Question

GL1601-Based on Problem 16-1A LO P1, P2, P3, P4 General Journal -a. Record the purchase of materials (on credit) -b. Record direct materials used in

GL1601-Based on Problem 16-1A LO P1, P2, P3, P4

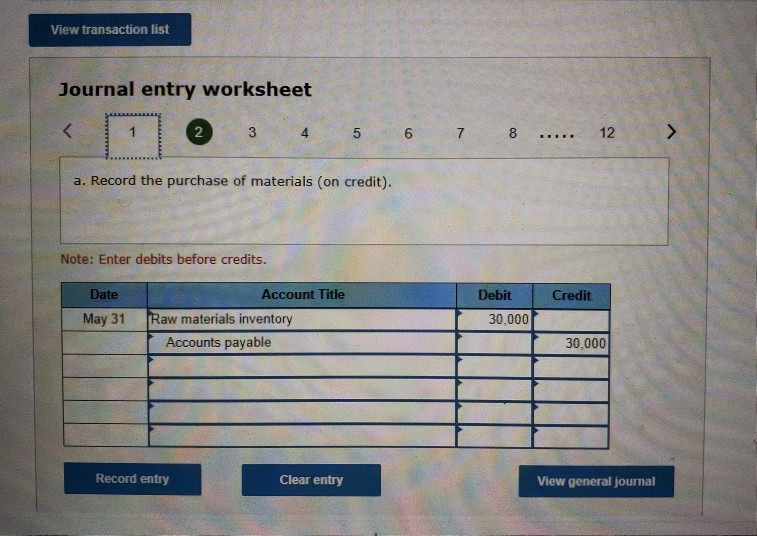

General Journal -a. Record the purchase of materials (on credit) -b. Record direct materials used in production. -c. Record the usage of indirect materials. -d. Record the cost of direct labor incurred but not yet paid. (Use "Factory wages payable" account). -e. Record the cost of indirect labor incurred but not yet paid. (Use "Factory wages payable" account). -f. Record the payment of the total factory payroll. -g. Record the cost of other factory overhead costs (credit Other account). -h. Record the application of overhead at a rate of 150% of direct materials costs (Cutting) and 120% of direct labor cost (Stitching). -i. Record the transferred costs of partially completed goods. -j. Record the transfer of production to finished goods, as calculated on the Cost of Goods Manufacturered tab. -k. Record the cost of goods sold, as calculated on the cost of goods sold tab. -l. Record the sale of goods on account.

