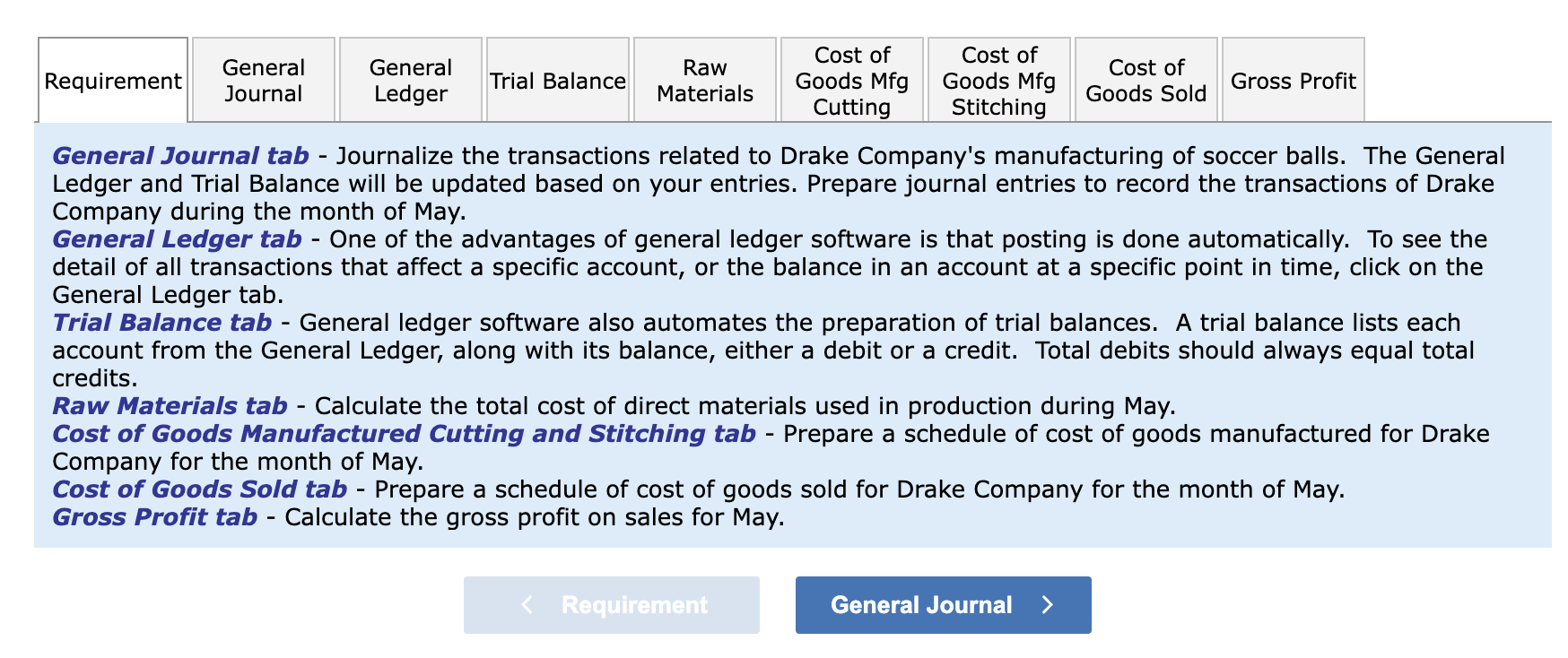

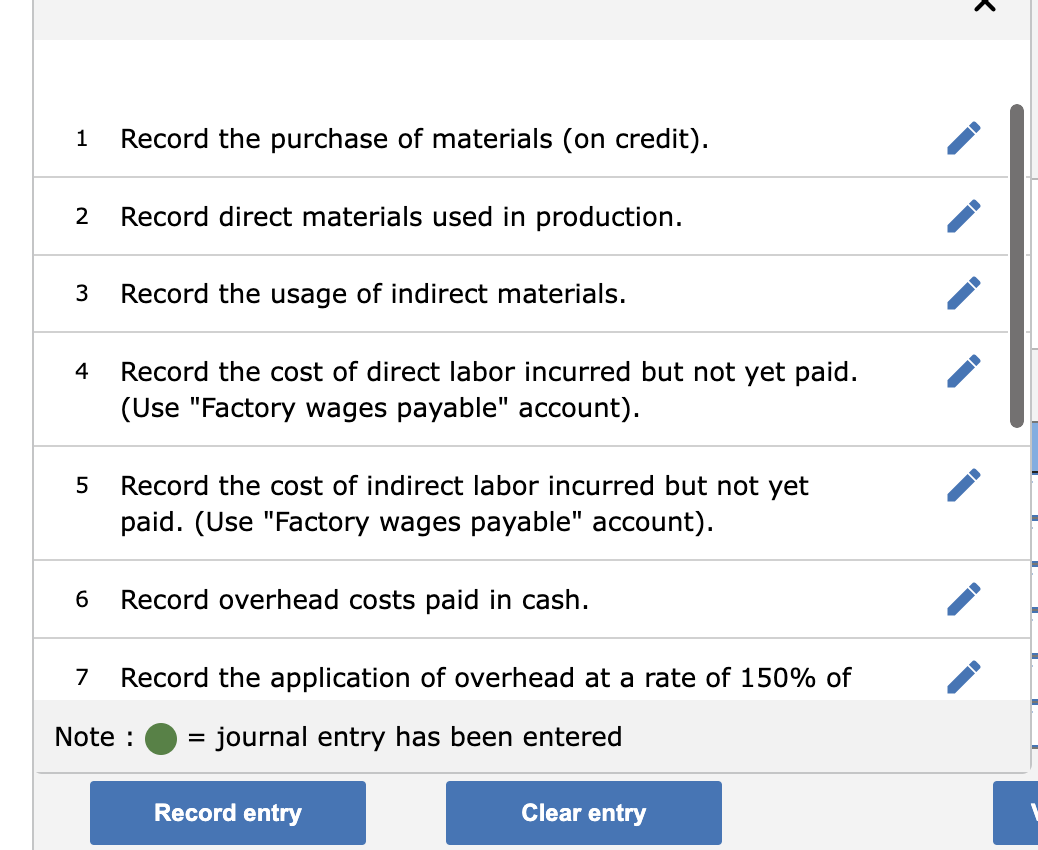

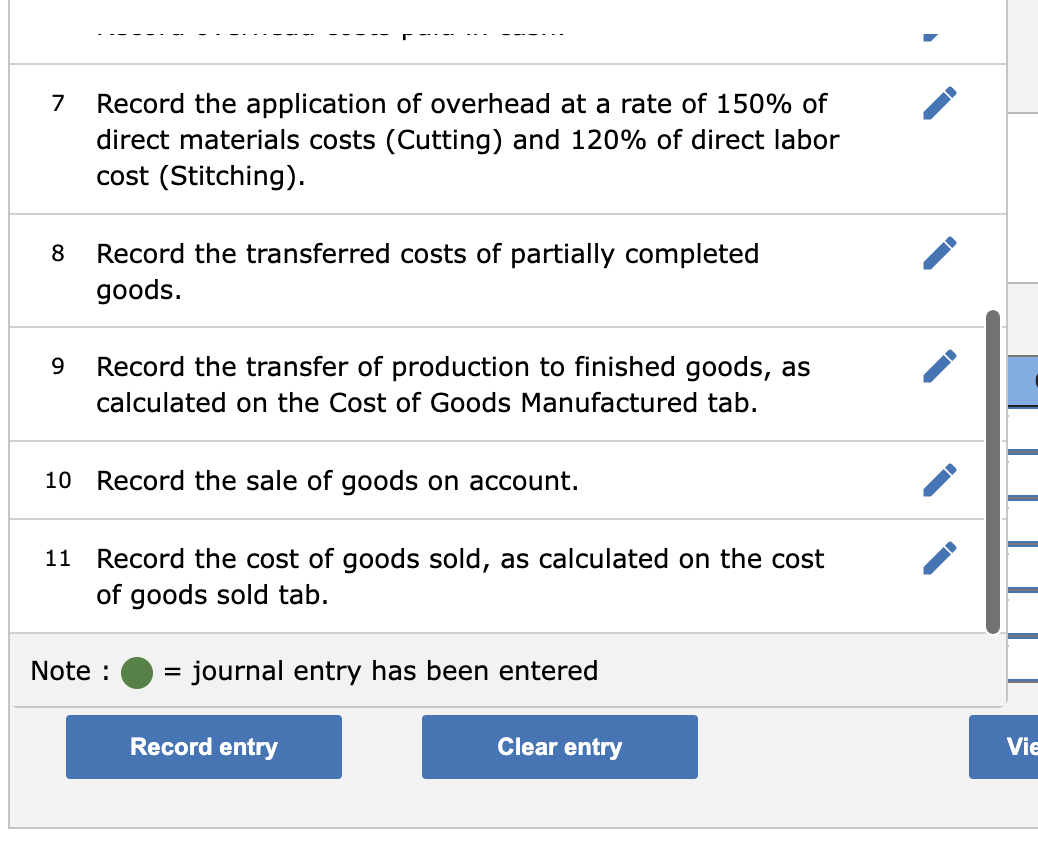

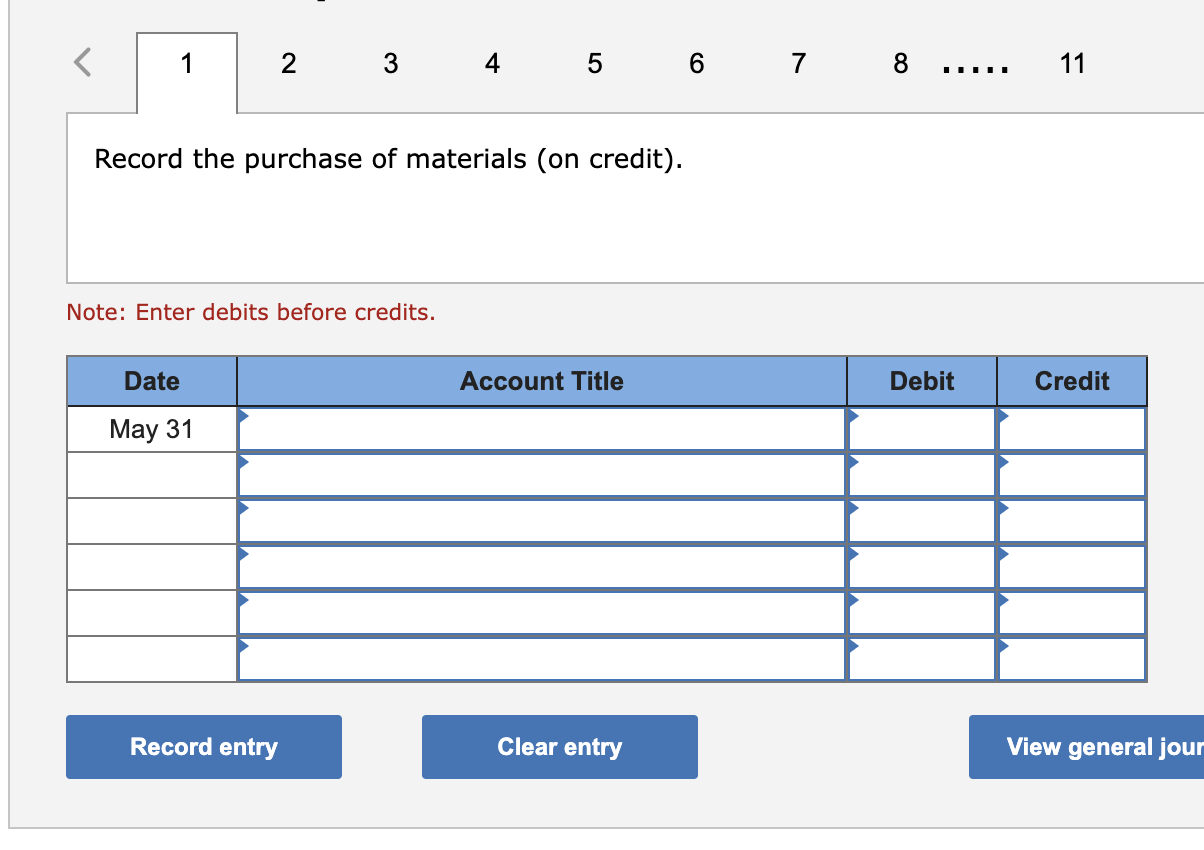

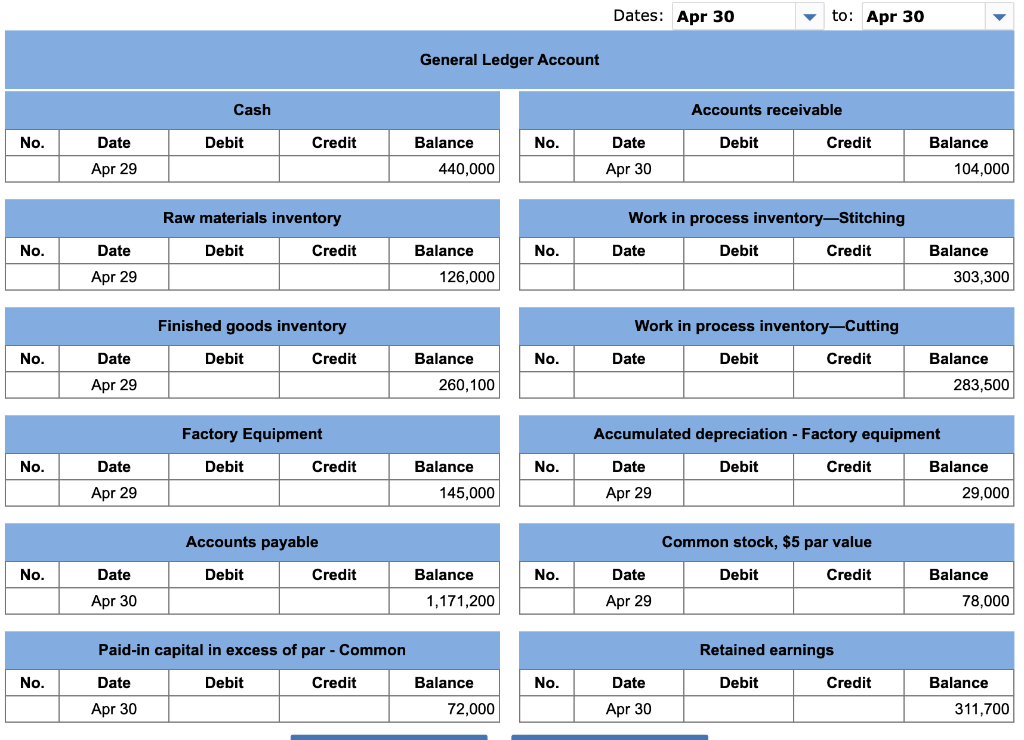

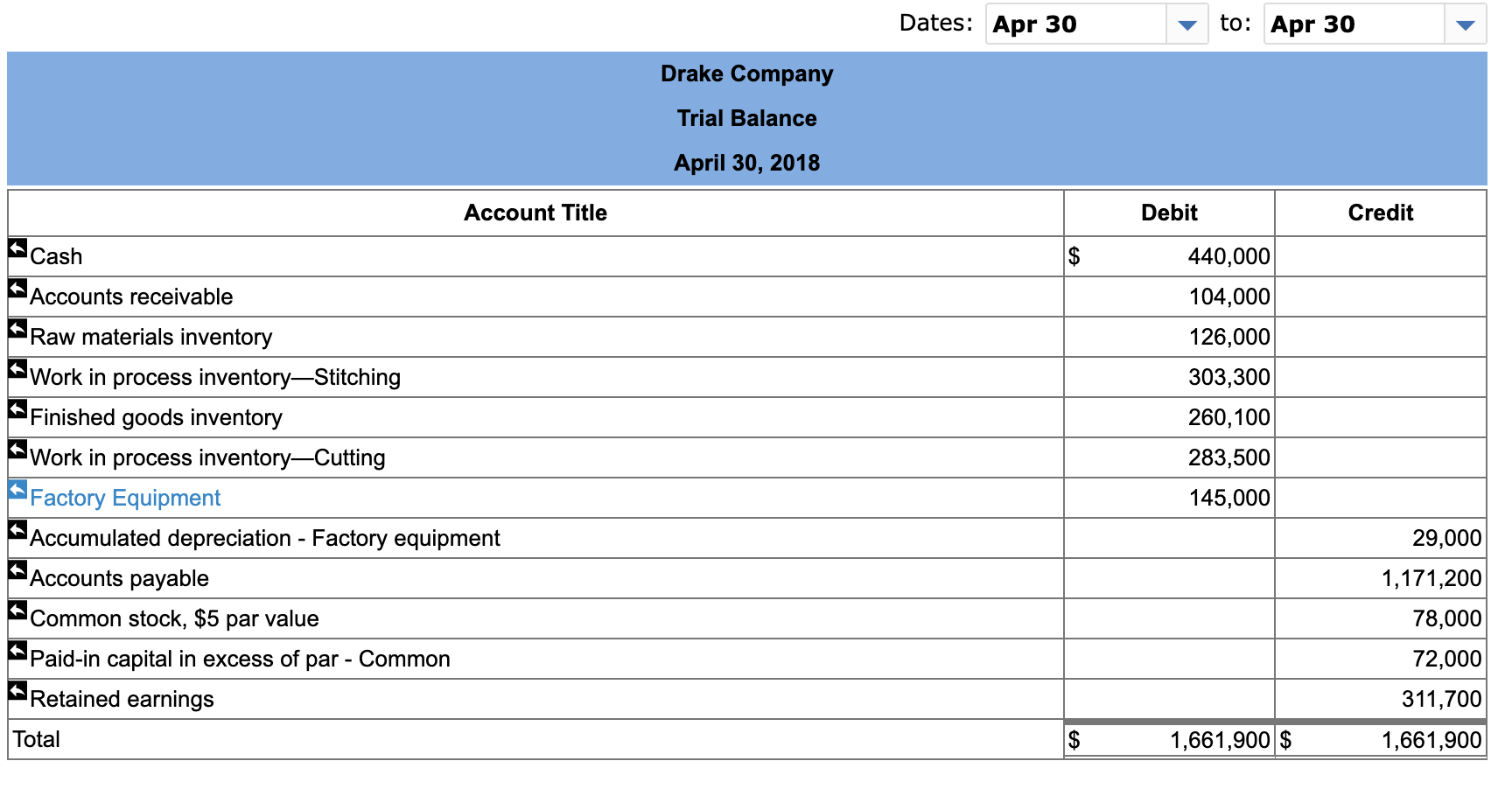

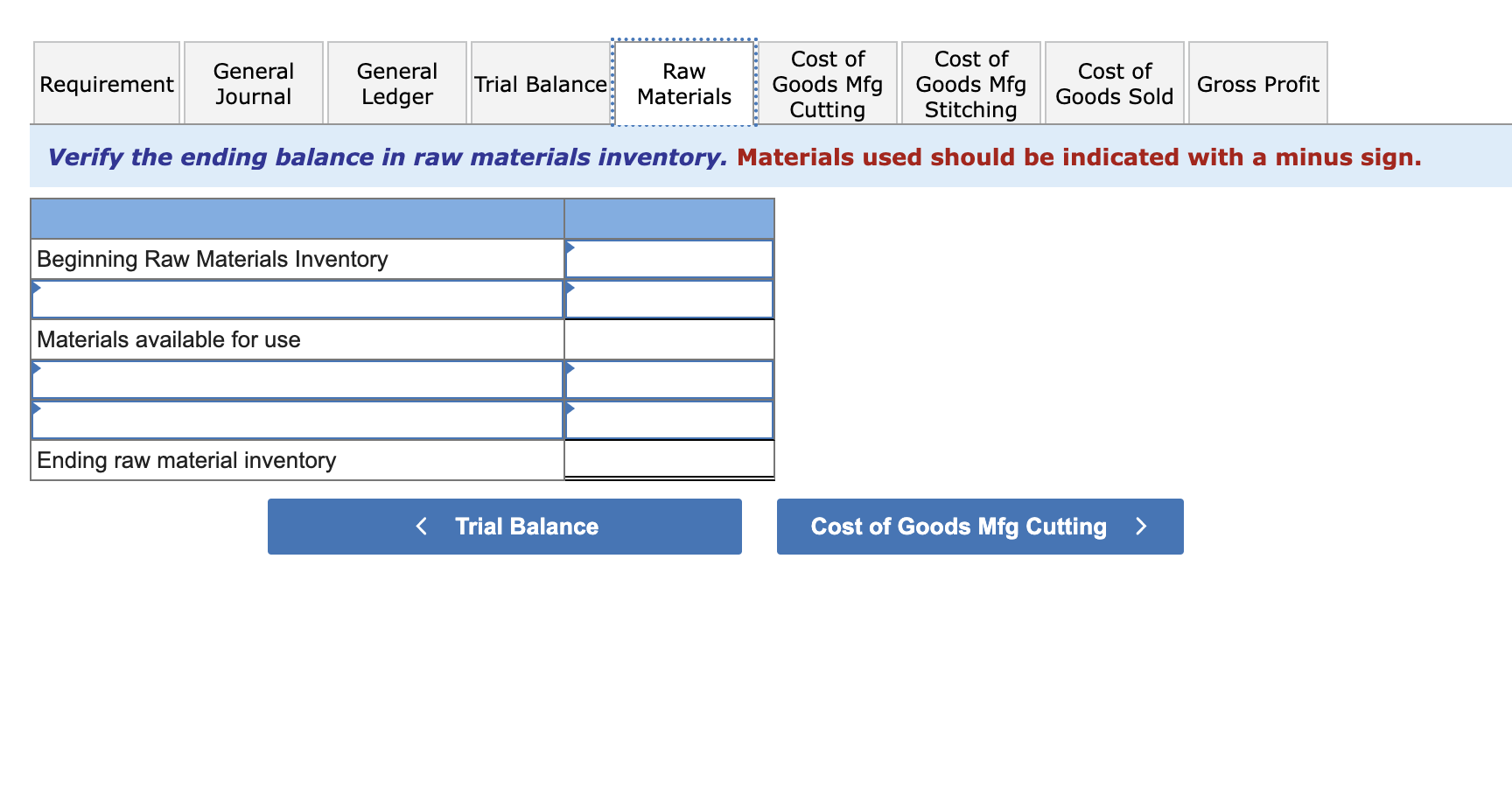

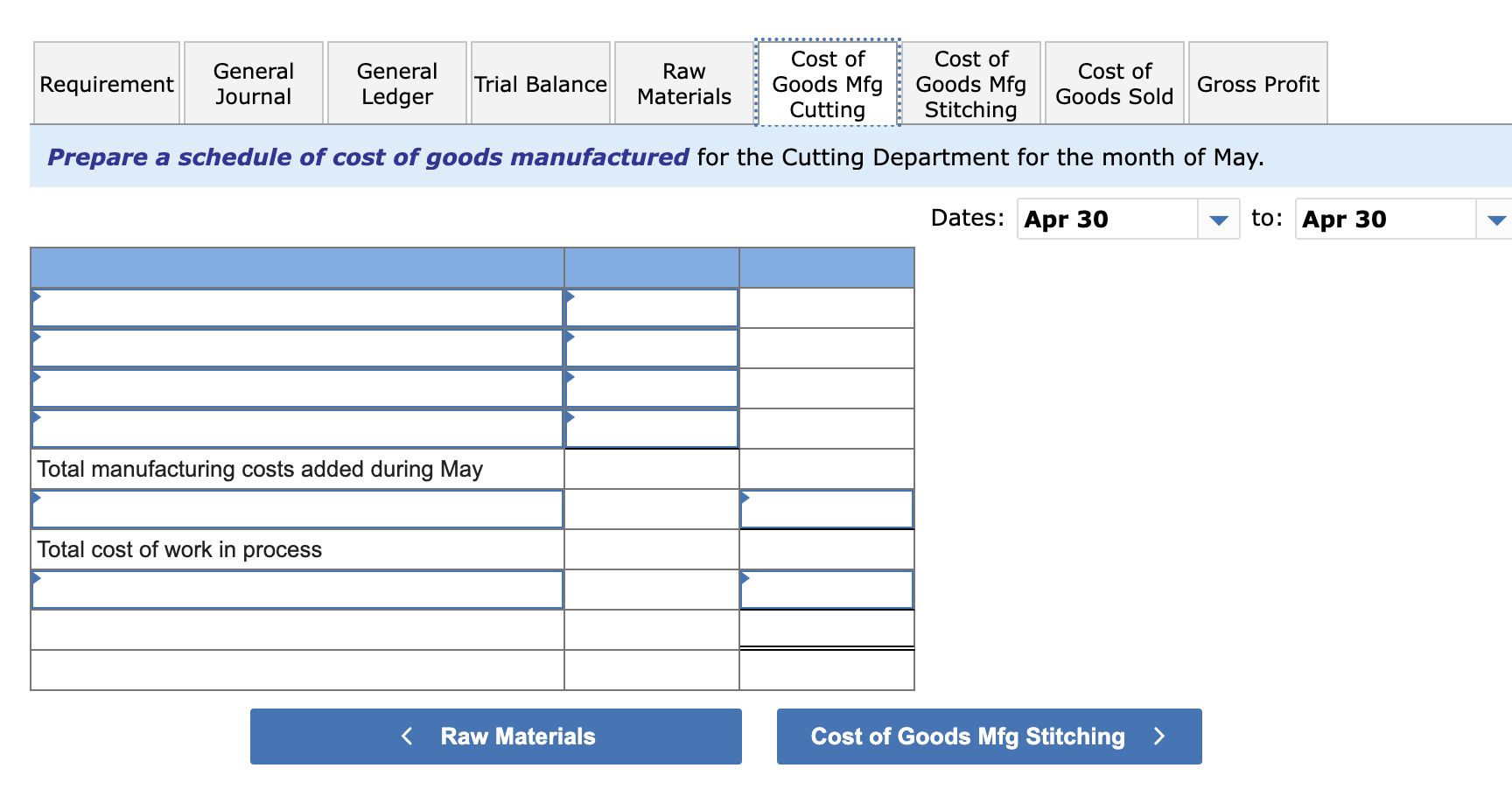

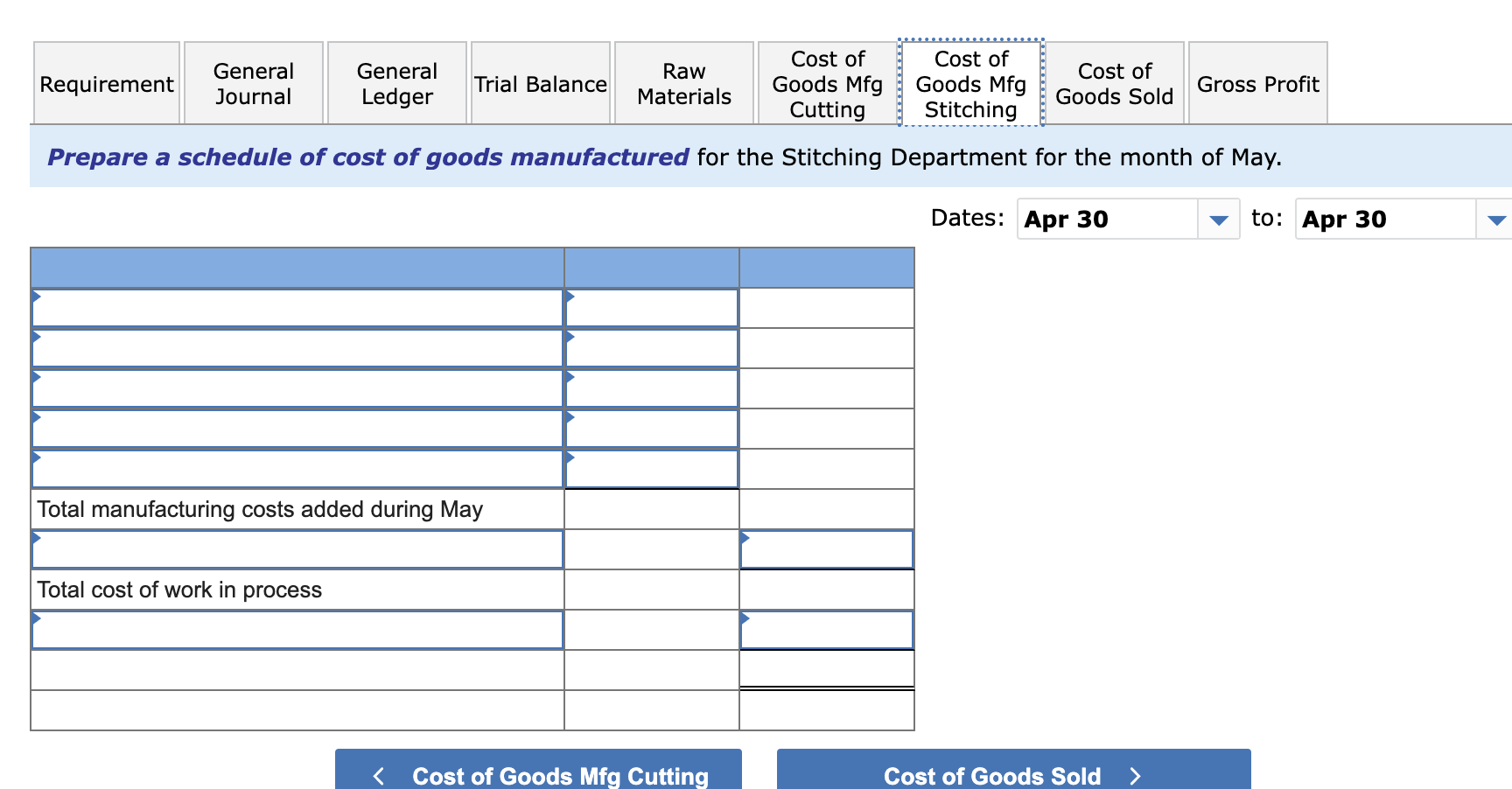

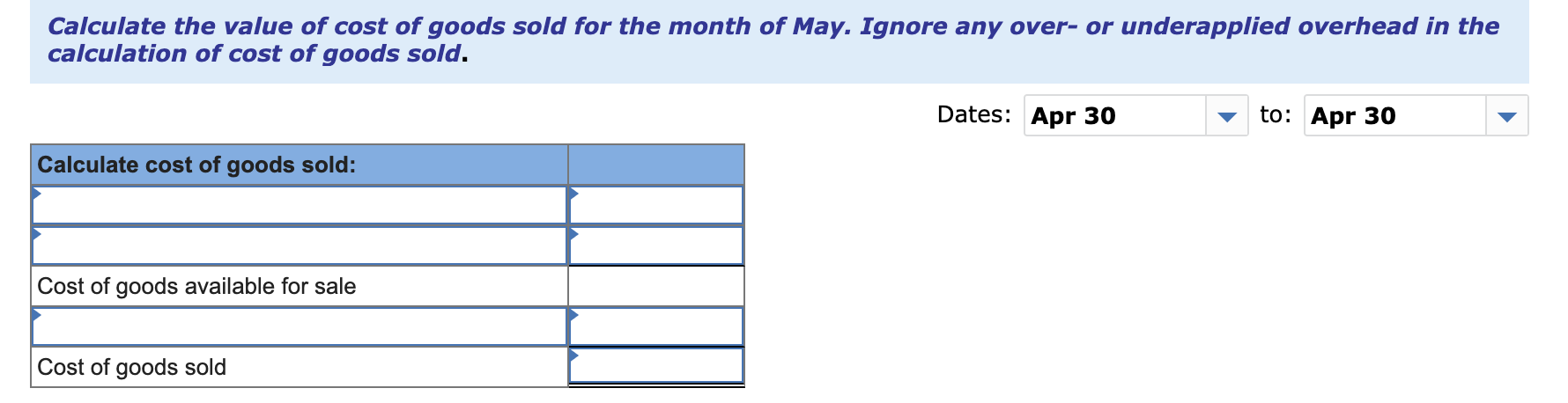

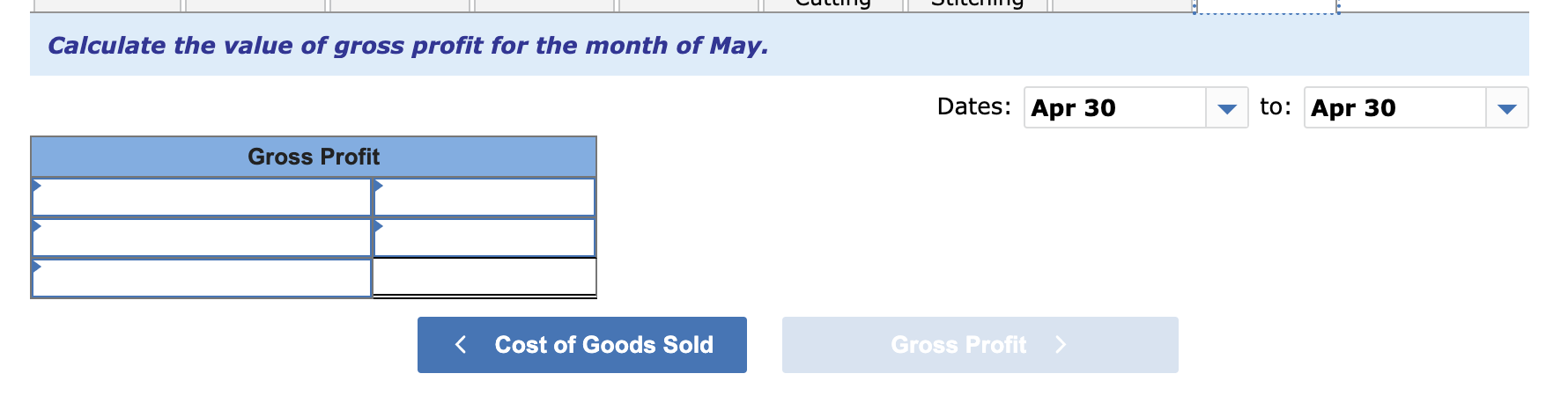

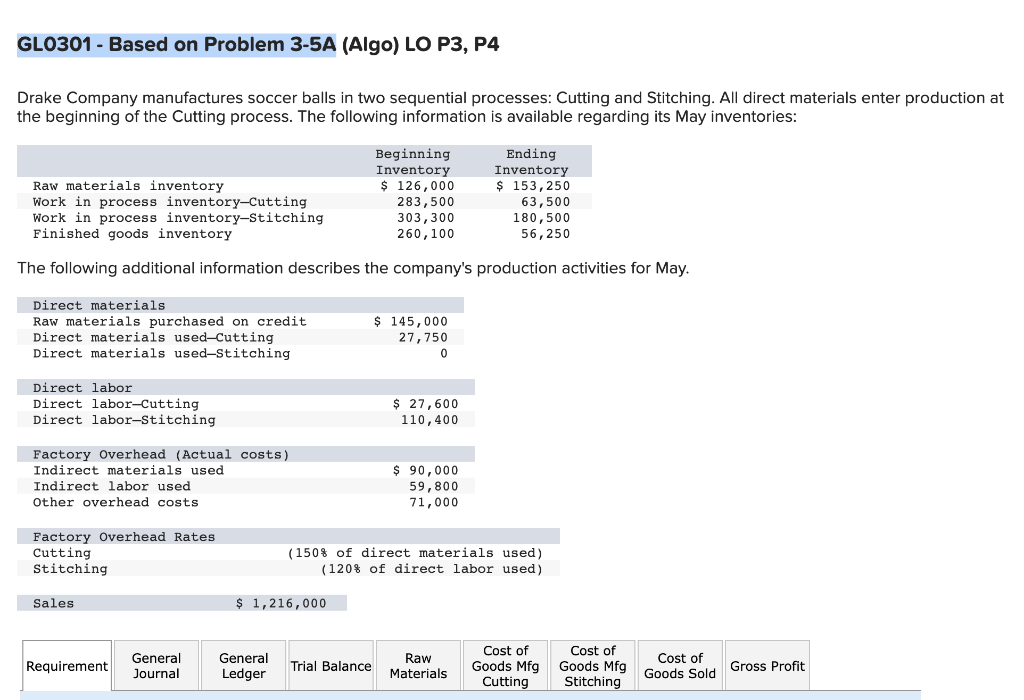

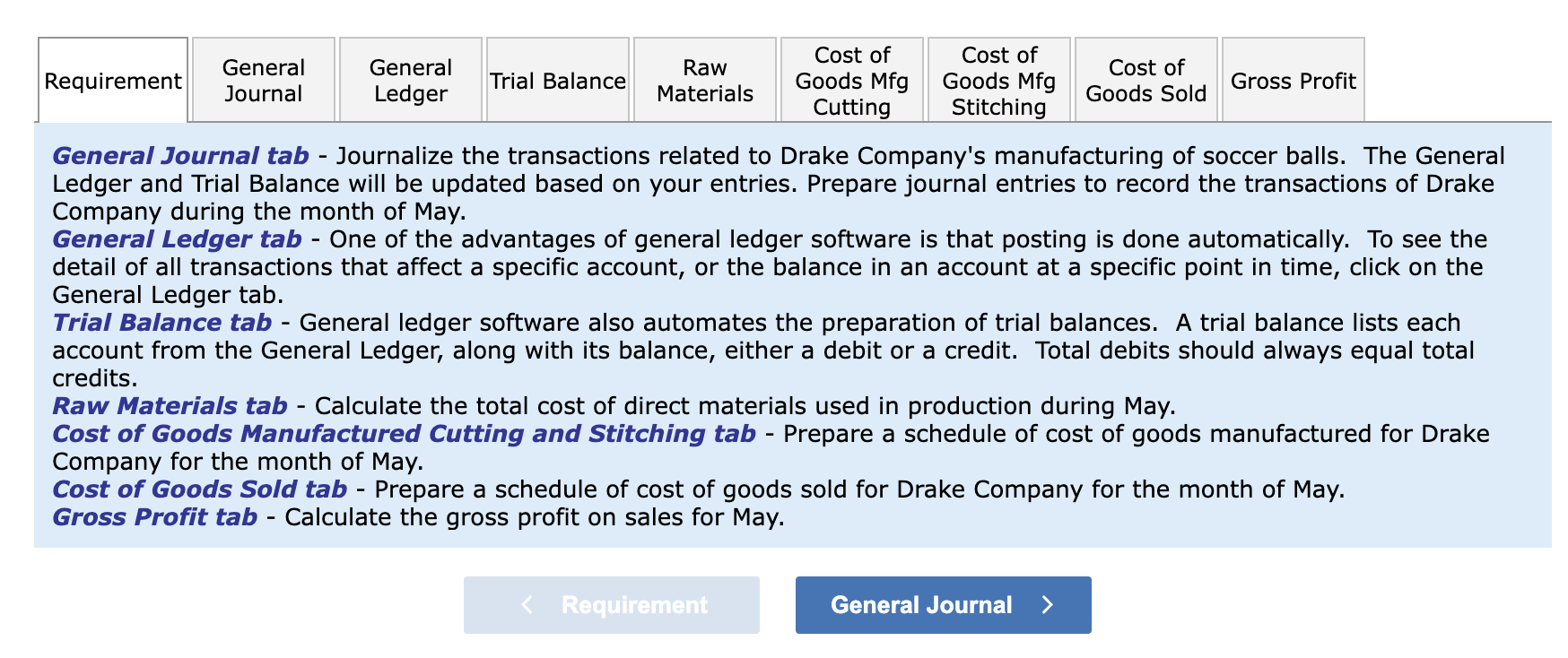

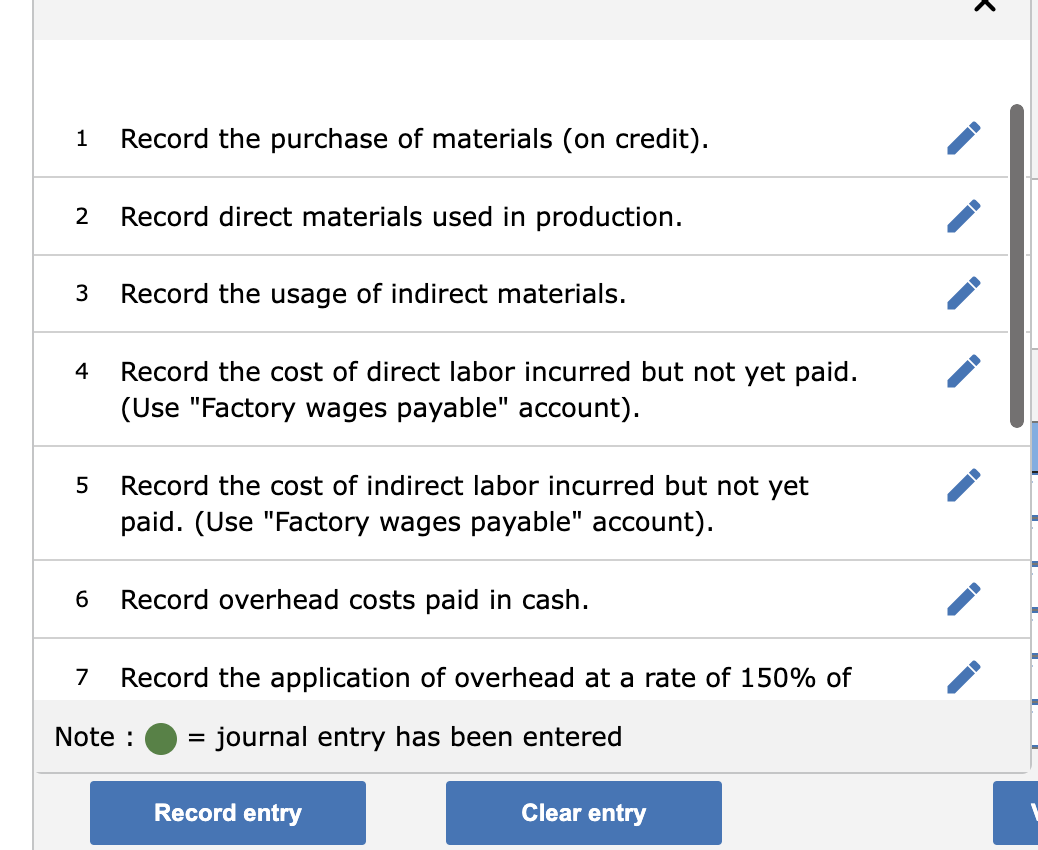

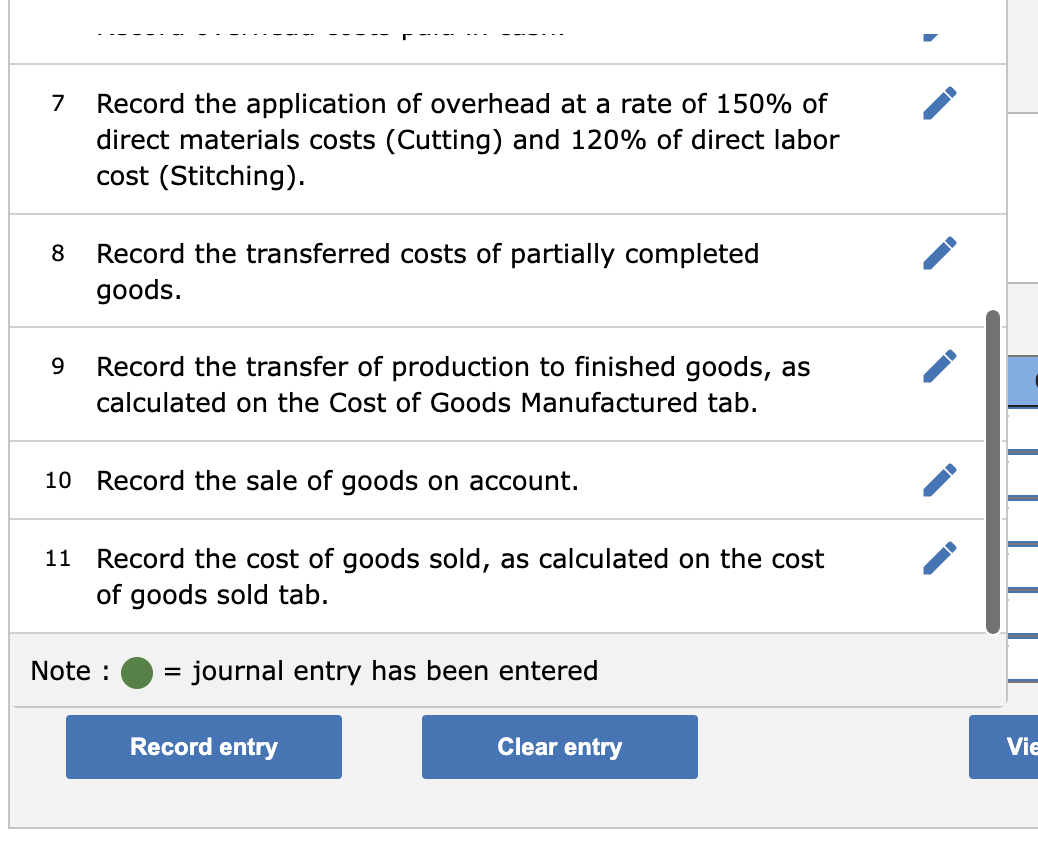

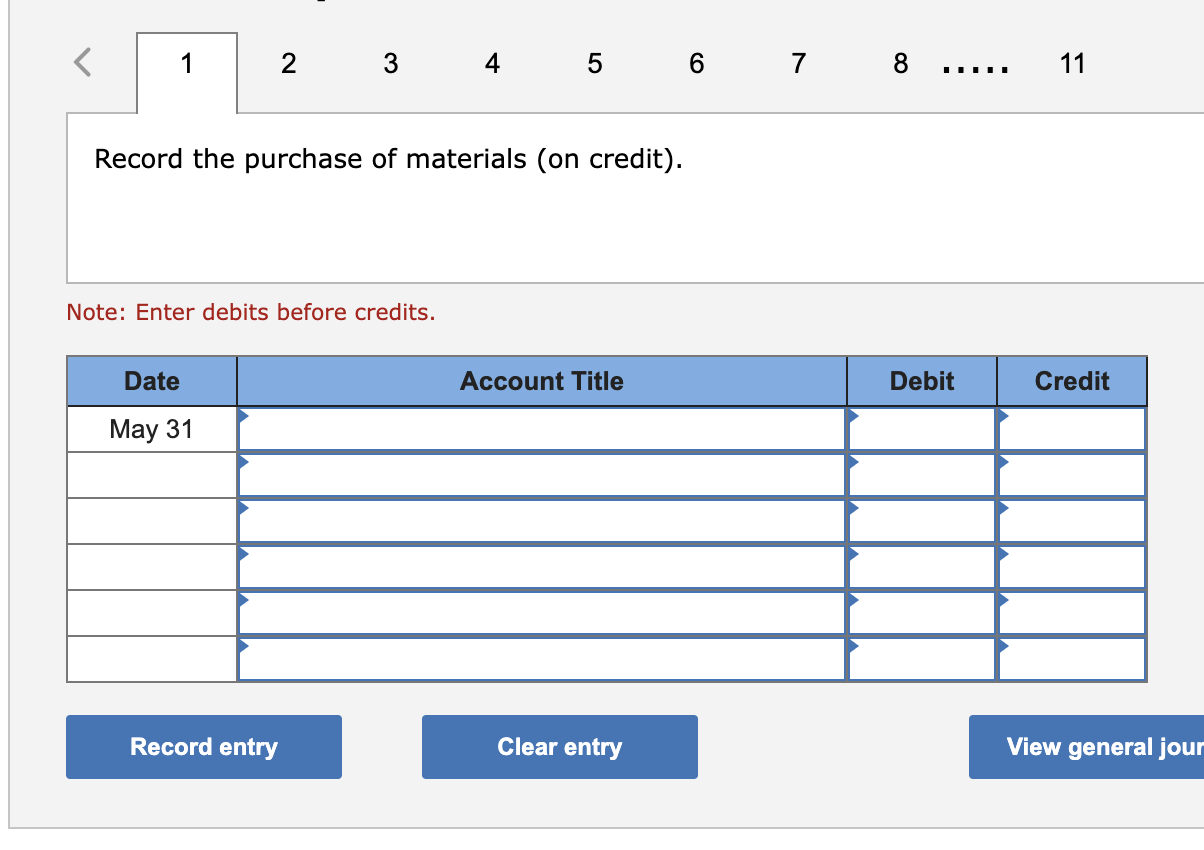

