Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GLASS Inc. is a manufacturer of aircraft equipment with a year end of July 31. As VP of Finance, you have been assessing two

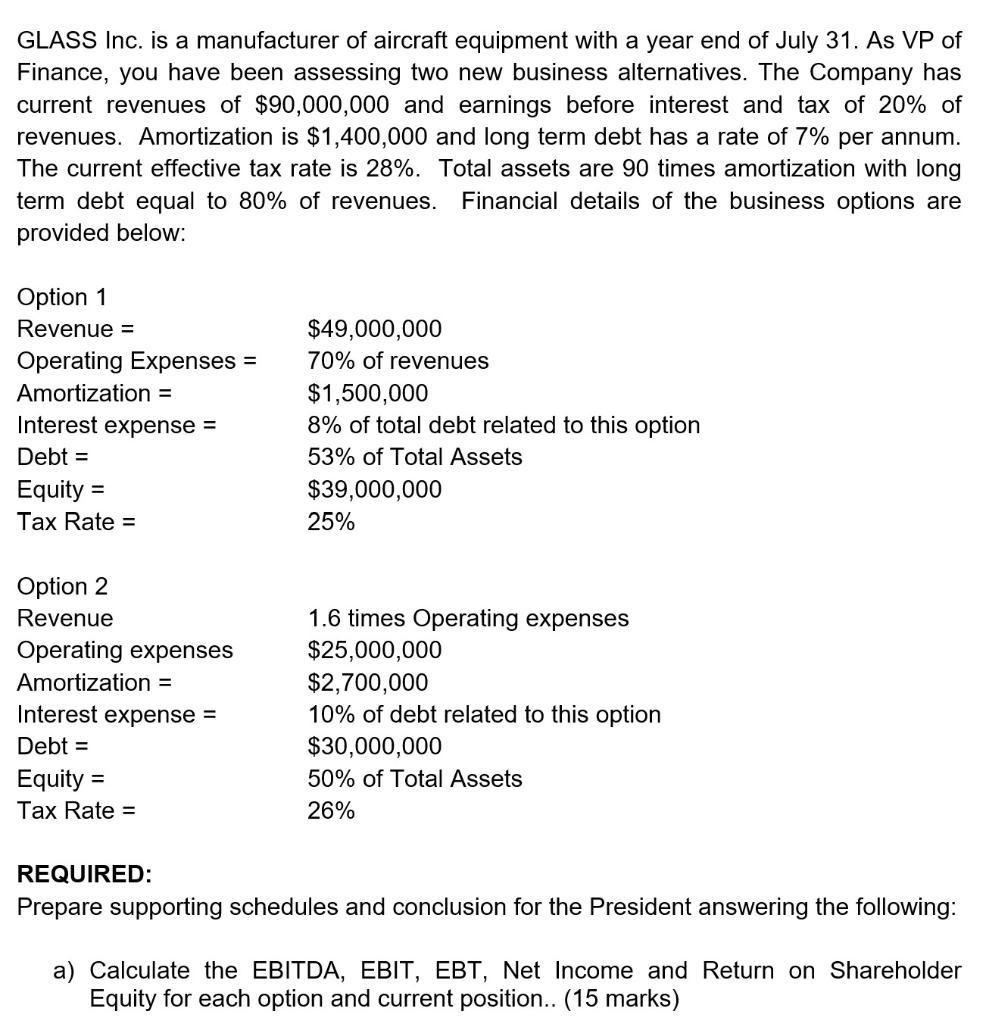

GLASS Inc. is a manufacturer of aircraft equipment with a year end of July 31. As VP of Finance, you have been assessing two new business alternatives. The Company has current revenues of $90,000,000 and earnings before interest and tax of 20% of revenues. Amortization is $1,400,000 and long term debt has a rate of 7% per annum. The current effective tax rate is 28%. Total assets are 90 times amortization with long term debt equal to 80% of revenues. Financial details of the business options are provided below: Option 1 Revenue = Operating Expenses = Amortization = Interest expense = Debt = Equity = Tax Rate = Option 2 Revenue Operating expenses Amortization = Interest expense = Debt = Equity = Tax Rate = $49,000,000 70% of revenues $1,500,000 8% of total debt related to this option 53% of Total Assets $39,000,000 25% 1.6 times Operating expenses $25,000,000 $2,700,000 10% of debt related to this option $30,000,000 50% of Total Assets 26% EQUIRED: Prepare supporting schedules and conclusion for the President answering the following: a) Calculate the EBITDA, EBIT, EBT, Net Income and Return on Shareholder Equity for each option and current position.. (15 marks)

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of EBITDA EBIT EBT Net Income and Return on Shareholder Equity for Each Option and Cur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started