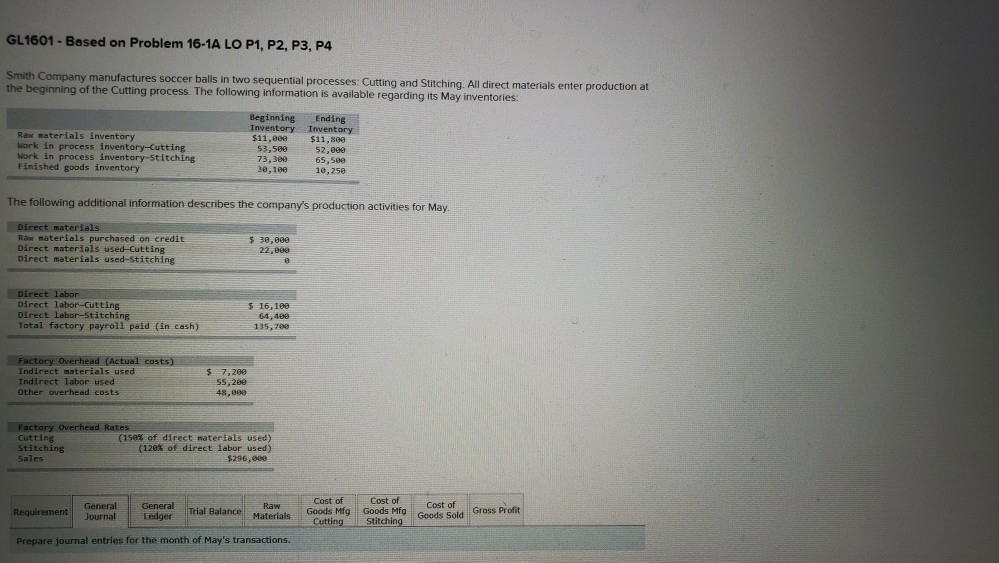

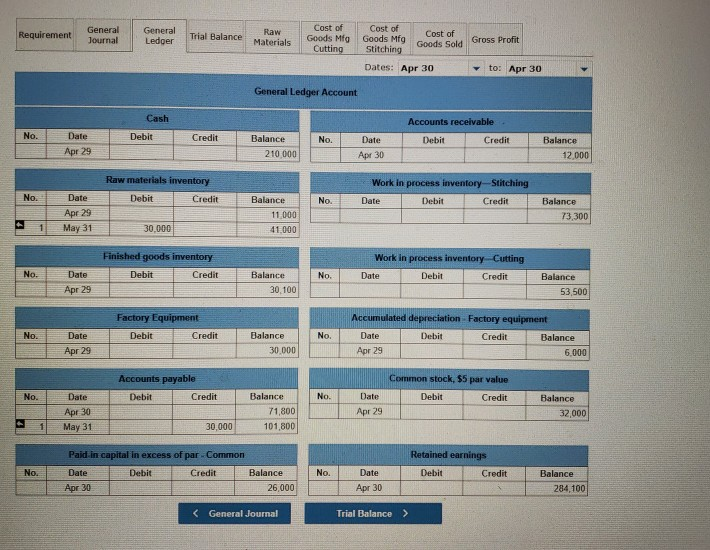

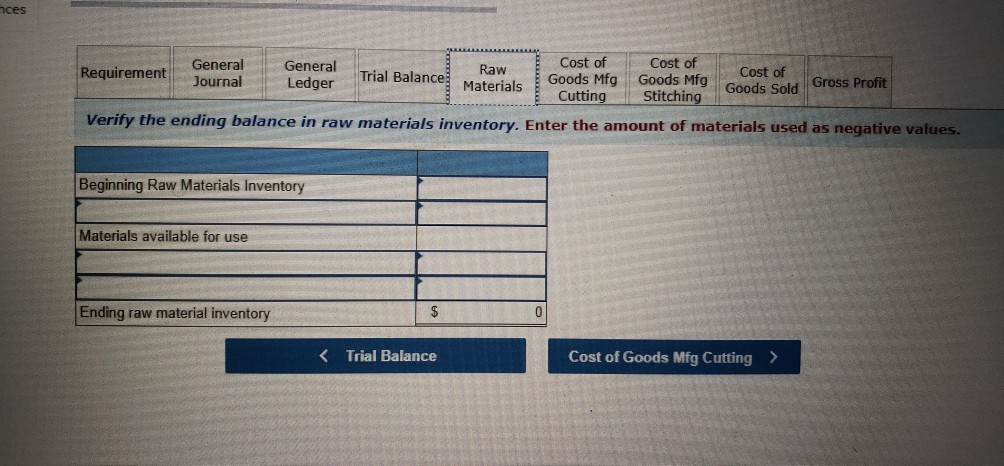

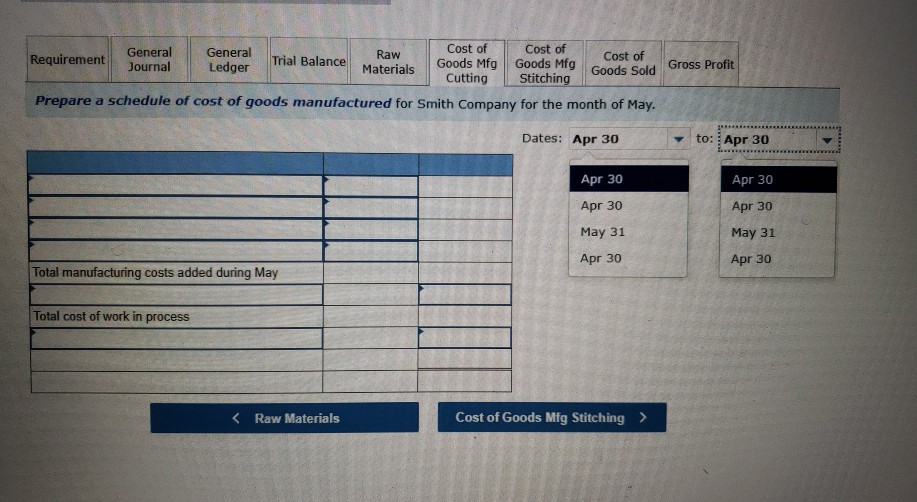

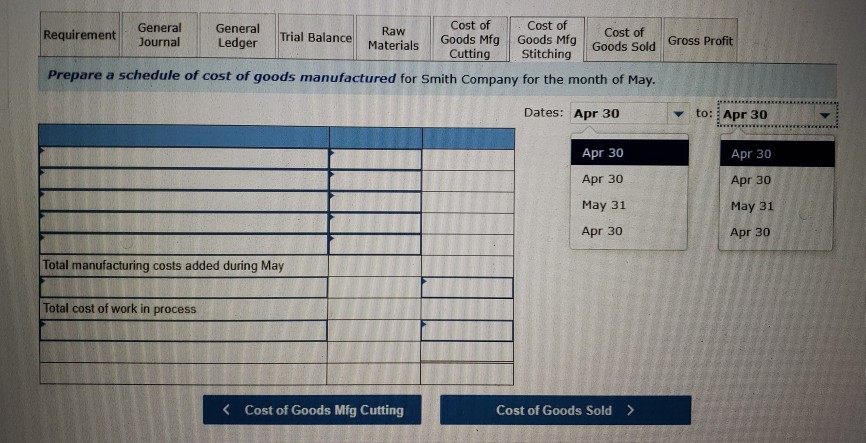

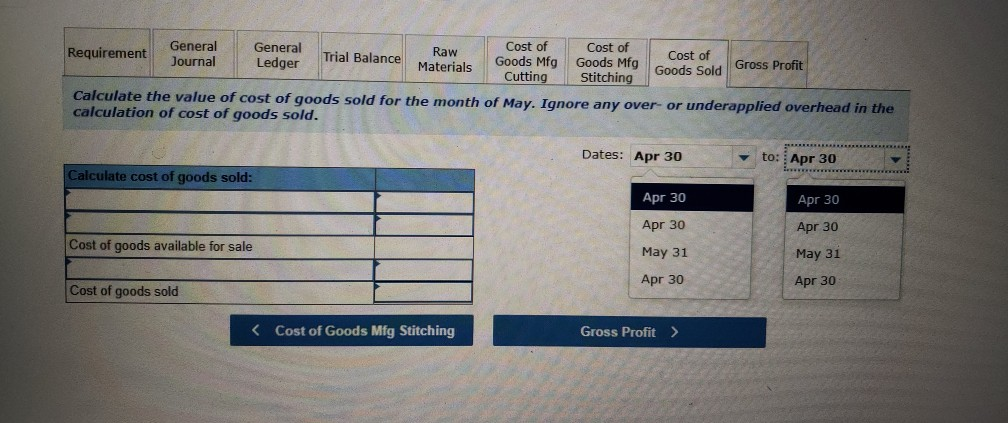

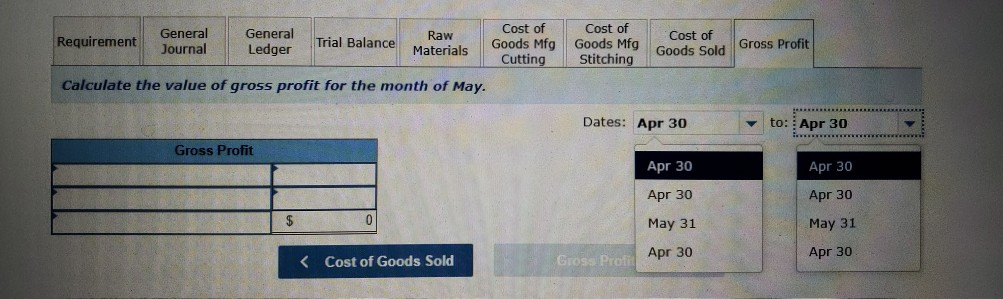

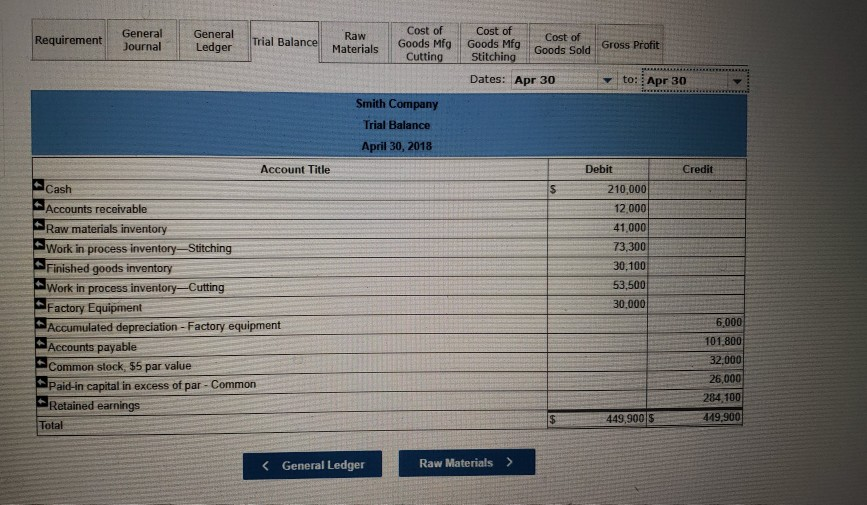

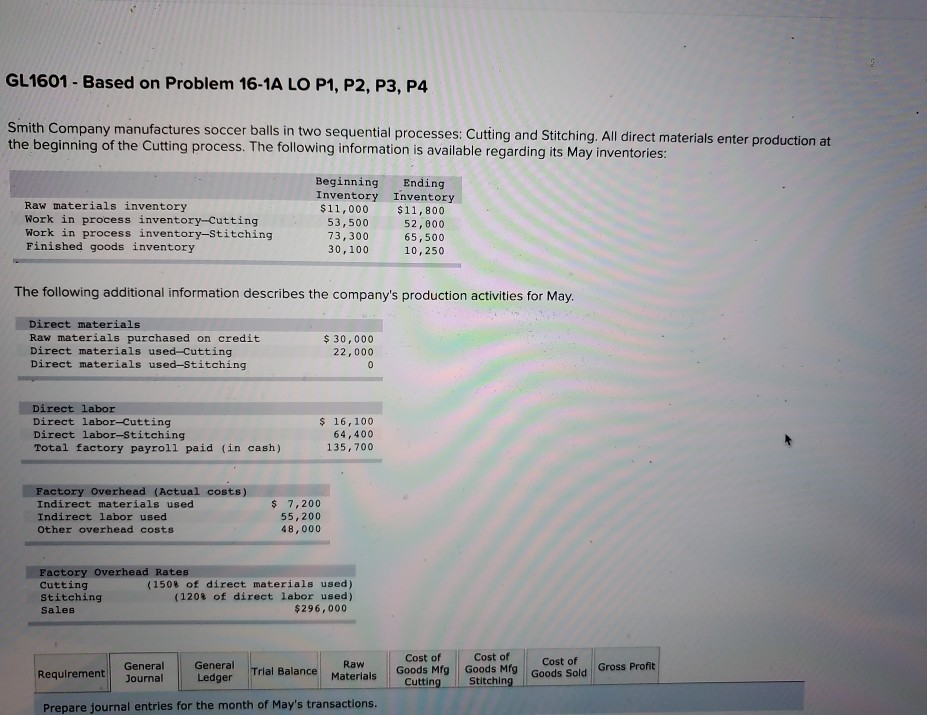

GL1601 - Based on Problem 16-1A LO P1, P2, P3, P4 Smith Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: Raw materials inventory Work in process inventory-Cutting Work in process inventory stitching Finished goods inventory Beginning Inventory $11,000 53,500 73.300 38, 189 Ending Inventory $11,869 52,000 65, See 10,250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on Credit Direct materials used-Cutting Direct materials used-stitching $ 30,000 22,00 Direct labor Direct labor-Cutting Direct labor-Stitching Total factory payroll paid (in cash) $ 16, 180 64, 135, 700 $ Factory Overhead (Actual costs) Indirect materials used Indirect laborused Other overhead costs 7,200 SS 280 48,00 Factory Overhead Rates Cutting (150% of direct materials used) Stitching (120% of direct labor used) $296,00 Sales Requirement General Journal General Ledger Trial Balance Raw Materials Cast of Goods Mfg Cutting Cost of Goods Mfg stitching Cost of Goods Sold Gross Profit Prepare journal entries for the month of May's transactions. View transaction list Journal entry worksheet nces General Requirement General Cost of Cost of Raw Journal Trial Balance Ledger Goods Mfg Materials Cost of Goods Mfg - Cutting Stitchine Goods Sold Gross Profit