Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Global Filter Corp. showed the following account balances at December 31, 2019 Accounts Receivable, $187,000, Allowance for Doubtful Accounts, $2,000, Sales (all on credit),

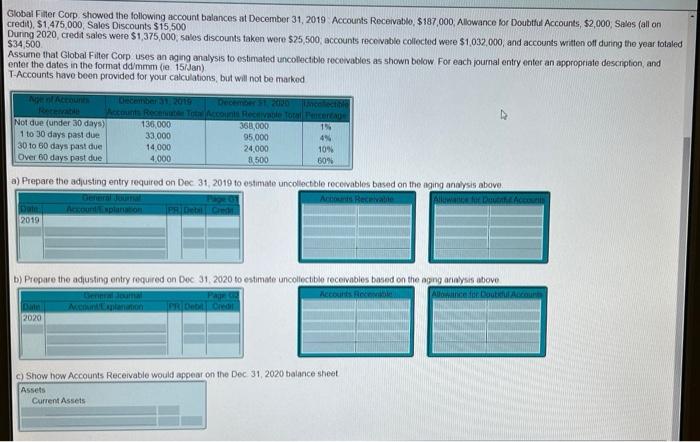

Global Filter Corp. showed the following account balances at December 31, 2019 Accounts Receivable, $187,000, Allowance for Doubtful Accounts, $2,000, Sales (all on credit), $1,475,000, Sales Discounts $15,500 During 2020, credit sales were $1,375,000, sales discounts taken were $25,500; accounts receivable collected were $1,032,000, and accounts written off during the year totaled $34,500 Assume that Global Filter Corp uses an aging analysis to estimated uncollectible receivables as shown below For each journal entry enter an appropriate description, and enter the dates in the format dd/mmm (e 15/Jan) T-Accounts have been provided for your calculations, but will not be marked. Ngent Accounts Receivable Not due (under 30 days) 1 to 30 days past due 30 to 60 days past due Over 60 days past due Date 2019 December 31, 2019 December 31, 2020 Accounts Recenate Total Accounts Receivable Total Pencerdage 1% 4% 10% 60% a) Prepare the adjusting entry required on Dec 31, 2019 to estimate uncollectible receivables based on the aging analysis above. Accounts Receivable Allowance fr Duuth Accounts Date 2020 136,000 33,000 14,000 4.000 General Journal Account/Explanation Current Assets 368,000 95,000 24,000 8,500 PR Detail Cre b) Prepare the adjusting entry required on Dec 31, 2020 to estimate uncollectible receivables based on the aging analysis above Accounts Recennable. Allowance for Doutsful Account Account Explanation c) Show how Accounts Receivable would appear on the Dec 31, 2020 balance sheet Assets

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Prepare the adjusting entry required on Dec 31 2019 to estimate uncollectible receivables based on the aging analysis above Date 31Dec2019 Descripti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started