Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Global, Inc. provides consulting services throughout the world. The company pays taxes to the nation where revenues are earned. Information about the company's taxes are

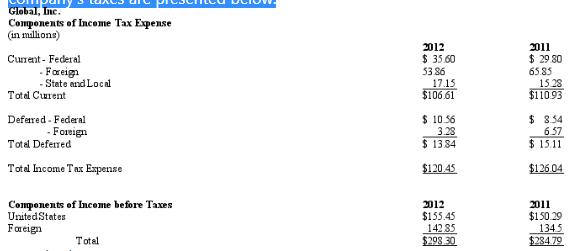

Global, Inc. provides consulting services throughout the world. The company pays taxes to the nation where revenues are earned. Information about the company's taxes are presented below:

Required:

Required:

a). Using the information provided for Global, prepare the company's journal entry to record income taxes for 2012 and 2011.

b). Using the information provided for Global, determine the company's effective tax rate for 2012 and 2011.

Global, Inc. Components of Income Tax Expense (in millions) Current- Federal - Foreign - State and Local Total Current Deferred - Federal -Foreign Total Deferred Total Income Tax Expense Components of Income before Taxes United States Foreign Total 2012 $ 35.60 53.86 17.15 $106.61 $10.56 3.28 $ 1384 $120.45 2012 $155.45 142.85 $298.30 2011 $ 29 30 65.85 15.28 $110.93 $8.54 6.57 $15.11 $126.04 2011 $150.29 1345 $284 79

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Given below Answee qiuen below Datel Alcount title End Expl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started