Verify the ending balance in raw materials inventory. Enter the amount of materials used as negative values. Beginning Raw Materials Inventory Materials available for use Ending raw material inventory $ 0 Requirement General Journal General Ledger Trial Balance Raw Materials Cost of Cost of Goods Mfg Goods Mfg Cutting Stitching Cost of Goods Sold Gross Profit Prepare a schedule of cost of goods manufactured for Smith Company for the month of May. Dates: Apr 30 to: Apr 30 Apr 30 Apr 30 Apr 30 Apr 30 May 31 Apr 30 May 31 Apr 30 Total manufacturing costs added during May Total cost of work in process General General Cost of Requirement Raw Cost of Cost of Trial Balance Journal Ledger Materials Goods Mfg Goods Mfg Goods Sold Gross Profit Cutting Stitching Prepare a schedule of cost of goods manufactured for Smith Company for the month of May. Dates: Apr 30 to: Apr 30 Apr 30 Apr 30 Apr 30 Apr 30 May 31 Apr 30 May 31 Apr 30 Total manufacturing costs added during May Total cost of work in process Goods Sold Gross Profit General Requirement General Cost of Raw Cost of Trial Balance Cost of Journal Ledger Materials Goods Mfg Goods Mfg Cutting Stitching Calculate the value of cost of goods sold for the month of May. Ignore any over- or underapplied overhead in the calculation of cost of goods sold. Dates: Apr 30 to: Apr 30 Calculate cost of goods sold: Cost of goods available for sale Apr 30 Apr 30 May 31 Apr 30 Apr 30 Apr 30 May 31 Apr 30 Cost of goods sold Requirement General Journal General Ledger Trial Balance Raw Materials Cost of Cost of Goods Mfg Goods Mfg Cutting Stitching Cost of Goods Sold G