Answered step by step

Verified Expert Solution

Question

1 Approved Answer

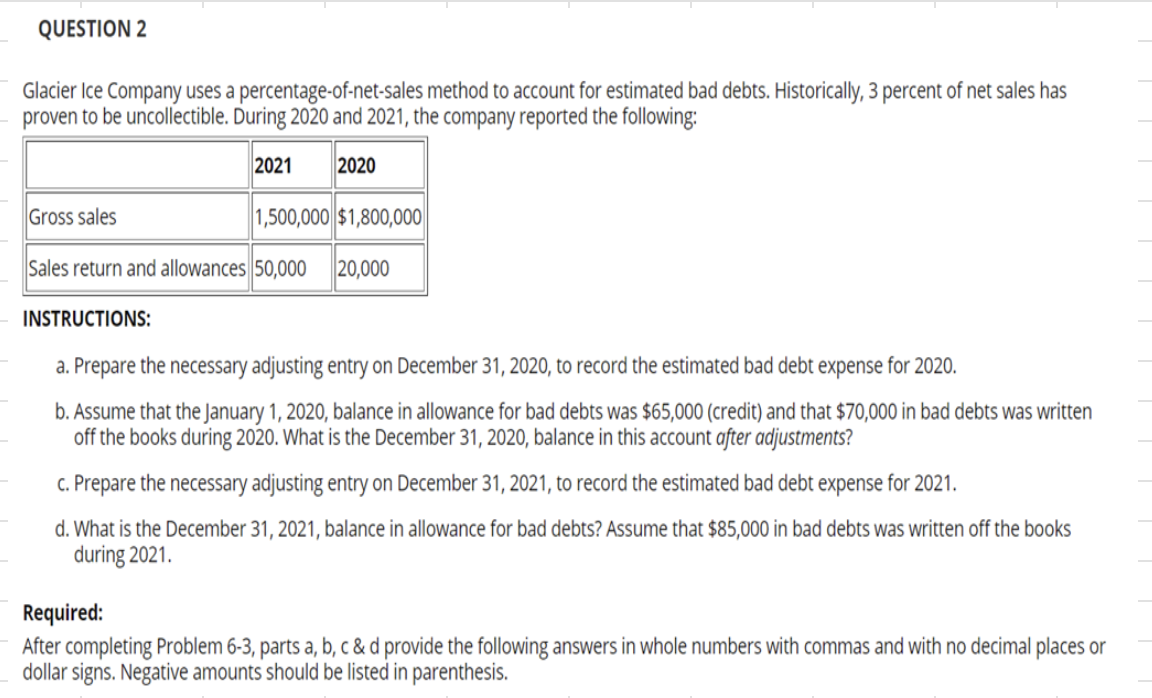

Glacier Ice Company uses a percentage-of-net-sales method to account for estimated bad debts. Historically, 3 percent of net sales has proven to be uncollectible. During

Glacier Ice Company uses a percentage-of-net-sales method to account for estimated bad debts. Historically, 3 percent of net sales has proven to be uncollectible. During 2020 and 2021, the company reported the following: INSTRUCTIONS: a. Prepare the necessary adjusting entry on December 31, 2020, to record the estimated bad debt expense for 2020. b. Assume that the January 1, 2020, balance in allowance for bad debts was $65,000 (credit) and that $70,000 in bad debts was written off the books during 2020. What is the December 31, 2020, balance in this account after adjustments? c. Prepare the necessary adjusting entry on December 31, 2021, to record the estimated bad debt expense for 2021. d. What is the December 31,2021 , balance in allowance for bad debts? Assume that $85,000 in bad debts was written off the books during 2021. Required: After completing Problem 6-3, parts a, b, c \& d provide the following answers in whole numbers with commas and with no decimal places or dollar signs. Negative amounts should be listed in parenthesis

Glacier Ice Company uses a percentage-of-net-sales method to account for estimated bad debts. Historically, 3 percent of net sales has proven to be uncollectible. During 2020 and 2021, the company reported the following: INSTRUCTIONS: a. Prepare the necessary adjusting entry on December 31, 2020, to record the estimated bad debt expense for 2020. b. Assume that the January 1, 2020, balance in allowance for bad debts was $65,000 (credit) and that $70,000 in bad debts was written off the books during 2020. What is the December 31, 2020, balance in this account after adjustments? c. Prepare the necessary adjusting entry on December 31, 2021, to record the estimated bad debt expense for 2021. d. What is the December 31,2021 , balance in allowance for bad debts? Assume that $85,000 in bad debts was written off the books during 2021. Required: After completing Problem 6-3, parts a, b, c \& d provide the following answers in whole numbers with commas and with no decimal places or dollar signs. Negative amounts should be listed in parenthesis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started