Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Global Green Energy (GGE) is considering three new investment projects presented below. The firm's CFO has calculated the initial investment and first five year

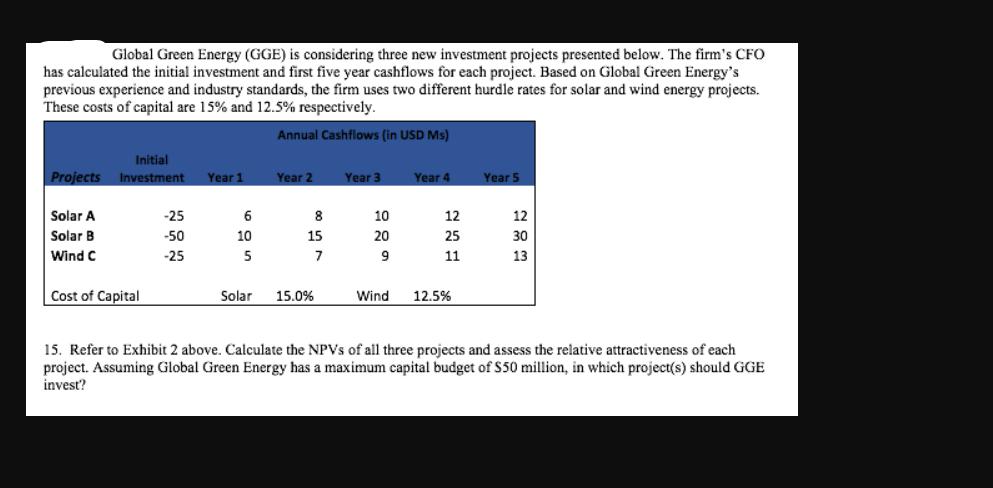

Global Green Energy (GGE) is considering three new investment projects presented below. The firm's CFO has calculated the initial investment and first five year cashflows for each project. Based on Global Green Energy's previous experience and industry standards, the firm uses two different hurdle rates for solar and wind energy projects. These costs of capital are 15% and 12.5% respectively. Annual Cashflows (in USD Ms) Projects Solar A Solar B Wind C Initial Investment Cost of Capital -25 -50 -25 Year 1 6 10 5 Year 2 8 15 7 Solar 15.0% Year 3 10 20 9 Wind Year 4 12 25 11 12.5% Year 5 12 30 13 15. Refer to Exhibit 2 above. Calculate the NPVS of all three projects and assess the relative attractiveness of each project. Assuming Global Green Energy has a maximum capital budget of $50 million, in which project(s) should GGE invest?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating NPVs Formula NPV CFt 1 r t Initial Investment Where CFt Cash flow in year t r Discount r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started