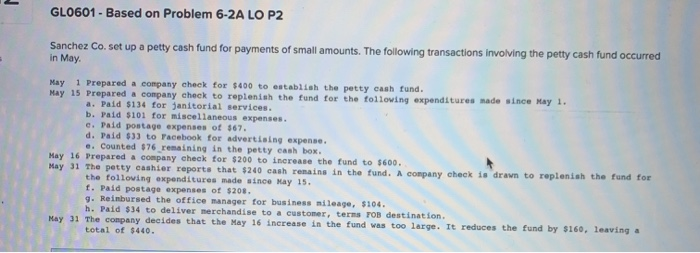

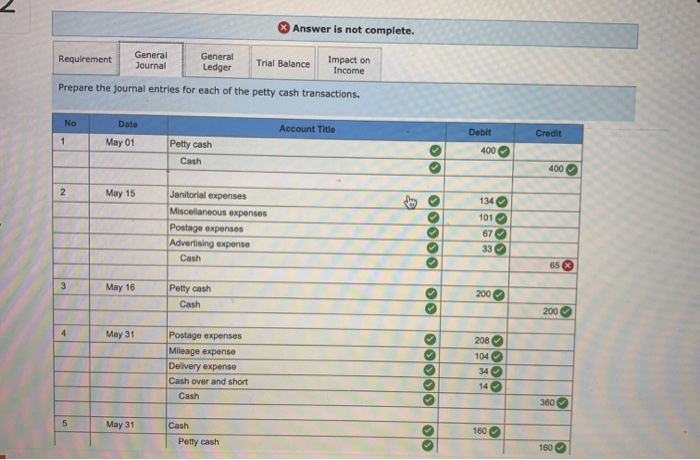

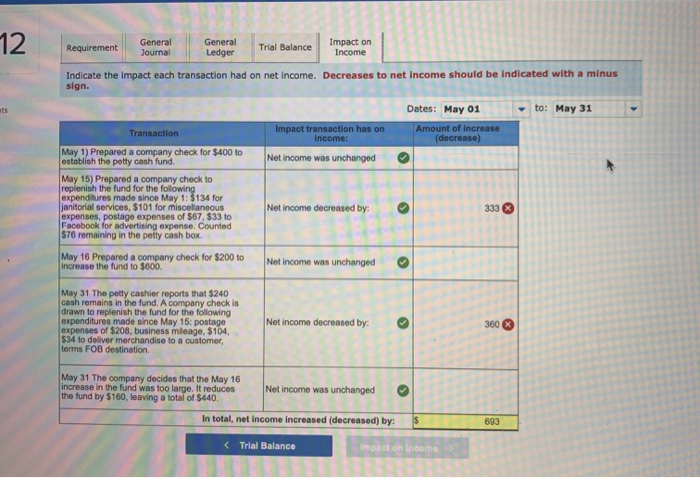

GL0601 - Based on Problem 6-2A LO P2 Sanchez Co. set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May. May 1 Prepared a company check for $400 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures nade since may 1. a. Paid $134 for janitorial services. b. Paid $101 for miscellaneous expenses. e. Paid postage expenses of $67. d. Paid 633 to Facebook for advertising expense. e. Counted 576 remaining in the petty cash box. May 16 Prepared a company check for $200 to increase the fund to $600. May 31 the petty cashier reports that $240 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. f. Paid postage expenses of $208. 9. Reimbursed the office manager for business mileage, $104. h. Paid $34 to deliver merchandise to a customer, terns FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $160, leaving a total of $440. Answer is not complete. Requirement General Journal General Ledger Trial Balance Impact on Income Prepare the journal entries for each of the petty cash transactions. No Date Account Title Debit Credit 1 May 01 Petty cash Cash 400 400 2 May 15 Janitorial expenses Miscellaneous expenses Postage expenses Advertising expense Cash OOOOO 134 101 67 33 65 3 3 May 16 Petty cash Cash 00 200 200 4 May 31 Postage expenses Mileage expense Delivery expense Cash over and short Cash OOOOO 208 104 34 14 360 5 May 31 Cash 160 Petty cash 3 160 12 ats General General Impact on Requirement Trial Balance Journal Ledger Income Indicate the impact each transaction had on net income. Decreases to net income should be indicated with a minus sign. Dates: May 01 to: May 31 Transaction Impact transaction has on Amount of increase Income: (decrease) May 1) Prepared a company check for $400 to establish the petty cash fund. Net income was unchanged May 15) Prepared a company check to replenish the fund for the following expenditures made since May 1: $134 for Janitorial services, $101 for miscellaneous Net income decreased by: 333 expenses, postage expenses of $67, 533 to Facebook for advertising expense. Counted S76 remaining in the petty cash box > May 16 Prepared a company check for $200 to increase the fund to 5000 Net income was unchanged May 31 The petty cashier reports that $240 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15: postage expenses of $208, business mileage, $104, $34 to deliver merchandise to a customer, terms FOB destination Net income decreased by: . 360 May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $160, leaving a total of $440. Net income was unchanged In total, net income increased (decreased) by: $ 693