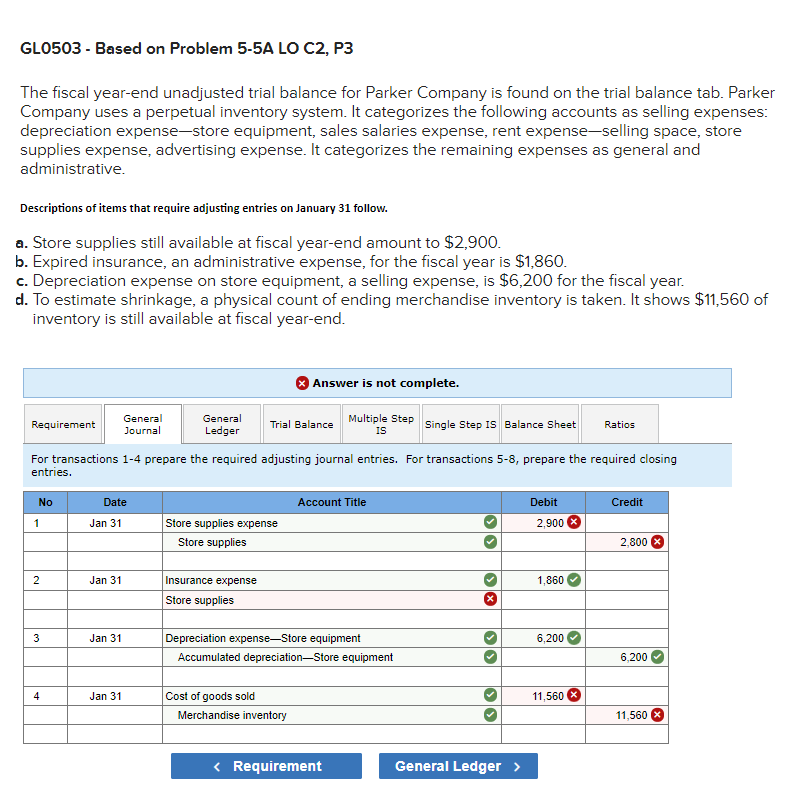

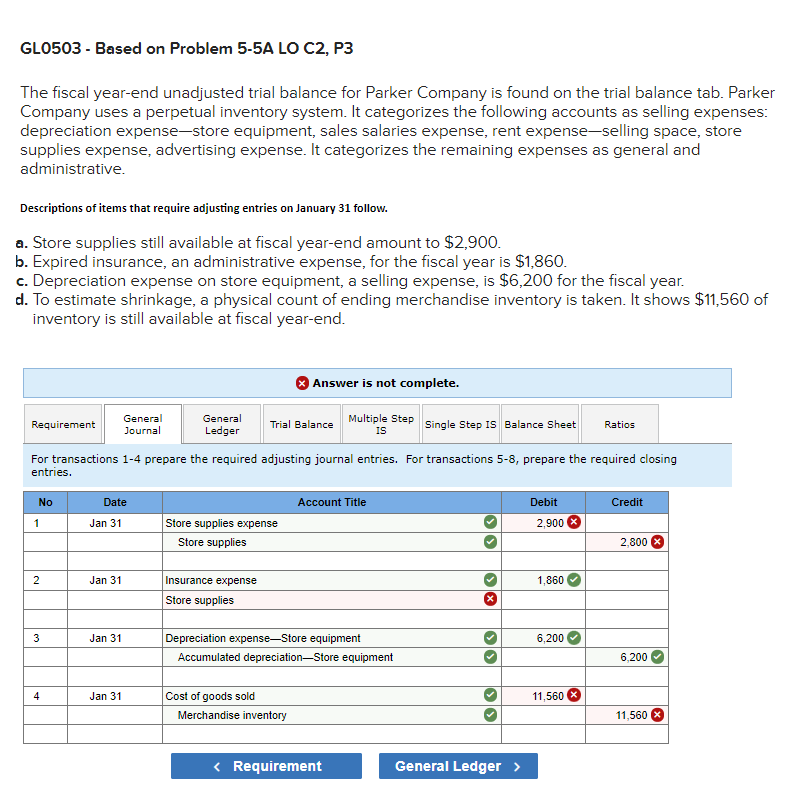

GL0503 - Based on Problem 5-5A LO C2, P3

The fiscal year-end unadjusted trial balance for Parker Company is found on the trial balance tab. Parker Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: depreciation expensestore equipment, sales salaries expense, rent expenseselling space, store supplies expense, advertising expense. It categorizes the remaining expenses as general and administrative. Descriptions of items that require adjusting entries on January 31 follow.

