Answered step by step

Verified Expert Solution

Question

1 Approved Answer

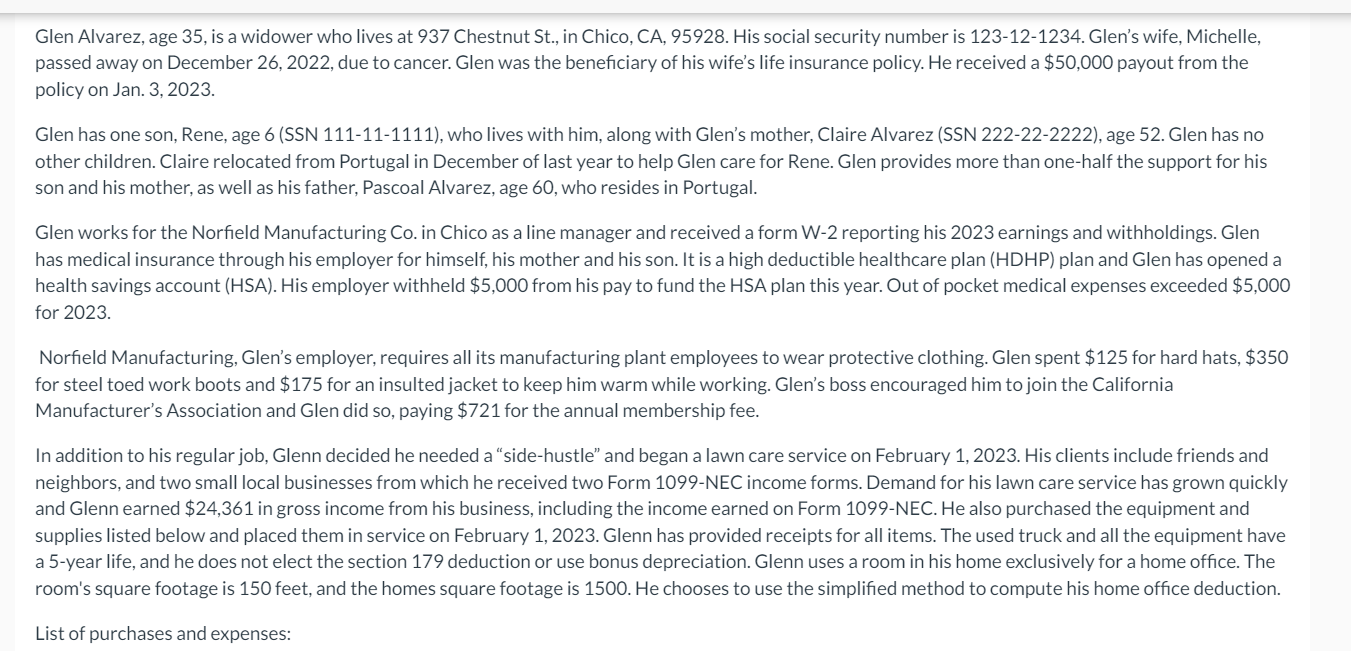

Glen Alvarez, age 3 5 , is a widower who lives at 9 3 7 Chestnut St . , in Chico, CA , 9 5

Glen Alvarez, age is a widower who lives at Chestnut St in Chico, CA His social security number is Glen's wife, Michelle,

passed away on December due to cancer. Glen was the beneficiary of his wife's life insurance policy. He received a $ payout from the

policy on Jan.

Glen has one son, Rene, age SSN who lives with him, along with Glen's mother, Claire Alvarez SSN age Glen has no

other children. Claire relocated from Portugal in December of last year to help Glen care for Rene. Glen provides more than onehalf the support for his

son and his mother, as well as his father, Pascoal Alvarez, age who resides in Portugal.

Glen works for the Norfield Manufacturing Co in Chico as a line manager and received a form W reporting his earnings and withholdings. Glen

has medical insurance through his employer for himself, his mother and his son. It is a high deductible healthcare plan HDHP plan and Glen has opened a

health savings account HSA His employer withheld $ from his pay to fund the HSA plan this year. Out of pocket medical expenses exceeded $

for

Norfield Manufacturing, Glen's employer, requires all its manufacturing plant employees to wear protective clothing. Glen spent $ for hard hats, $

for steel toed work boots and $ for an insulted jacket to keep him warm while working. Glen's boss encouraged him to join the California

Manufacturer's Association and Glen did so paying $ for the annual membership fee.

In addition to his regular job, Glenn decided he needed a "sidehustle" and began a lawn care service on February His clients include friends and

neighbors, and two small local businesses from which he received two Form NEC income forms. Demand for his lawn care service has grown quickly

and Glenn earned $ in gross income from his business, including the income earned on Form NEC. He also purchased the equipment and

supplies listed below and placed them in service on February Glenn has provided receipts for all items. The used truck and all the equipment have

a year life, and he does not elect the section deduction or use bonus depreciation. Glenn uses a room in his home exclusively for a home office. The

room's square footage is feet, and the homes square footage is He chooses to use the simplified method to compute his home office deduction.

List of purchases and expenses:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started