Gross Profit Calculate the value of gross profit for the month of May. Dates: Apr 30 to: Apr 30 Gross Profit Apr 30 Apr 30 May 31 Apr 30 Apr 30 May 31 Apr 30 $ GL 1601 - Based on Problem 16-1A LO P1, P2, P3, P4 Smith Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory Beginning Inventory $11,000 53,500 73, 300 30,100 Ending Inventory $11,800 52,000 65,500 10, 250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching $ 30,000 22,000 Direct labor Direct labor-Cutting Direct labor-Stitching Total factory payroll paid (in cash) $ 16,100 64,400 135, 700 $ Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs 7,200 55,200 48,000 Factory Overhead Rates Cutting (1508 of direct materials used) Stitching (1208 of direct labor used) Sales $296,000 Cost of Cost of General Journal Raw Trial Balance Materials Gross Profit Cost of Goods Mfg Goods Mfg Goods Sold Cutting Stitching General Ledger Requirement Prenare tournal entries for the month of May's transactions. GL1601 - Based on Problem 16-1A LO P1, P2, P3, P4 Smith Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: Raw materials inventory Work in process inventory-Cutting Work in process inventory stitching Finished goods inventory Beginning Inventory $11,000 53,500 73.300 38, 189 Ending Inventory $11,869 52,000 65, See 10,250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on Credit Direct materials used-Cutting Direct materials used-stitching $ 30,000 22,00 Direct labor Direct labor-Cutting Direct labor-Stitching Total factory payroll paid (in cash) $ 16, 180 64, 135, 700 $ Factory Overhead (Actual costs) Indirect materials used Indirect