Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GL0601 (Static) - Based on Problem 6-2A Kiona Company LO P2 Kiona Company set up a petty cash fund for payments of small amounts.

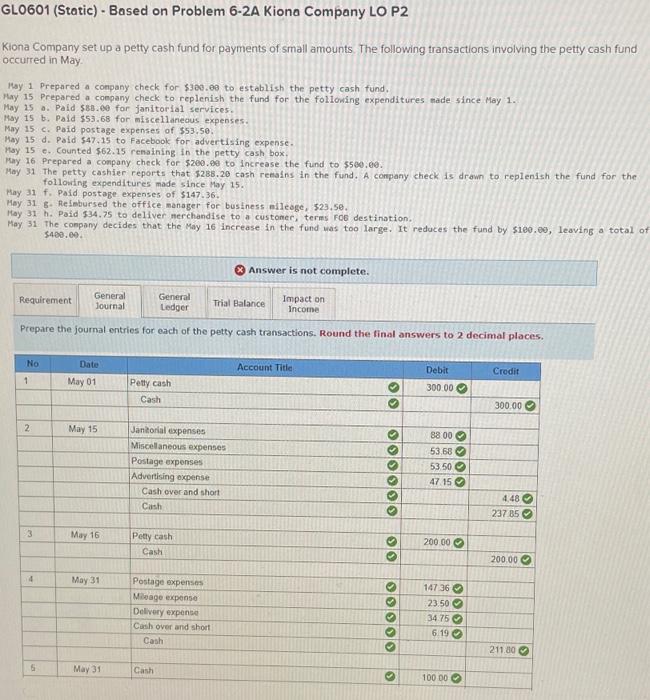

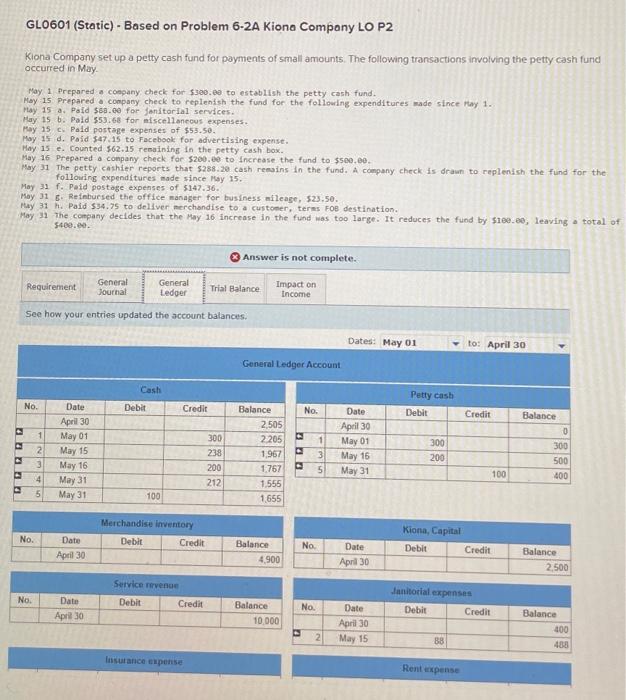

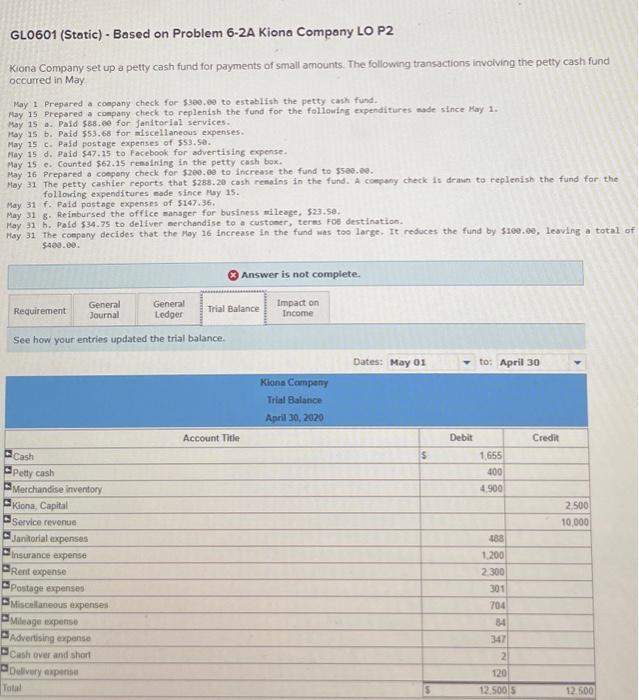

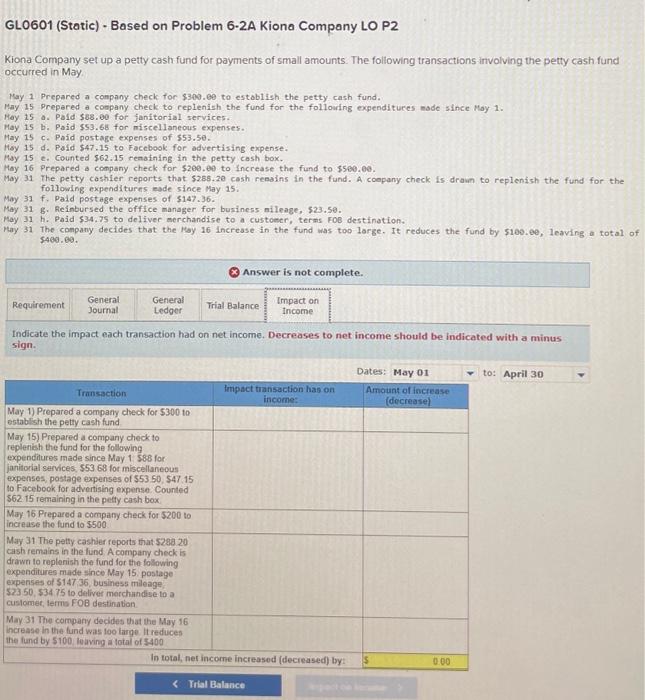

GL0601 (Static) - Based on Problem 6-2A Kiona Company LO P2 Kiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May. May 1 Prepared a company check for $300.00 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $88.00 for janitorial services. May 15 b. Paid $53.68 for miscellaneous expenses. May 15 c. Paid postage expenses of $53.50. May 15 d. Paid $47.15 to Facebook for advertising expense. May 15 e. Counted $62.15 remaining in the petty cash box. May 16 Prepared a company check for $200.00 to increase the fund to $500.00. May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $147.36. May 31 g. Reimbursed the office manager for business mileage, $23.50. May 31 h. Paid $34.75 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $100.00, leaving a total of $400.00. Answer is not complete. General Requirement Journal General Ledger Trial Balance Impact on Income Prepare the journal entries for each of the petty cash transactions. Round the final answers to 2 decimal places. No 1 Date May 01 Petty cash Cash 2 May 15 Janitorial expenses Miscellaneous expenses Postage expenses Advertising expense Cash over and short Cash 3 May 16 Petty cash Cash 4 May 311 Postage expenses Mileage expense Delivery expense Cash over and short Cashi 6 May 311 Cash Account Title Debit Credit 300.00 300.00 88 00 53.68 53.50- 47.15 4.48 237.85 200.00 200.00 00000 3 147 36 23.50- 34.75 6.19 211.80 100 00 GL0601 (Static) - Based on Problem 6-2A Kiona Company LO P2 Klona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May. May 1 Prepared a company check for $300.00 to establish the petty cash fund. May 15 Prepared company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $88.00 for janitorial services. May 15 b. Paid $53.68 for miscellaneous expenses. May 15 c. Paid postage expenses of $53.50. May 15 d. Paid $47.15 