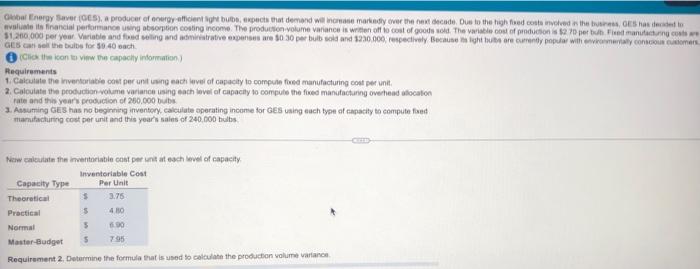

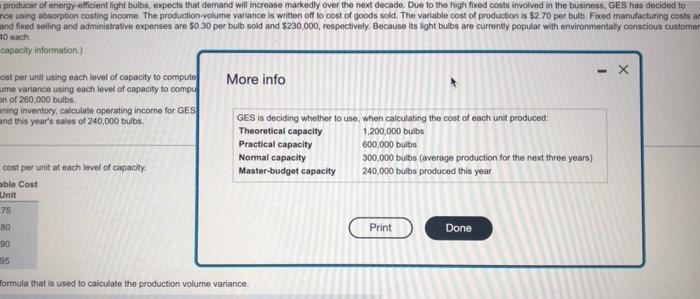

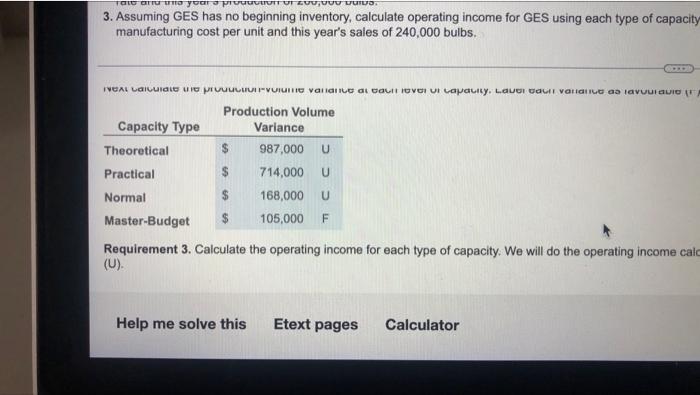

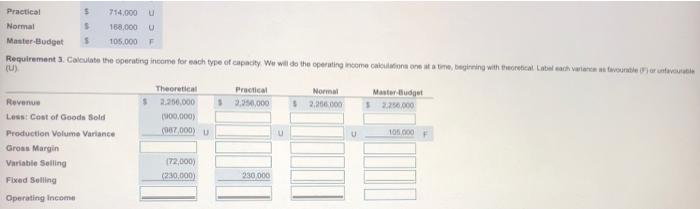

Global Energy Saver (GES), a producer of energy efficient light buba,pects that demand wil markedly over the decade. Dus to the high foco naved the Sheet volte i financial performano ung absorption couting income. The production volume variance is written off to cost of goods old. The cost of productions 127 per un manufacturing costs 31.200.000 per year Variable and fasting and writive expenses are 50 30 per bulbsold and 1230 000, respectively Because shuts are currently popular will come contou come GESCs the bibe for $0.40 sach Click the icon to the capacity Information) Requirements 1. Calculate the inventoria com per unit using each level of capacity to compute fed manufacturing cost per unit, 2. Calculate the production volume variance using each level of capacity to compute the five manufacturing overhead location rate and this year's production of 260.000 3. Assuming GES has no beginning inventory, calculate operating income for GES uning each type of capacity to compute front manufacturing cost per unit and this year's sales of 240.000 bulbs Now calculate the inventore cont per unit at each level of capacity inventoriable Cost Capacity Type Per Unit Theoretical 5 3.75 Practical $ 430 Normal 5 600 Master-Budget 5 7.95 Requirement 2. Determine the formula that is used to calculate the production volume variance producer of energy efficient light bulbs, expects that demand will increase markedly over the next decade. Due to the high fixed costs involved in the business, GES has decided to noe using absorption costing income. The production-volume variance is written off to cost of goods sold. The variable cost of production is $2.70 per bulb. Fixed manufacturing costs ar and fixed selling and administrative expenses are 50.30 per bulb sold and $230,000, respectively. Because its light bulbs are currently popular with environmentally conscious customer 0 each capacity information) - X ost per unit using each level of capacity to compute More info ume variance using each level of capacity to compu on of 260,000 bulbs aning inventory, calculate operating income for GES and this year's sales of 240,000 bulbs GES is deciding whether to use, when calculating the cost of each unit produced Theoretical capacity 1.200,000 bulbs Practical capacity 600,000 bulbs Normal capacity 300,000 bulbs (average production for the next three years) cost per unit at each level of capacity Master-budget capacity 240.000 bulbs produced this year able Cost Unit 75 -80 Done 90 Print formula that is used to calculate the production volume variance Tattoo ya promos 3. Assuming GES has no beginning inventory, calculate operating income for GES using each type of capacity manufacturing cost per unit and this year's sales of 240,000 bulbs. IVAL LIQUIDI u pivuuLLIVUIUTID vanane di BOLOVI UI Lapauty. Love U Varaa avuuia Production Volume Capacity Type Variance Theoretical 987,000 U Practical 714,000 U Normal 168,000 U Master-Budget 105,000 F Requirement 3. Calculate the operating income for each type of capacity. We will do the operating income calc (U). Help me solve this Etext pages Calculator Practical $ 714,000 Normal $ 188,000 Master Budget 105.000 F Requirements Calculate the operating income for each type of capacity. We will do the operating come calculation on the beginning with thetical leather stavble or unav (u) Theoretical Practical Normal Master Budget Revenue $ 2.250.000 $9.950,000 $ 2,206.000 5 2.250.000 Less Cost of Goods Sold (900.000 (87000) U 105.000 Production Volume Variance Gross Margin Variable Selling 172,000) (230.000 230 000 Fixed Selling Operating Income