Answered step by step

Verified Expert Solution

Question

1 Approved Answer

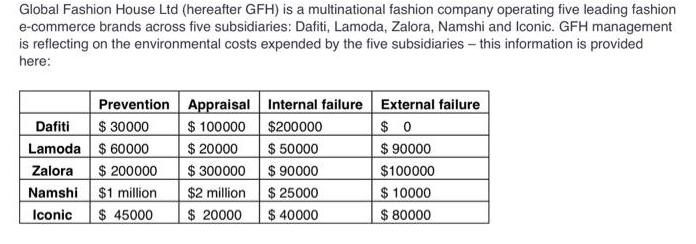

Global Fashion House Ltd (hereafter GFH) is a multinational fashion company operating five leading fashion e-commerce brands across five subsidiaries: Dafiti, Lamoda, Zalora, Namshi

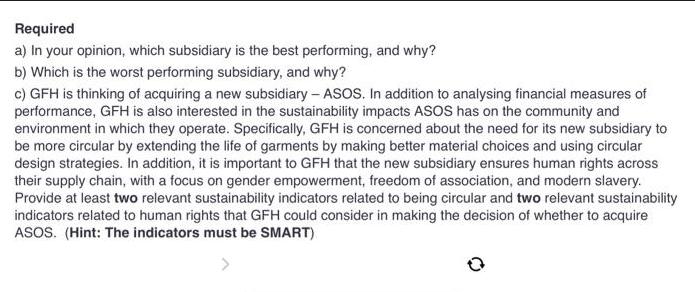

Global Fashion House Ltd (hereafter GFH) is a multinational fashion company operating five leading fashion e-commerce brands across five subsidiaries: Dafiti, Lamoda, Zalora, Namshi and Iconic. GFH management is reflecting on the environmental costs expended by the five subsidiaries - this information is provided here: Prevention Appraisal Internal failure $100000 $200000 $20000 $ 50000 $ 90000 $ 25000 $ 40000 Dafiti $ 30000 Lamoda $60000 Zalora Namshi Iconic $ 200000 $1 million $ 45000 $ 300000 $2 million $20000 External failure $0 $ 90000 $100000 $ 10000 $ 80000 Required a) In your opinion, which subsidiary is the best performing, and why? b) Which is the worst performing subsidiary, and why? c) GFH is thinking of acquiring a new subsidiary - ASOS. In addition to analysing financial measures of performance, GFH is also interested in the sustainability impacts ASOS has on the community and environment in which they operate. Specifically, GFH is concerned about the need for its new subsidiary to be more circular by extending the life of garments by making better material choices and using circular design strategies. In addition, it is important to GFH that the new subsidiary ensures human rights across their supply chain, with a focus on gender empowerment, freedom of association, and modern slavery. Provide at least two relevant sustainability indicators related to being circular and two relevant sustainability indicators related to human rights that GFH could consider in making the decision of whether to acquire ASOS. (Hint: The indicators must be SMART). >

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To determine which subsidiary is the best performing we can consider the overall environmental costs incurred by each subsidiary By summing up the costs under each category prevention appraisal inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started