Question

Gleam Company has a line of successful dental products that are sold in retail outlets across the country. These products include toothpastes, flosses, and rinses.

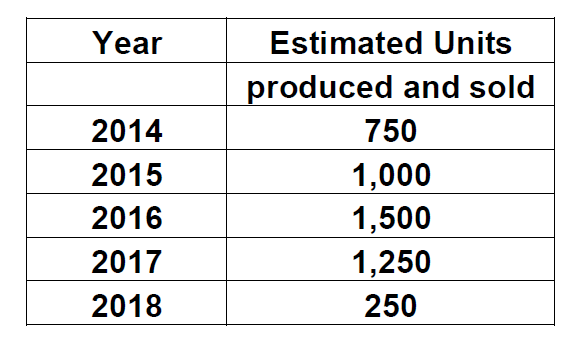

Gleam Company has a line of successful dental products that are sold in retail outlets across the country. These products include toothpastes, flosses, and rinses. The financial managers of Gleam are considering the production of a new toothpaste that heir R & D team has determined is an improvement over its existing whitening toothpaste. Gleam's marketing research has concluded that introducing the new toothpaste, Blaze, next year would be appropriate, and that projected sales in millions of units would be the following:

The marketing manager estimates that each tube of Blaze should sell for $3, and production management has estimated that the cost of each tube is $1.5. Marketing also estimates that advertising and other promotions will cost $200 million in 2014 and 2015 but then fall to $100 million in 2016 and then $50 million each year following.

The marketing research indicates that sales of Blaze will reduce sales of its other whitening toothpaste, Brilliant, at a pace of approximately 400 million in the first year, 300 million in the second year and then 200 million unit per year thereafter. Brilliant sells for $2.5 per tube and costs $1 er tube for manufacturing. Gleam will need to stock an additional $500 million of raw materials for the paste and tube production at the end of 2013, maintaining this level through 2015, then reduce it to $400 million by the end of 2016, $200 million at the end of 2017 and then $0 at the end of 2018.

The company would be able to use vacant space in another production facility to produce Blaze. This other production facility was built 10 years ago at a cost of $200 million and is being depreciated as a 20 year Accelerated Cost Recovery System asset. Blaze's production will take up approximately one-quarter of the floor space of this facility. The production equipment to manufacture the Blaze toothpaste and tube will

cost $3 billion and will be depreciated as a 7 year Accelerated Cost Recovery System asset. Gleam expects to be able to sell this equipment at the end of five years for $5 million. The equipment will be acquired December 31, 2013 and production begins in January 2014.

The purchasing managers have alerted the capital project's manager that there is uncertainty regarding the input prices for the abrasives, fluorides, and surfactants used in both Blaze and Brilliant. Though their initial projections are the most likely costs, it is possible that due to potential fluctuations in the raw materials markets in the near-term that the cost may be 20 percent less than or greater than projected for both Blaze and Brilliant toothpastes. However, due to competition in the consumer market, it is unlikely that Gleam can pass along any added costs in the sales price.

Gleam's marginal tax rate is 35%f, and this project's cost of capital is 10%. Based on all this information, should the company go ahead with Blaze?

Year Estimated Units produced and sold 2014 750 2015 1,000 2016 1,500 2017 1,250 2018 250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the financial information provided Gleam Company should proceed with the production of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started