Question

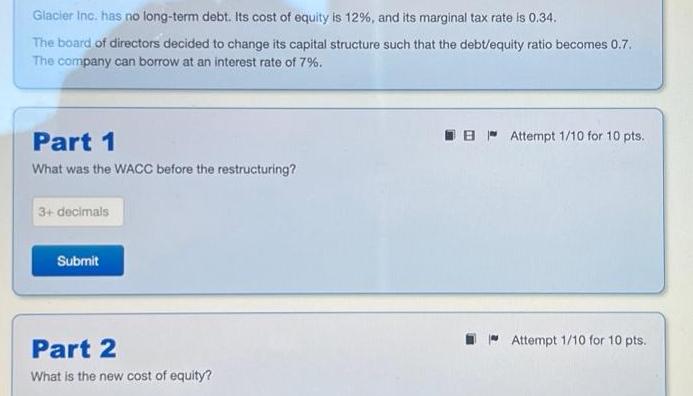

Glacier Inc. has no long-term debt. Its cost of equity is 12%, and its marginal tax rate is 0.34. The board of directors decided

Glacier Inc. has no long-term debt. Its cost of equity is 12%, and its marginal tax rate is 0.34. The board of directors decided to change its capital structure such that the debt/equity ratio becomes 0.7. The company can borrow at an interest rate of 7%. Part 1 What was the WACC before the restructuring? 3+ decimals Submit Part 2 What is the new cost of equity? Attempt 1/10 for 10 pts. Attempt 1/10 for 10 pts. Part 3 What is the new WACC? Attempt 1/10 for 10 pts.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculating the WACC before the restructuring The WACC Weighted Average Cost of Capital is a weigh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Jonathan Berk and Peter DeMarzo

3rd edition

978-0132992473, 132992477, 978-0133097894

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App