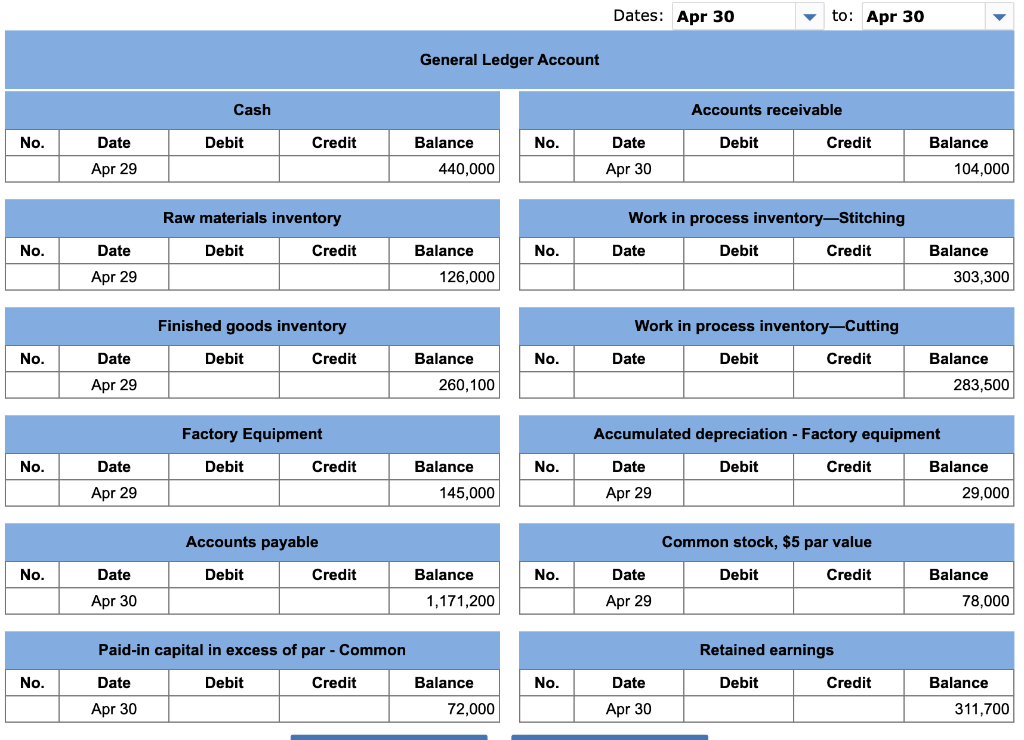

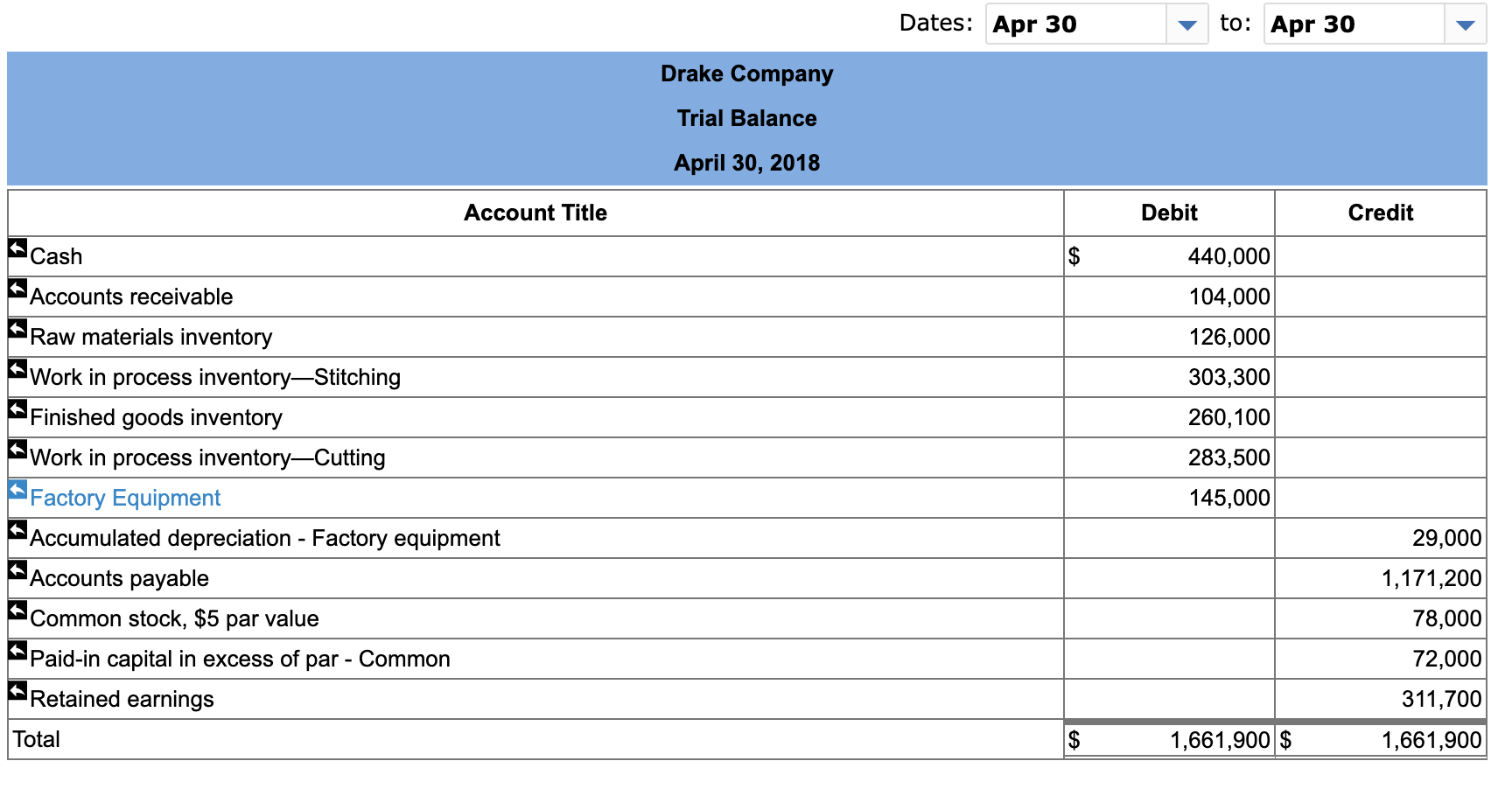

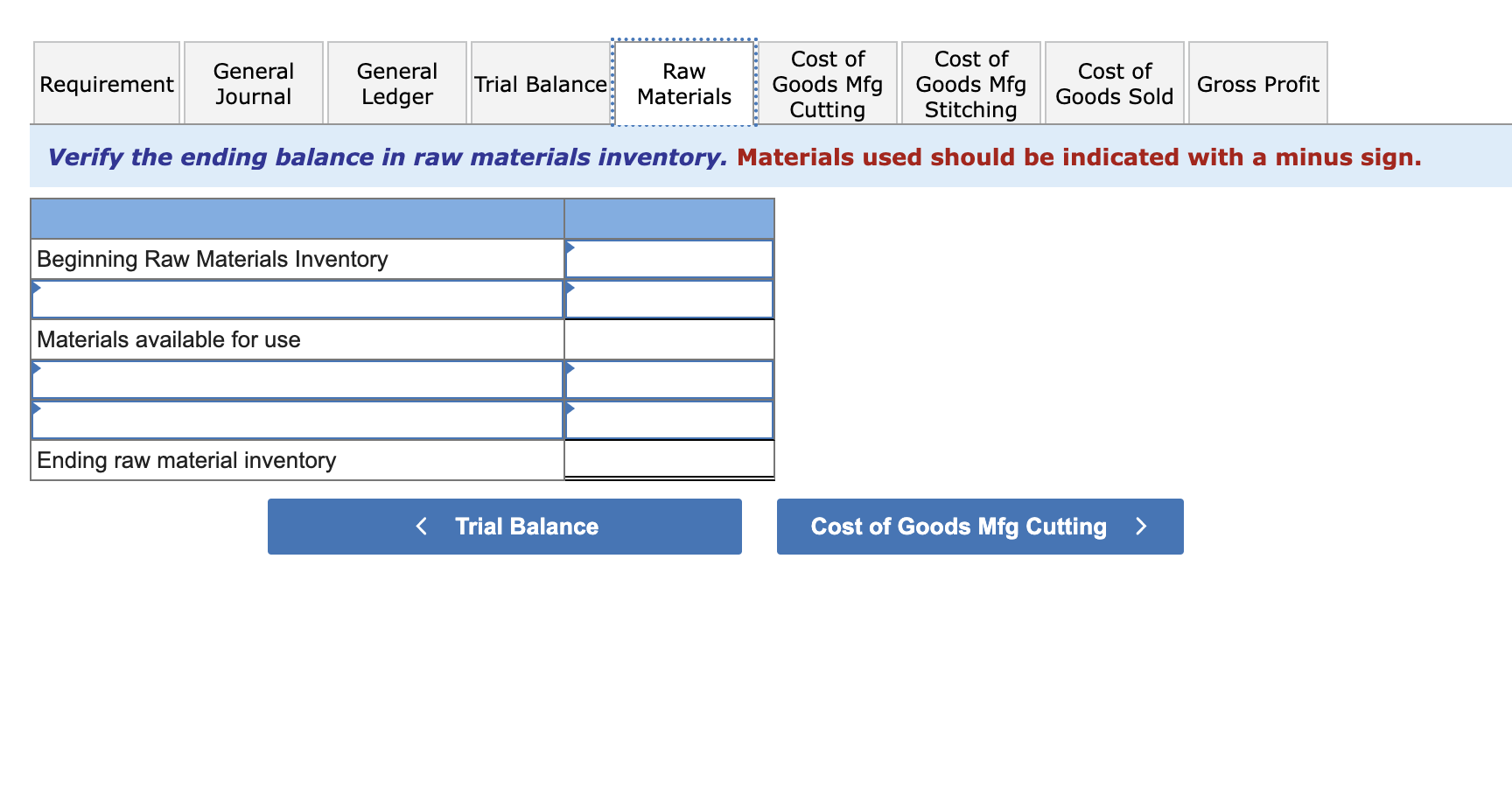

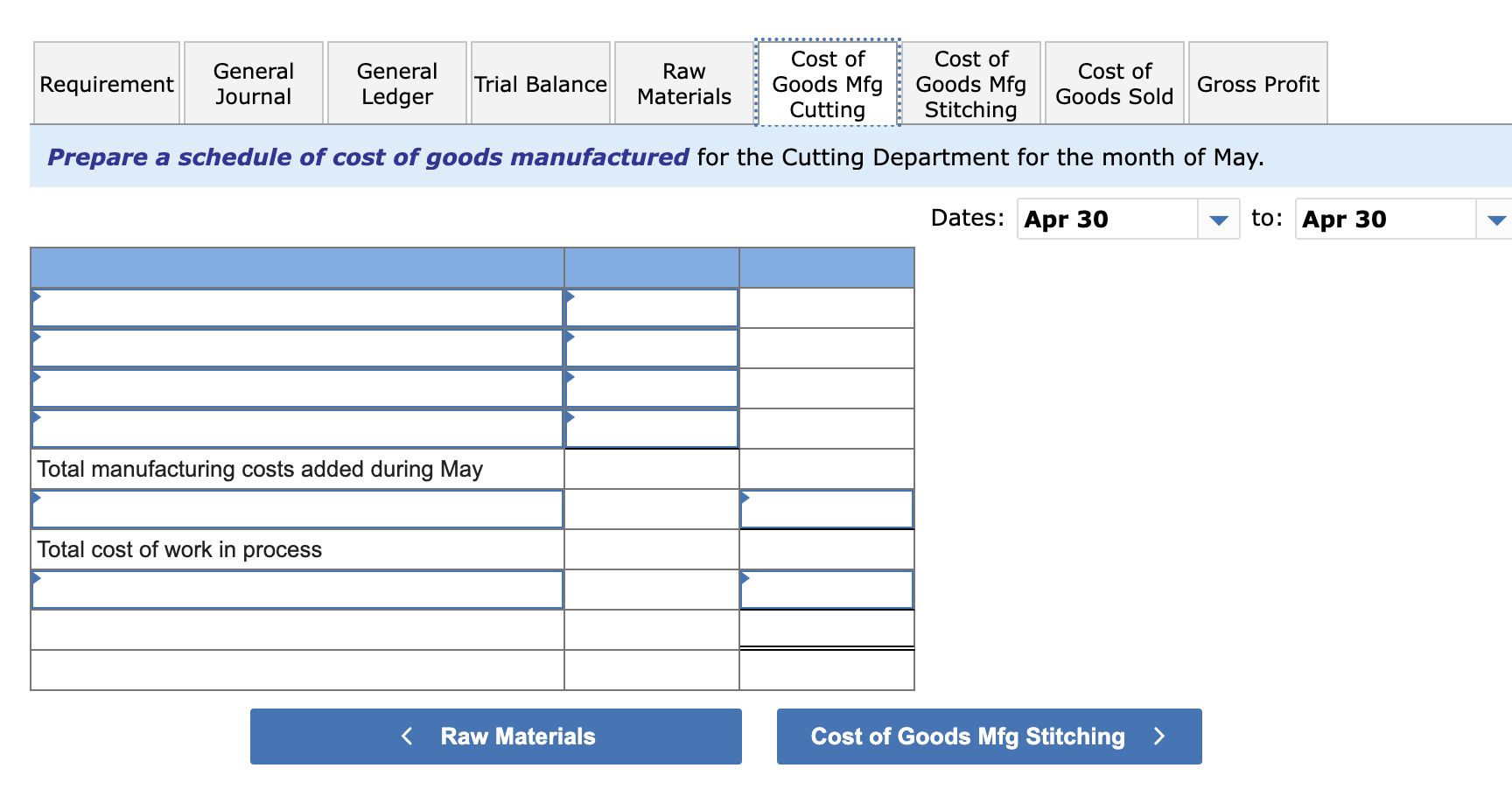

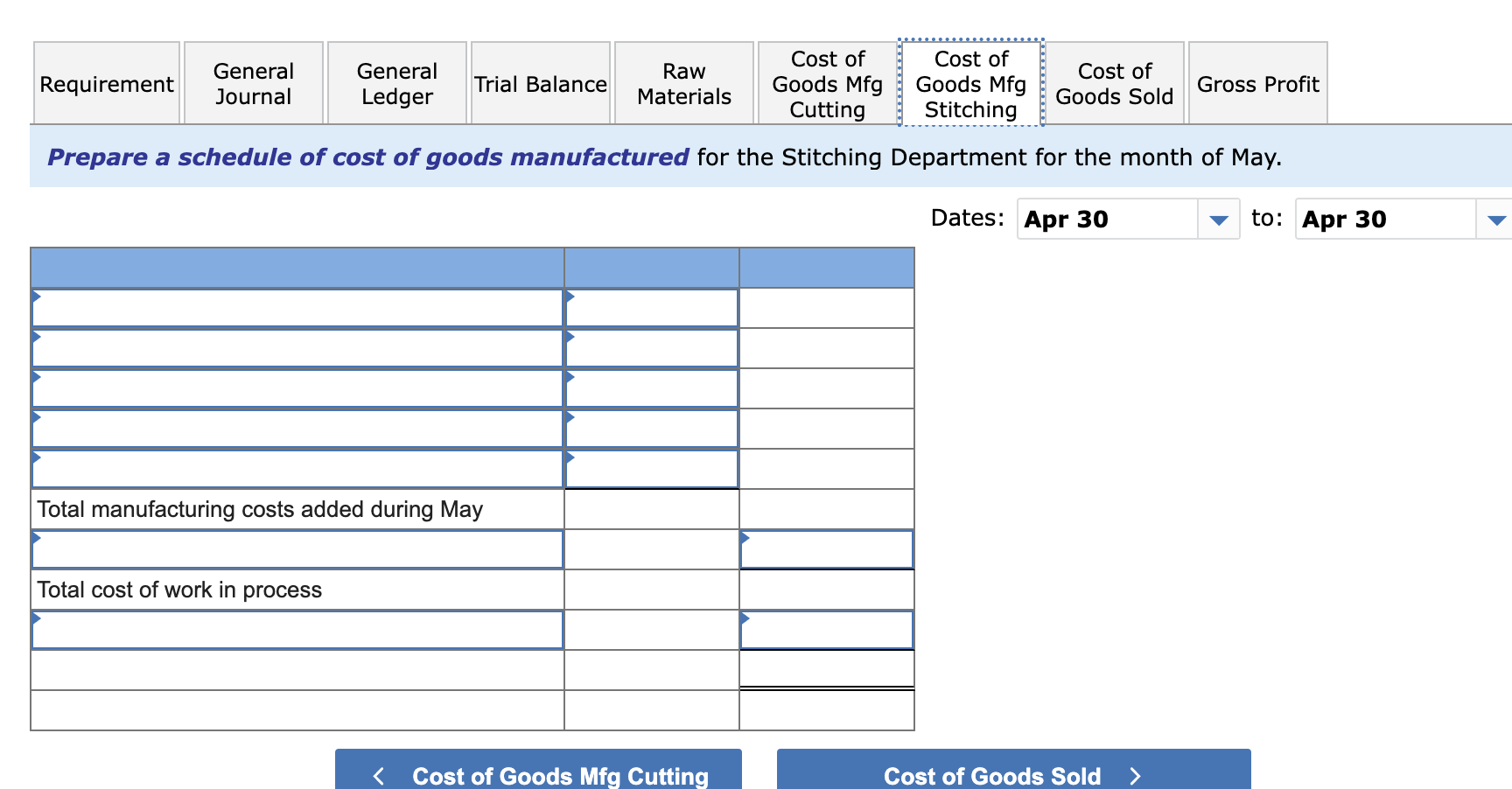

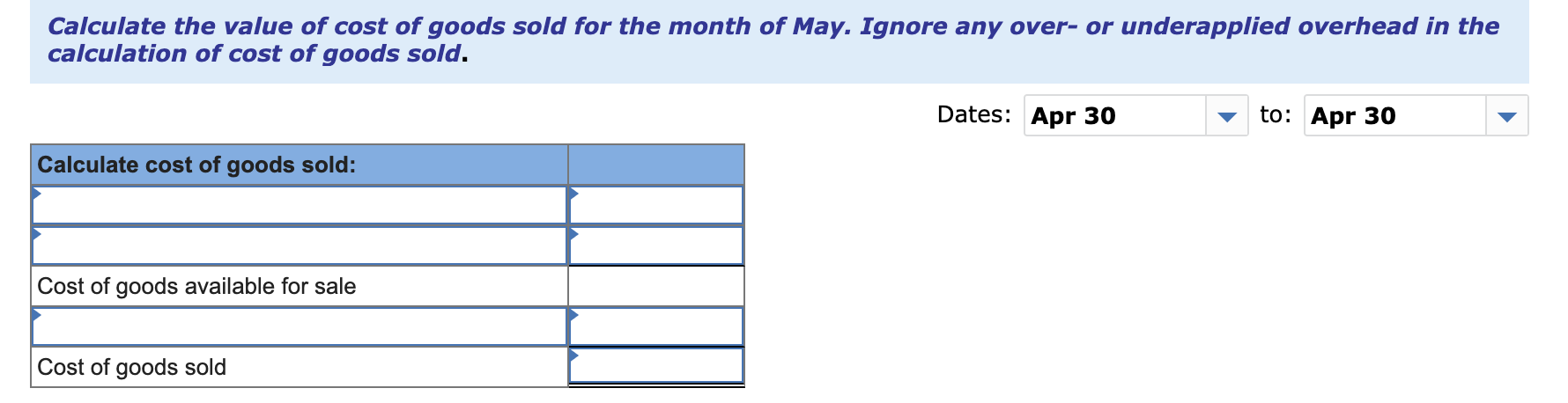

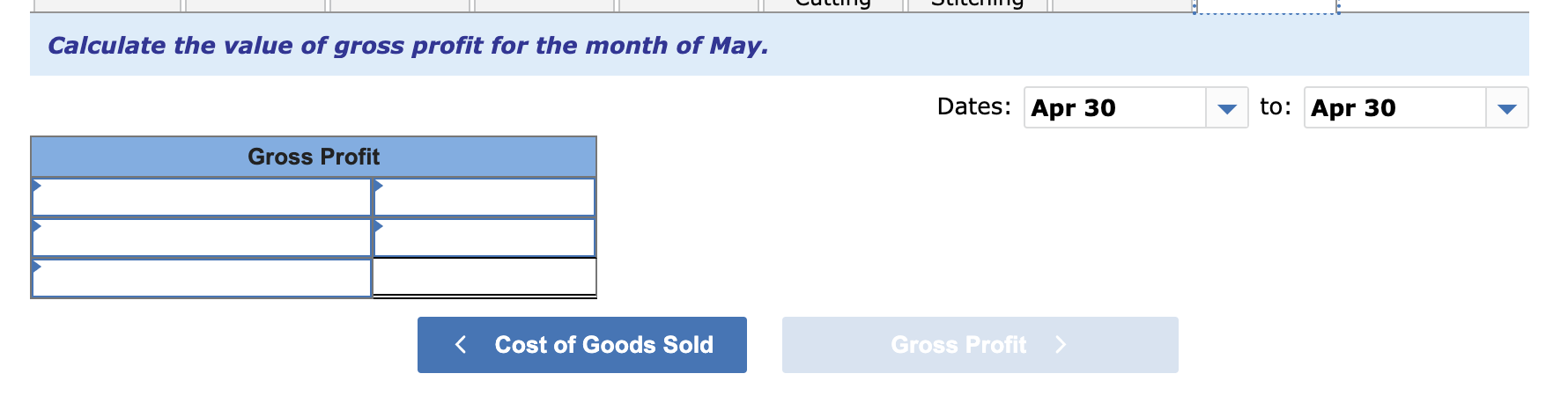

GL0301 - Based on Problem 3-5A (Algo) LO P3, P4 Drake Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: The following additional information describes the company's production activities for May. General Journal tab - Journalize the transactions related to Drake Company's manufacturing of soccer balls. The General Ledger and Trial Balance will be updated based on your entries. Prepare