- Store supplies still available at fiscal year-end amount to $2,900.

- Expired insurance, an administrative expense, for the fiscal year is $1,860.

- Depreciation expense on store equipment, a selling expense, is $6,200 for the fiscal year.

- To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,560 of inventory is still available at fiscal year-end.

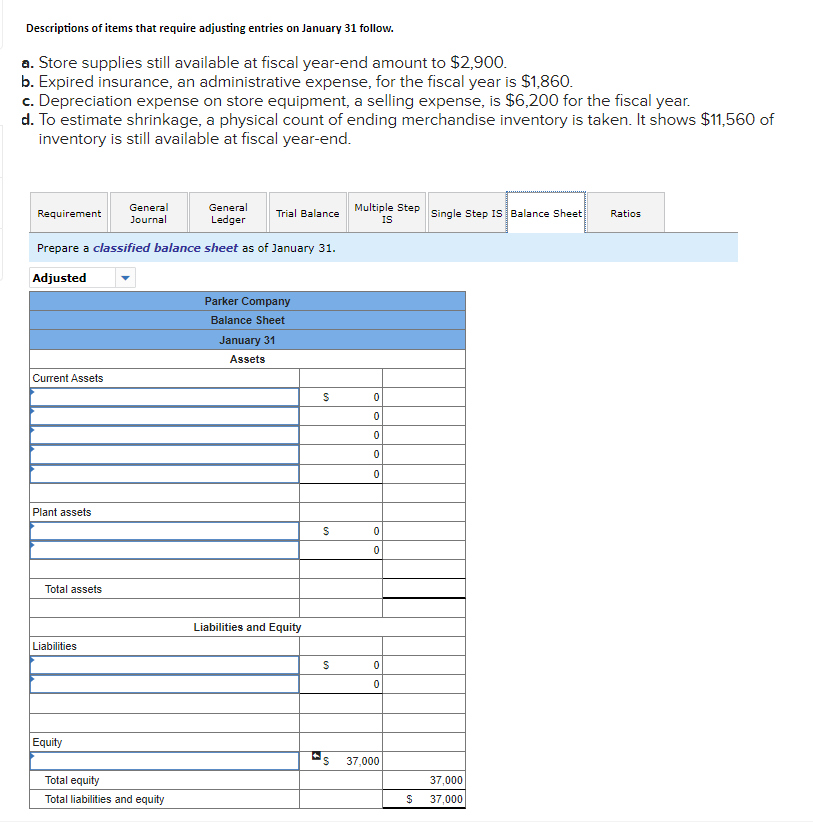

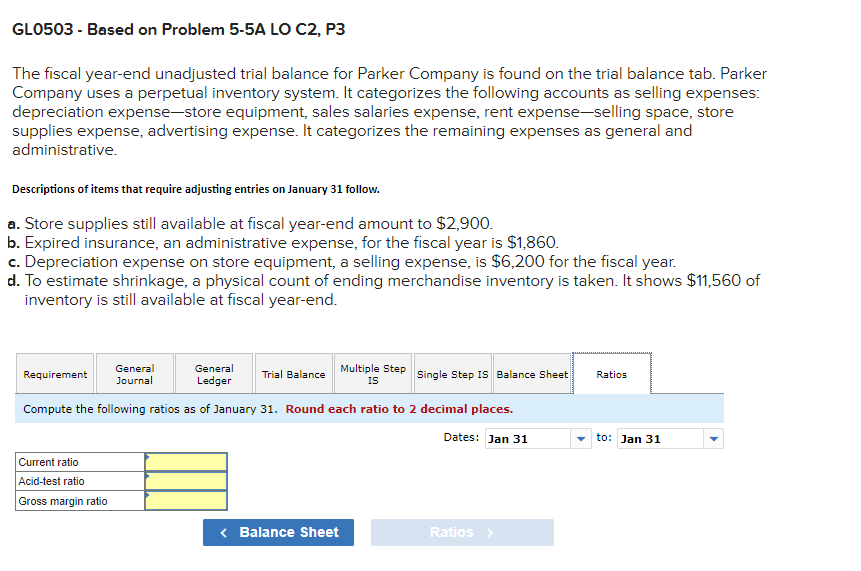

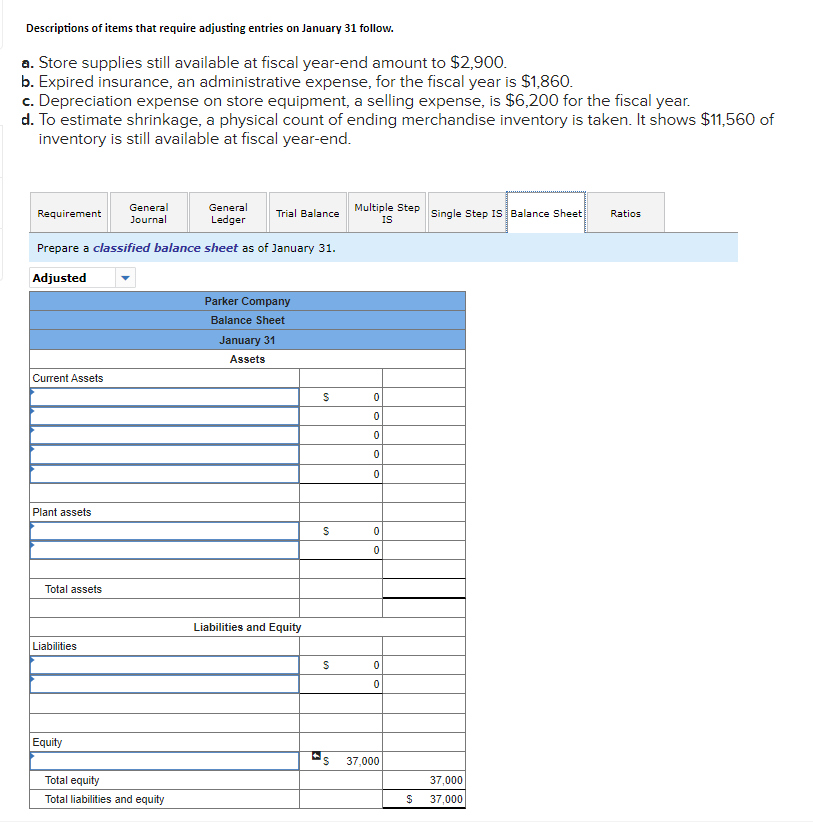

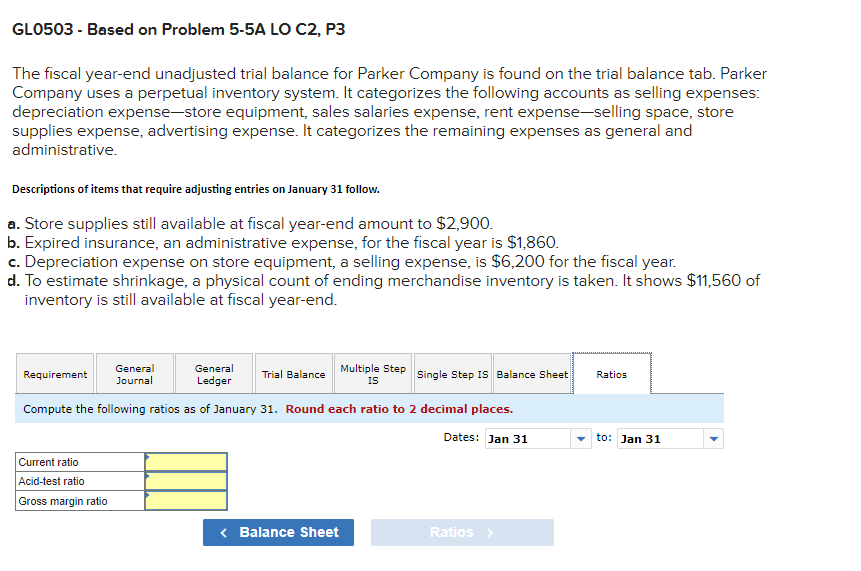

GL0503 - Based on Problem 5-5A LO C2, P3 The fiscal year-end unadjusted trial balance for Parker Company is found on the trial balance tab. Parker Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: depreciation expense-store equipment, sales salaries expense, rent expense-selling space, store supplies expense, advertising expense. It categorizes the remaining expenses as general and administrative. Descriptions of items that require adjusting entries on January 31 follow. a. Store supplies still available at fiscal year-end amount to $2,900. b. Expired insurance, an administrative expense, for the fiscal year is $1,860. c. Depreciation expense on store equipment, a selling expense, is $6,200 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,560 of inventory is still available at fiscal year-end. Answer is not complete. Requirement General Journal General Ledger Trial Balance Multiple Step IS Single Step IS Balance Sheet Ratios For transactions 1-4 prepare the required adjusting journal entries. For transactions 5-8, prepare the required closing entries. No Date Account Title Debit Credit 1 Jan 31 2,900 Store supplies expense Store supplies 2.800 2 Jan 31 1,860 Insurance expense Store supplies >X 3 Jan 31 6.200 Depreciation expense-Store equipment Accumulated depreciationStore equipment 6.200 4 Jan 31 11,560 Cost of goods sold Merchandise inventory 11,560 Descriptions of items that require