to Facebook for advertising expense. May 15 e. Counted $62.15 remaining in the petty cash box. May 16 Prepared a company check for $200.00 to increase the fund to $500.00. May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $147.36. May 31 g Reimbursed the office manager for business mileage, $23.50. May 31 h. Paid $34.75 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $100.00, leaving a total of $400.00. Answer is not complete. General Journal General Ledger Trial Balance Impact on Income Requirement See how your entries updated the account balances. Dates: May 01 to: April 30 General Ledger Account Cash Petty cash No. Date Debit Credit Balance No. Date Debit Credit Balance April 30 2,505 April 30 0 1 May 01 300 2205 2 May 15 238 1,967 a 3 May 16 333 1 May 01 300 300 3 May 16 200 500 200 1,767 5 May 31 100 400 4 May 31 212 1.555 a 5 May 31 100 1,655 Merchandise inventory Kiona, Capital No. Date Debit Credit Balance No. April 30 4,900 Date April 30 Debit Credit Balance 2,500 No. Date April 30 Service revenue Debit Janitorial expenses Credit Balance 10,000 No. D 2 Date April 30 May 15 Debit Credit Balance 400 88 488 Insurance expense Rent expense GL0601 (Static) - Based on Problem 6-2A Kiona Company LO P2 Kiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May May 1 Prepared a company check for $300.00 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $88.00 for Janitorial services. May 15 b. Paid $53.68 for miscellaneous expenses. May 15 c. Paid postage expenses of $53.50. May 15 d. Paid $47.15 to Facebook for advertising expense. May 15 e. Counted $62.15 remaining in the petty cash box. May 16 Prepared a company check for $200.00 to increase the fund to $500.00. May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $147.36. May 31 g. Reimbursed the office manager for business mileage, $23.50. May 31 h. Paid $34.75 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $100.00, leaving a total of $400.00. Answer is not complete. Requirement General Journal General Ledger Trial Balance Impact on Income See how your entries updated the trial balance. Cash Petty cash Merchandise inventory Kiona, Capital Service revenue Janitorial