laborused Other overhead costs 7,200 SS 280 48,00 Factory Overhead Rates Cutting (150% of direct materials used) Stitching (120% of direct labor used) $296,00 Sales Requirement General Journal General Ledger Trial Balance Raw Materials Cast of Goods Mfg Cutting Cost of Goods Mfg stitching Cost of Goods Sold Gross Profit Prepare journal entries for the month of May's transactions. View transaction list Journal entry worksheet nces General Requirement General Cost of Cost of Raw Journal Trial Balance Ledger Goods Mfg Materials Cost of Goods Mfg - Cutting Stitchine Goods Sold Gross Profit Verify the ending balance in raw materials inventory. Enter the amount of materials used as negative values. Beginning Raw Materials Inventory Materials available for use Ending raw material inventory $ 0 Requirement General Journal General Ledger Trial Balance Raw Materials Cost of Cost of Goods Mfg Goods Mfg Cutting Stitching Cost of Goods Sold Gross Profit Prepare a schedule of cost of goods manufactured for Smith Company for the month of May. Dates: Apr 30 to: Apr 30 Apr 30 Apr 30 Apr 30 Apr 30 May 31 Apr 30 May 31 Apr 30 Total manufacturing costs added during May Total cost of work in process General General Cost of Requirement Raw Cost of Cost of Trial Balance Journal Ledger Materials Goods Mfg Goods Mfg Goods Sold Gross Profit Cutting Stitching Prepare a schedule of cost of goods manufactured for Smith Company for the month of May. Dates: Apr 30 to: Apr 30 Apr 30 Apr 30 Apr 30 Apr 30 May 31 Apr 30 May 31 Apr 30 Total manufacturing costs added during May Total cost of work in process Goods Sold Gross