adjusting entries on January 31 follow. a. Store supplies still available at fiscal year-end amount to $2,900. b. Expired insurance, an administrative expense, for the fiscal year is $1,860. c. Depreciation expense on store equipment, a selling expense, is $6,200 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,560 of inventory is still available at fiscal year-end. Multiple Step IS Single Step Is Balance Sheet Ratios General General Requirement Trial Balance Journal Ledger Prepare a classified balance sheet as of January 31. Adjusted Parker Company Balance Sheet January 31 Assets Current Assets S 0 0 0 0 0 Plant assets S 0 0 Total assets Liabilities and Equity Liabilities S 0 0 Equity 37,000 37,000 Total equity Total liabilities and equity S 37,000 GL0503 - Based on Problem 5-5A LO C2, P3 The fiscal year-end unadjusted trial balance for Parker Company is found on the trial balance tab. Parker Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: depreciation expense-store equipment, sales salaries expense, rent expense-selling space, store supplies expense, advertising expense. It categorizes the remaining expenses as general and administrative. Descriptions of items that require adjusting entries on January 31 follow. a. Store supplies still available at fiscal year-end amount to $2,900. b. Expired insurance, an administrative expense, for the fiscal year is $1,860. c. Depreciation expense on store equipment, a selling expense, is $6,200 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,560 of inventory is still available at fiscal year-end. Requirement General Journal General Ledger Trial Balance Multiple Step Single Step Is Balance Sheet Ratios IS Compute the following ratios as of January 31. Round each ratio to 2 decimal places. Dates: Jan 31 o: Jan 31 Current ratio Acid-test ratio Gross margin ratio X 3 Jan 31 6.200 Depreciation expense-Store equipment Accumulated depreciationStore equipment 6.200 