Answered step by step

Verified Expert Solution

Question

1 Approved Answer

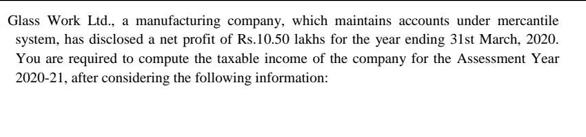

Glass Work Ltd., a manufacturing company, which maintains accounts under mercantile system, has disclosed a net profit of Rs.10.50 lakhs for the year ending

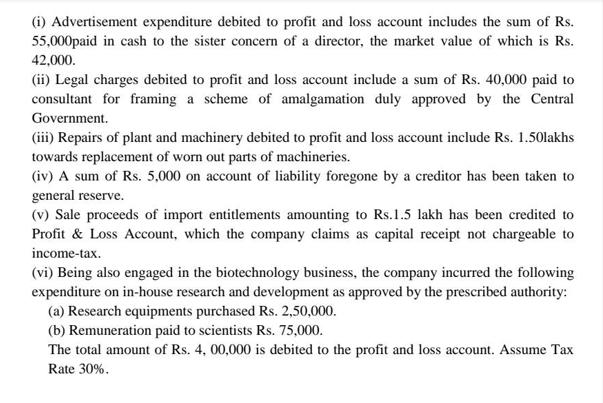

Glass Work Ltd., a manufacturing company, which maintains accounts under mercantile system, has disclosed a net profit of Rs.10.50 lakhs for the year ending 31st March, 2020. You are required to compute the taxable income of the company for the Assessment Year 2020-21, after considering the following information: (i) Advertisement expenditure debited to profit and loss account includes the sum of Rs. 55,000paid in cash to the sister concern of a director, the market value of which is Rs. 42,000. (ii) Legal charges debited to profit and loss account include a sum of Rs. 40,000 paid to consultant for framing a scheme of amalgamation duly approved by the Central Government. (iii) Repairs of plant and machinery debited to profit and loss account include Rs. 1.50lakhs towards replacement of worn out parts of machineries. (iv) A sum of Rs. 5,000 on account of liability foregone by a creditor has been taken to general reserve. (v) Sale proceeds of import entitlements amounting to Rs.1.5 lakh has been credited to Profit & Loss Account, which the company claims as capital receipt not chargeable to income-tax. (vi) Being also engaged in the biotechnology business, the company incurred the following expenditure on in-house research and development as approved by the prescribed authority: (a) Research equipments purchased Rs. 2,50,000. (b) Remuneration paid to scientists Rs. 75,000. The total amount of Rs. 4, 00,000 is debited to the profit and loss account. Assume Tax Rate 30%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the taxable income of Glass Work Ltd for the assessment year 202021 we need to make adjustments to the net profit as disclosed by the compa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started