Profit General Requirement General Cost of Raw Cost of Trial Balance Cost of Journal Ledger Materials Goods Mfg Goods Mfg Cutting Stitching Calculate the value of cost of goods sold for the month of May. Ignore any over- or underapplied overhead in the calculation of cost of goods sold. Dates: Apr 30 to: Apr 30 Calculate cost of goods sold: Cost of goods available for sale Apr 30 Apr 30 May 31 Apr 30 Apr 30 Apr 30 May 31 Apr 30 Cost of goods sold Requirement General Journal General Ledger Trial Balance Raw Materials Cost of Cost of Goods Mfg Goods Mfg Cutting Stitching Cost of Goods Sold G Gross Profit Calculate the value of gross profit for the month of May. Dates: Apr 30 to: Apr 30 Gross Profit Apr 30 Apr 30 May 31 Apr 30 Apr 30 May 31 Apr 30 $ GL 1601 - Based on Problem 16-1A LO P1, P2, P3, P4 Smith Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory Beginning Inventory $11,000 53,500 73, 300 30,100 Ending Inventory $11,800 52,000 65,500 10, 250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching $ 30,000 22,000 Direct labor Direct labor-Cutting Direct labor-Stitching Total factory payroll paid (in cash) $ 16,100 64,400 135, 700 $ Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs 7,200 55,200 48,000 Factory Overhead Rates Cutting (1508 of direct materials used) Stitching (1208 of direct labor used) Sales $296,000 Cost of Cost of General Journal Raw Trial Balance Materials Gross Profit Cost of Goods Mfg Goods Mfg Goods Sold Cutting Stitching General Ledger Requirement Prenare tournal entries for the month of May's transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started