Answered step by step

Verified Expert Solution

Question

1 Approved Answer

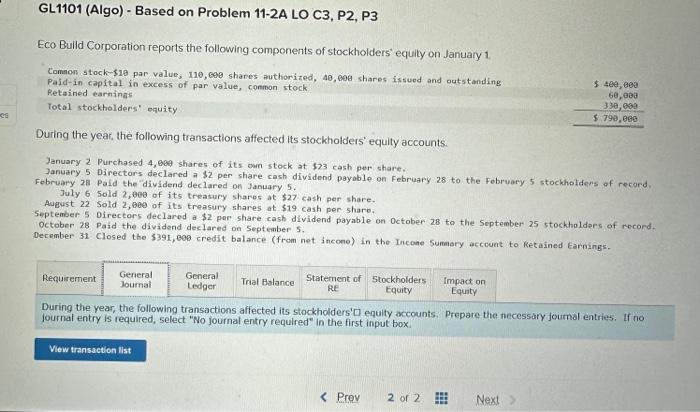

GL1101 (Algo) Based on Problem 11-2A LO C3, P2, P3 Eco Build Corporation reports the following components of stockholders' equity on January 1 Common

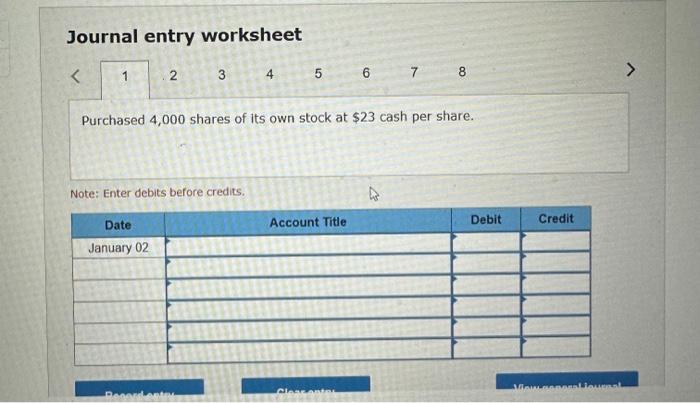

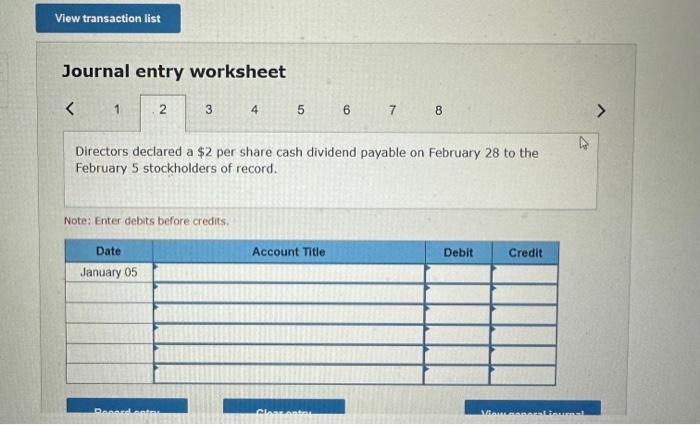

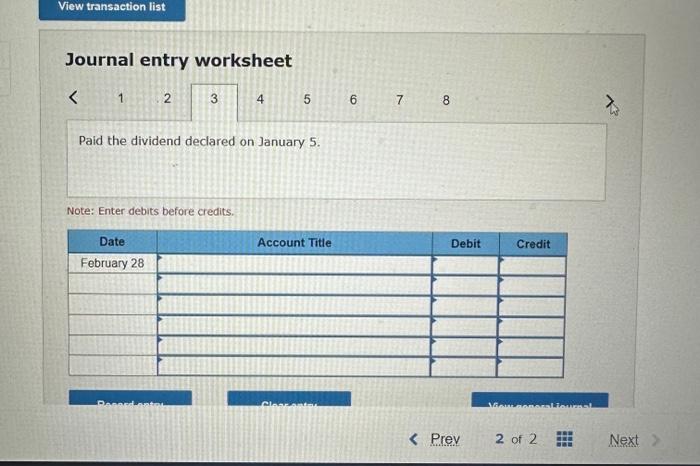

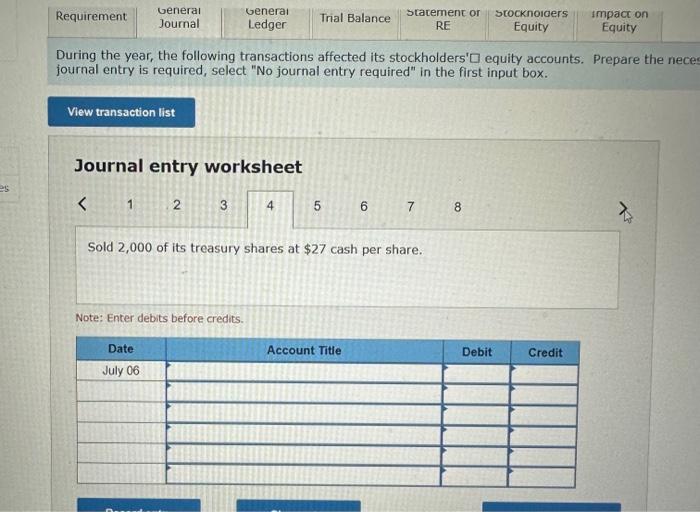

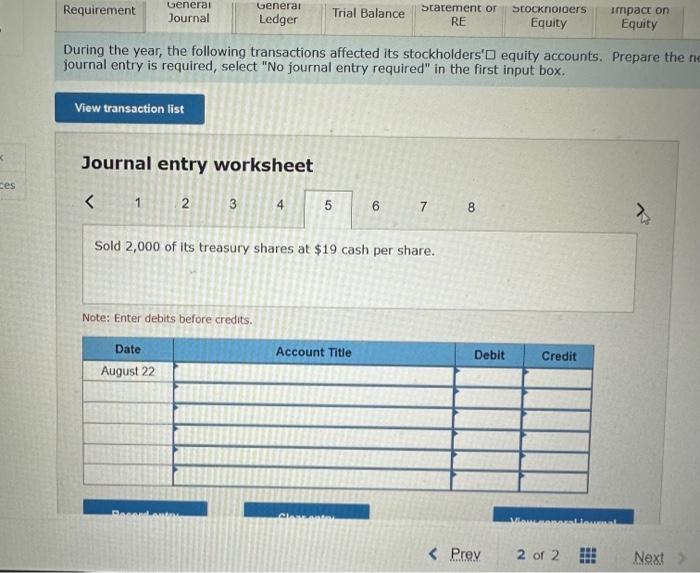

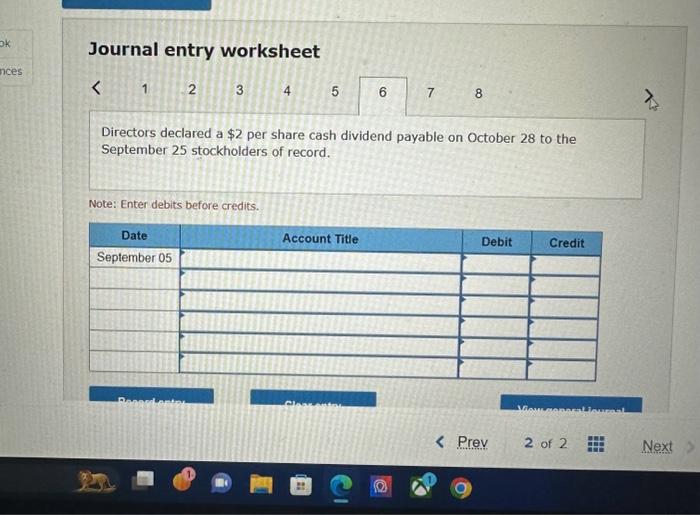

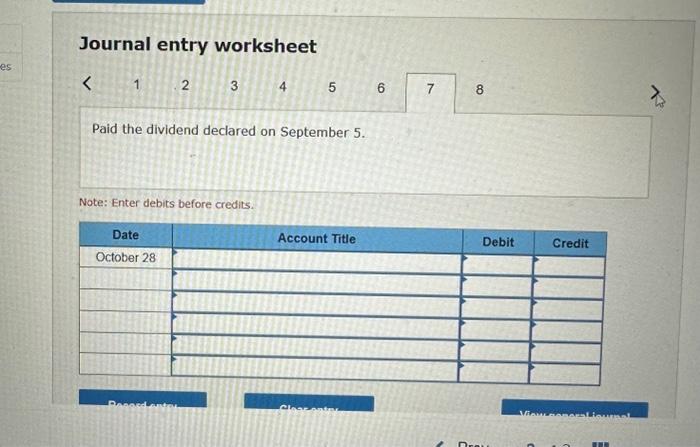

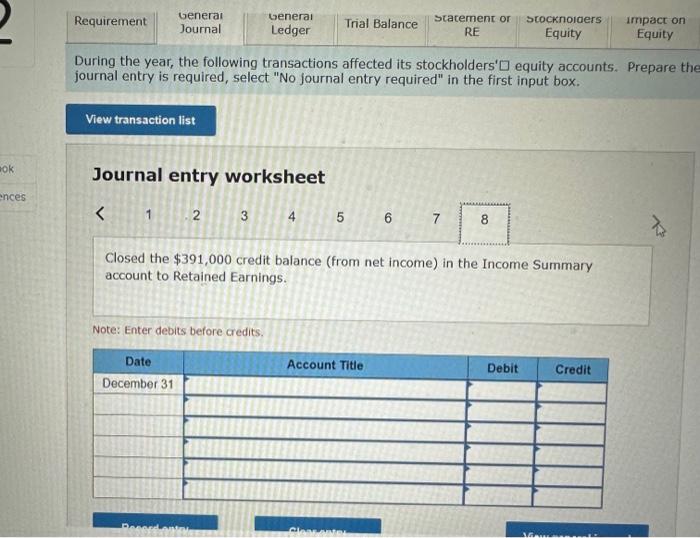

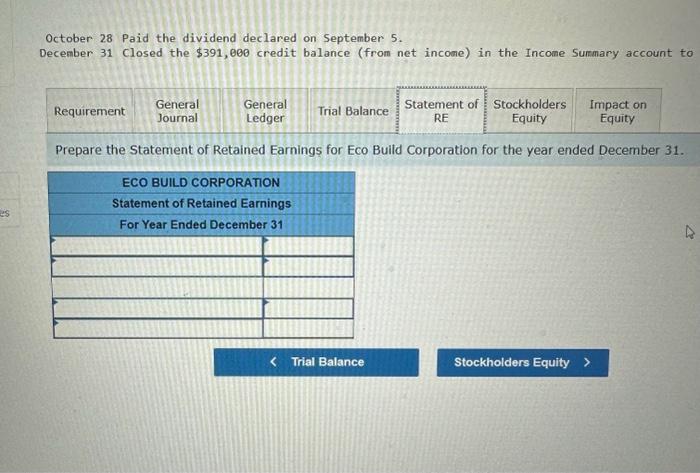

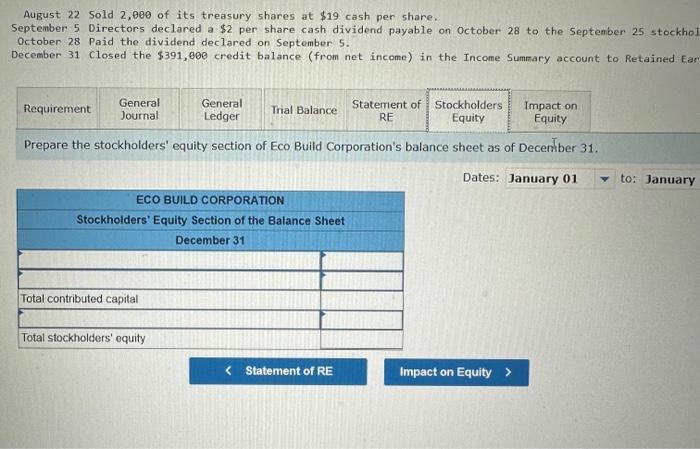

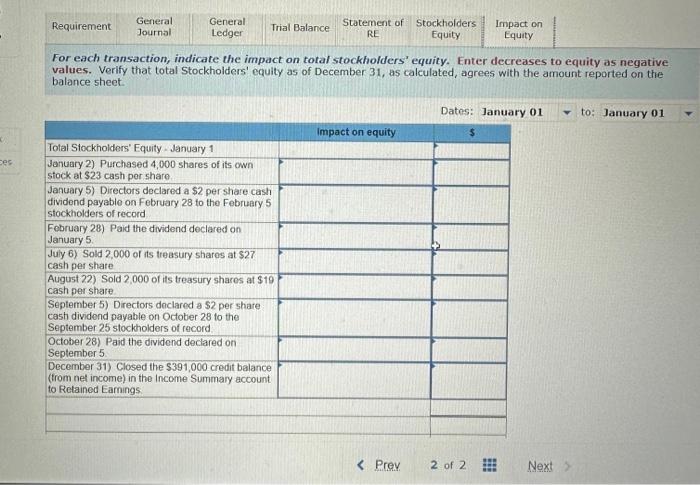

GL1101 (Algo) Based on Problem 11-2A LO C3, P2, P3 Eco Build Corporation reports the following components of stockholders' equity on January 1 Common stock-$10 par value, 110,000 shares authorized, 40,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings $ 400,000 60,000 330,000 $ 790,000 Total stockholders' equity S During the year, the following transactions affected its stockholders' equity accounts. January 2 Purchased 4,000 shares of its own stock at $23 cash per share. January 5 Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. February 28 Paid the dividend declared on January 5. July 6 Sold 2,000 of its treasury shares at $27 cash per share. August 22 Sold 2,000 of its treasury shares at $19 cash per share. September 5 Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend declared on September 5. December 31 Closed the $391,000 credit balance (from net income) in the Incone Summary account to Retained Earnings. Requirement General Journal General Ledger Trial