journal entries to record the transactions of Drake Company during the month of May. General Ledger tab - One of the advantages of general ledger software is that posting is done automatically. To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Trial Balance tab - General ledger software also automates the preparation of trial balances. A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total credits. Raw Materials tab - Calculate the total cost of direct materials used in production during May. Cost of Goods Manufactured Cutting and Stitching tab - Prepare a schedule of cost of goods manufactured for Drake Company for the month of May. Cost of Goods Sold tab - Prepare a schedule of cost of goods sold for Drake Company for the month of May. Gross Profit tab - Calculate the gross profit on sales for May. 1 Record the purchase of materials (on credit). 2 Record direct materials used in production. 3 Record the usage of indirect materials. 4 Record the cost of direct labor incurred but not yet paid. (Use "Factory wages payable" account). 5 Record the cost of indirect labor incurred but not yet paid. (Use "Factory wages payable" account). 6 Record overhead costs paid in cash. 7 Record the application of overhead at a rate of 150% of Note : = journal entry has been entered 7 Record the application of overhead at a rate of 150% of direct materials costs (Cutting) and 120% of direct labor cost (Stitching). 8 Record the transferred costs of partially completed goods. 9 Record the transfer of production to finished goods, as calculated on the Cost of Goods Manufactured tab. 10 Record the sale of goods on account. 11 Record the cost of goods sold, as calculated on the cost of goods sold tab. Note : = journal entry has been entered Record the purchase of materials (on credit). Note: Enter debits before credits. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Cash } \\ \hline \multicolumn{5}{|c|}{ General Led } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 29 & & & 440,000 \\ \hline \end{tabular} Dates: Apr 30 to: Apr 30 \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Raw materials inventory } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 29 & & & 126,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Work in process inventory-Stitching } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & & & & 303,300 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Finished goods inventory } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 29 & & & 260,100 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Work in process inventory-Cutting } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & & & & 283,500 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Factory Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 29 & & & 145,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accumulated depreciation - Factory equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 29 & & & 29,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common stock, $5 par value } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 29 & & & 78,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Paid-in capital in excess of par - Common } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 30 & & & 72,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Retained earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 30 & & & 311,700 \\ \hline \end{tabular} Dates: Apr 30 to: Apr 30 Drake Company Trial Balance April 30, 2018 Verify the ending balance in raw materials inventory. Materials used should be indicated with a minus sign. Prepare a schedule of cost of goods manufactured for the Cutting Department for the month of May. Prepare a schedule of cost of goods manufactured for the Stitching Department for the month of May. Calculate the value of cost of goods sold for the month of May. Ignore any over-or underapplied overhead in the calculation of cost of goods sold. Calculate the value of gross profit for the month of May

please help will give thumbs up

please help will give thumbs up