4 Jan 31 11,560 Cost of goods sold Merchandise inventory 11,560 Descriptions of items that require adjusting entries on January 31 follow. a. Store supplies still available at fiscal year-end amount to $2,900. b. Expired insurance, an administrative expense, for the fiscal year is $1,860. c. Depreciation expense on store equipment, a selling expense, is $6,200 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,560 of inventory is still available at fiscal year-end. Multiple Step IS Single Step Is Balance Sheet Ratios General General Requirement Trial Balance Journal Ledger Prepare a classified balance sheet as of January 31. Adjusted Parker Company Balance Sheet January 31 Assets Current Assets S 0 0 0 0 0 Plant assets S 0 0 Total assets Liabilities and Equity Liabilities S 0 0 Equity 37,000 37,000 Total equity Total liabilities and equity S 37,000 GL0503 - Based on Problem 5-5A LO C2, P3 The fiscal year-end unadjusted trial balance for Parker Company is found on the trial balance tab. Parker Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: depreciation expense-store equipment, sales salaries expense, rent expense-selling space, store supplies expense, advertising expense. It categorizes the remaining expenses as general and administrative. Descriptions of items that require adjusting entries on January 31 follow. a. Store supplies still available at fiscal year-end amount to $2,900. b. Expired insurance, an administrative expense, for the fiscal year is $1,860. c. Depreciation expense on store equipment, a selling expense, is $6,200 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,560 of inventory is still available at fiscal year-end. Requirement General Journal General Ledger Trial Balance Multiple Step Single Step Is Balance Sheet Ratios IS Compute the following ratios as of January 31. Round each ratio to 2 decimal places. Dates: Jan 31 o: Jan 31 Current ratio Acid-test ratio Gross margin ratio