Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Glasgow plc has an investment in one company, Dundee Ltd. Glasgow plc acquired four million ordinary shares in Dundee Ltd on 1 January 2021

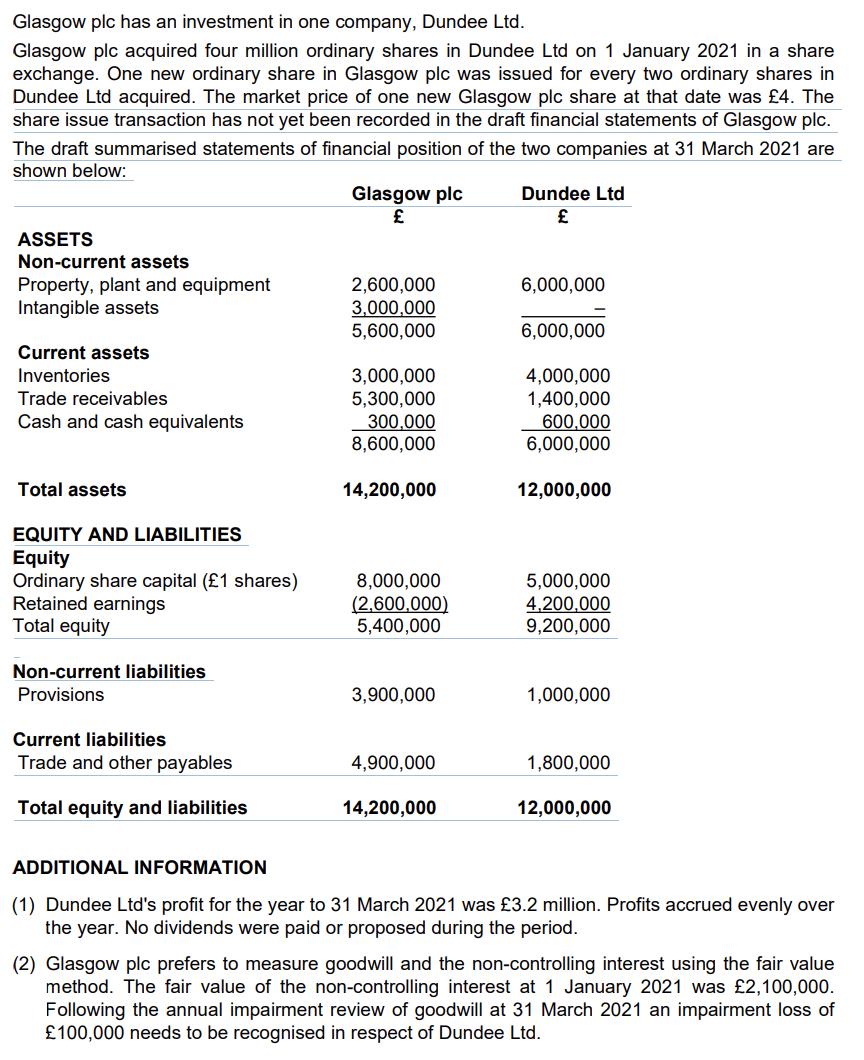

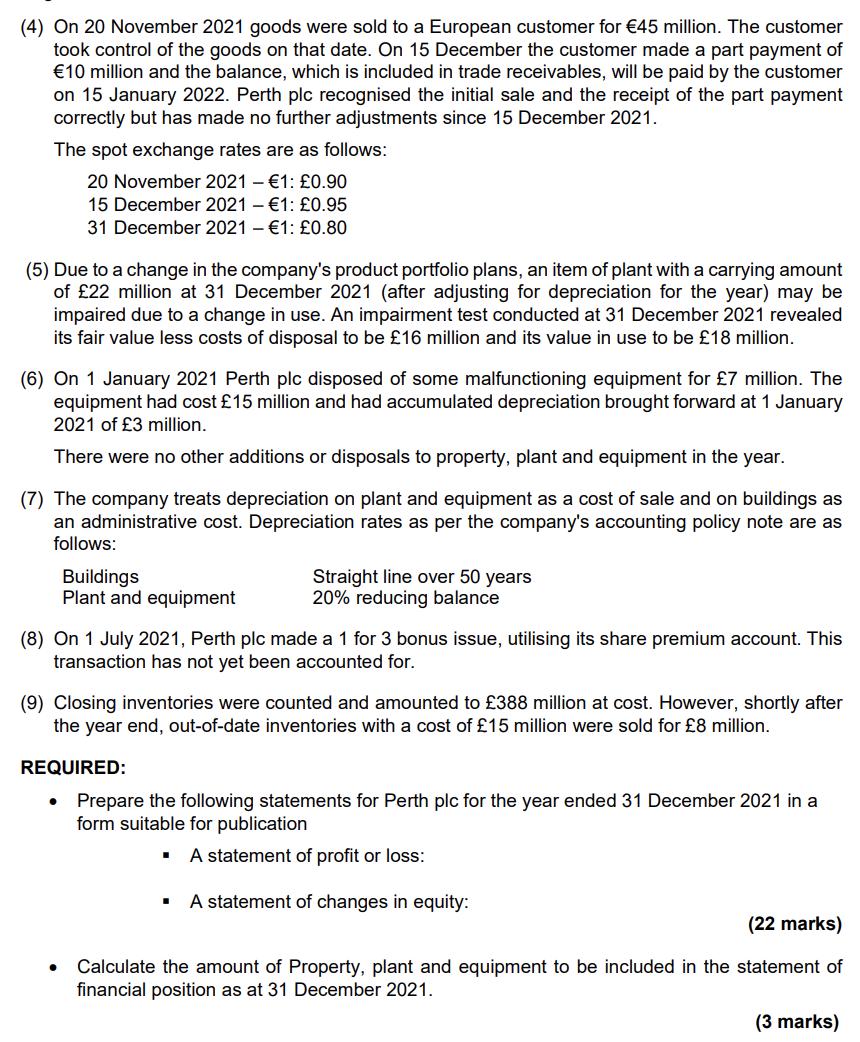

Glasgow plc has an investment in one company, Dundee Ltd. Glasgow plc acquired four million ordinary shares in Dundee Ltd on 1 January 2021 in a share exchange. One new ordinary share in Glasgow plc was issued for every two ordinary shares in Dundee Ltd acquired. The market price of one new Glasgow plc share at that date was 4. The share issue transaction has not yet been recorded in the draft financial statements of Glasgow plc. The draft summarised statements of financial position of the two companies at 31 March 2021 are shown below: Glasgow plc Dundee Ltd ASSETS Non-current assets 2,600,000 6,000,000 Property, plant and equipment Intangible assets 3,000,000 5,600,000 6,000,000 Current assets Inventories 3,000,000 4,000,000 Trade receivables 5,300,000 1,400,000 Cash and cash equivalents 300,000 600,000 8,600,000 6,000,000 Total assets 14,200,000 12,000,000 EQUITY AND LIABILITIES Equity Ordinary share capital (1 shares) 8,000,000 5,000,000 Retained earnings (2,600,000) 4,200,000 Total equity 5,400,000 9,200,000 Non-current liabilities Provisions 3,900,000 1,000,000 Current liabilities Trade and other payables 4,900,000 1,800,000 Total equity and liabilities 14,200,000 12,000,000 ADDITIONAL INFORMATION (1) Dundee Ltd's profit for the year to 31 March 2021 was 3.2 million. Profits accrued evenly over the year. No dividends were paid or proposed during the period. (2) Glasgow plc prefers to measure goodwill and the non-controlling interest using the fair value method. The fair value of the non-controlling interest at 1 January 2021 was 2,100,000. Following the annual impairment review of goodwill at 31 March 2021 an impairment loss of 100,000 needs to be recognised in respect of Dundee Ltd. (4) On 20 November 2021 goods were sold to a European customer for 45 million. The customer took control of the goods on that date. On 15 December the customer made a part payment of 10 million and the