expenses Insurance expense Rent expense Postage expenses Miscellaneous expenses Mileage expense Advertising expense Cash over and short Delivery expense Total Dates: May 01 to: April 30 Kiona Company Trial Balance April 30, 2020 Account Title Debit Credit S 1,655 400 4,900 2,500 10,000 488 1,200 2.300 301 704 84 347 2 120 5 12,500 S 12.500 GL0601 (Static) - Based on Problem 6-2A Kiona Company LO P2 Kiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May May 1 Prepared a company check for $300.00 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $88.00 for janitorial services. May 15 b. Paid $53.68 for miscellaneous expenses. May 15 c. Paid postage expenses of $53.50. May 15 d. Paid $47.15 to Facebook for advertising expense. May 15 e. Counted $62.15 remaining in the petty cash box. May 16 Prepared a company check for $200.00 to increase the fund to $500.00. May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $147.36. May 31 g. Reimbursed the office manager for business mileage, $23.50. May 31 h. Paid $34.75 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $100.00, leaving a total of $400.00. Answer is not complete. General Requirement Journal General Ledger Impact on Trial Balance Income Indicate the impact each transaction had on net income. Decreases to net income should be indicated with a minus sign. Transaction May 1) Prepared a company check for $300 to establish the petty cash fund May 15) Prepared a company check to Dates: May 01 to: April 30 Impact transaction has on income: Amount of increase (decrease) replenish the fund for the following expenditures made since May 1 $88 for janitorial services, $53 68 for miscellaneous expenses, postage expenses of $53.50, $47.15 to Facebook for advertising expense. Counted $62 15 remaining in the petty cash box. May 16 Prepared a company check for $200 to increase the fund to $500 May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. postage expenses of $147 36, business mileage, $23 50, $34.75 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $100, leaving a total of $400 In total, net income increased (decreased) by:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started