Balance Statement of Stockholders RE Equity Impact on Equity During the year, the following transactions affected its stockholders' equity accounts. Prepare the necessary journal entries. If no journal entry is required, select "No journal entry required" in the first input box. View transaction list < Prev 2 of 2 Next Journal entry worksheet < 1 2 3 4 5 6 7 8 > Purchased 4,000 shares of its own stock at $23 cash per share. Note: Enter debits before credits. Date January 02 Recorderte Account Title Debit Credit View.senegal Journal View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 8 Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. Note: Enter debits before credits. Date January 05 Account Title Debit Credit View generatioural View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 8 Paid the dividend declared on January 5. Note: Enter debits before credits. Date February 28 Rese Account Title Debit Credit < Prev 2 of 2 Next > Requirement General Journal General Ledger Trial Balance Statement or RE Stocknoiders Equity impact on Equity During the year, the following transactions affected its stockholders' equity accounts. Prepare the neces journal entry is required, select "No journal entry required" in the first input box. View transaction list Journal entry worksheet es < 1 2 3 4 5 6 7 8 Sold 2,000 of its treasury shares at $27 cash per share. Note: Enter debits before credits. Date July 06 Account Title Debit Credit 73 Requirement General Journal Genera Ledger Trial Balance Statement or STOCKNOgers RE Equity impact on Equity During the year, the following transactions affected its stockholders' equity accounts. Prepare the ne journal entry is required, select "No journal entry