balance, which is included in trade receivables, will be paid by the customer on 15 January 2022. Perth plc recognised the initial sale and the receipt of the part payment correctly but has made no further adjustments since 15 December 2021. The spot exchange rates are as follows: 20 November 2021 - 1: 0.90 15 December 2021 - 1: 0.95 31 December 2021 - 1: 0.80 (5) Due to a change in the company's product portfolio plans, an item of plant with a carrying amount of 22 million at 31 December 2021 (after adjusting for depreciation for the year) may be impaired due to a change in use. An impairment test conducted at 31 December 2021 revealed its fair value less costs of disposal to be 16 million and its value in use to be 18 million. (6) On 1 January 2021 Perth plc disposed of some malfunctioning equipment for 7 million. The equipment had cost 15 million and had accumulated depreciation brought forward at 1 January 2021 of 3 million. There were no other additions or disposals to property, plant and equipment in the year. (7) The company treats depreciation on plant and equipment as a cost of sale and on buildings as an administrative cost. Depreciation rates as per the company's accounting policy note are as follows: Buildings Straight line over 50 years 20% reducing balance Plant and equipment (8) On 1 July 2021, Perth plc made a 1 for 3 bonus issue, utilising its share premium account. This transaction has not yet been accounted for. (9) Closing inventories were counted and amounted to 388 million at cost. However, shortly after the year end, out-of-date inventories with a cost of 15 million were sold for 8 million. REQUIRED: Prepare the following statements for Perth plc for the year ended 31 December 2021 in a form suitable for publication A statement of profit or loss: A statement of changes in equity: (22 marks) Calculate the amount of Property, plant and equipment to be included in the statement of financial position as at 31 December 2021. (3 marks)

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution here A Statement Showing Consolidated financial Position Particulars Particulars Amount Amo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started