Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Glenn Grimes is the founder and president of Heartland Construction, a real estate development venture. The business transactions during February while the company was being

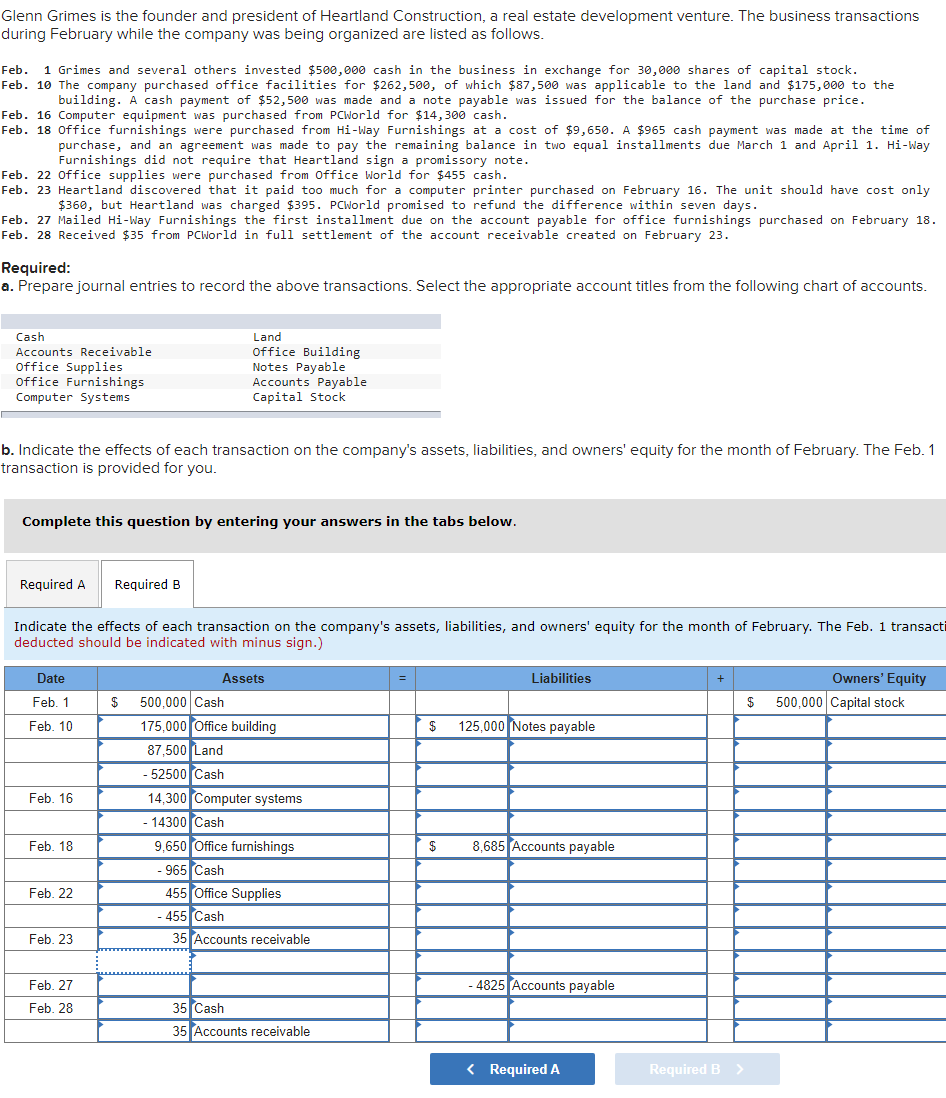

Glenn Grimes is the founder and president of Heartland Construction, a real estate development venture. The business transactions during February while the company was being organized are listed as follows. Feb. 1 Grimes and several others invested $500,000 cash in the business in exchange for 30,000 shares of capital stock. Feb. 10 The company purchased office facilities for $262,500, of which $87,500 was applicable to the land and $175, 000 to the building. A cash payment of $52,500 was made and a note payable was issued for the balance of the purchase price. Feb. 16 Computer equipment was purchased from PCWorld for $14,300cash. Feb. 18 office furnishings were purchased from Hi-Way Furnishings at a cost of $9,650. A $965 cash payment was made at the time of purchase, and an agreement was made to pay the remaining balance in two equal installments due March 1 and April 1 . Hi-Way Furnishings did not require that Heartland sign a promissory note. Feb. 22 Office supplies were purchased from Office World for $455 cash. Feb. 23 Heartland discovered that it paid too much for a computer printer purchased on February 16 . The unit should have cost only $360, but Heartland was charged $395. PCWorld promised to refund the difference within seven days. Feb. 27 Mailed Hi-Way Furnishings the first installment due on the account payable for office furnishings purchased on February 18. Feb. 28 Received $35 from PCWorld in full settlement of the account receivable created on February 23 . Required: a. Prepare journal entries to record the above transactions. Select the appropriate account titles from the following chart of accounts. b. Indicate the effects of each transaction on the company's assets, liabilities, and owners' equity for the month of February. The Feb. 1 transaction is provided for you. Complete this question by entering your answers in the tabs below. Indicate the effects of each transaction on the company's assets, liabilities, and owners' equity for the month of February. The Feb. 1 transac deducted should be indicated with minus sign.)

Glenn Grimes is the founder and president of Heartland Construction, a real estate development venture. The business transactions during February while the company was being organized are listed as follows. Feb. 1 Grimes and several others invested $500,000 cash in the business in exchange for 30,000 shares of capital stock. Feb. 10 The company purchased office facilities for $262,500, of which $87,500 was applicable to the land and $175, 000 to the building. A cash payment of $52,500 was made and a note payable was issued for the balance of the purchase price. Feb. 16 Computer equipment was purchased from PCWorld for $14,300cash. Feb. 18 office furnishings were purchased from Hi-Way Furnishings at a cost of $9,650. A $965 cash payment was made at the time of purchase, and an agreement was made to pay the remaining balance in two equal installments due March 1 and April 1 . Hi-Way Furnishings did not require that Heartland sign a promissory note. Feb. 22 Office supplies were purchased from Office World for $455 cash. Feb. 23 Heartland discovered that it paid too much for a computer printer purchased on February 16 . The unit should have cost only $360, but Heartland was charged $395. PCWorld promised to refund the difference within seven days. Feb. 27 Mailed Hi-Way Furnishings the first installment due on the account payable for office furnishings purchased on February 18. Feb. 28 Received $35 from PCWorld in full settlement of the account receivable created on February 23 . Required: a. Prepare journal entries to record the above transactions. Select the appropriate account titles from the following chart of accounts. b. Indicate the effects of each transaction on the company's assets, liabilities, and owners' equity for the month of February. The Feb. 1 transaction is provided for you. Complete this question by entering your answers in the tabs below. Indicate the effects of each transaction on the company's assets, liabilities, and owners' equity for the month of February. The Feb. 1 transac deducted should be indicated with minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started