required" in the first input box. View transaction list Journal entry worksheet ces < 1 2 3 4 5 6 7 8 Sold 2,000 of its treasury shares at $19 cash per share. Note: Enter debits before credits. Date August 22 Account Title Debit Credit 76 < Prev 2 of 2 Next nces Journal entry worksheet 1 2 3 4 5 6 7 8 Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record. Note: Enter debits before credits. Date September 05 Account Title Debit Credit < Prev 2 of 2 Next > Journal entry worksheet es < 1 2 3 4 5 Paid the dividend declared on September 5. Note: Enter debits before credits. Date October 28 6 7 8 Account Title Debit Credit ok Requirement General Journal General Ledger Trial Balance Statement or Stocknolders RE Equity impact on Equity During the year, the following transactions affected its stockholders' equity accounts. Prepare the journal entry is required, select "No journal entry required" in the first input box. View transaction list Journal entry worksheet ences < 1 2 3 4 5 6 7 8 Closed the $391,000 credit balance (from net income) in the Income Summary account to Retained Earnings. Note: Enter debits before credits. Date December 31 Account Title Debit Credit Repertonter es October 28 Paid the dividend declared on September 5. December 31 Closed the $391,000 credit balance (from net income) in the Income Summary account to General Requirement Journal General Ledger Trial Balance Statement of Stockholders RE Equity Impact on Equity Prepare the Statement of Retained Earnings for Eco Build Corporation for the year ended December 31. ECO BUILD CORPORATION Statement of Retained Earnings For Year Ended December 31 August 22 Sold 2,000 of its treasury shares at $19 cash per share. September 5 Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockhol October 28 Paid the dividend declared on September 5.. December 31 Closed the $391,000 credit balance (from net income) in the Income Summary account to Retained Ear Requirement General Journal General Ledger Trial Balance RE Statement of Stockholders Equity Impact on Equity Prepare the stockholders' equity section of Eco Build Corporation's balance sheet as of December 31. ECO BUILD CORPORATION Stockholders' Equity Section of the Balance Sheet December 31 Total contributed capital Dates: January 01 to: January Total stockholders' equity < Statement of RE Impact on Equity > ces General Requirement Journal General Ledger Trial Balance Statement of Stockholders RE Equity Impact on Equity For each transaction, indicate the impact on total stockholders' equity. Enter decreases to equity as negative values. Verify that total Stockholders' equity as of December 31, as calculated, agrees with the amount reported on the balance sheet. Total Stockholders' Equity January 1 January 2) Purchased 4,000 shares of its own stock at $23 cash per share. January 5) Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record February 28) Paid the dividend declared on January 5. July 6) Sold 2,000 of its treasury shares at $27 cash per share August 22) Sold 2,000 of its treasury shares at $19 cash per share. September 5) Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record October 28) Paid the dividend declared on September 5 December 31) Closed the $391,000 credit balance (from net income) in the Income Summary account to Retained Earnings Dates: January 01 to: January 01 Impact on equity < Prev 2 of 2 Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started