Global Investments is considering the following project: The project has an investment of R500 000. The depreciation is calculated on the straight-line method. The

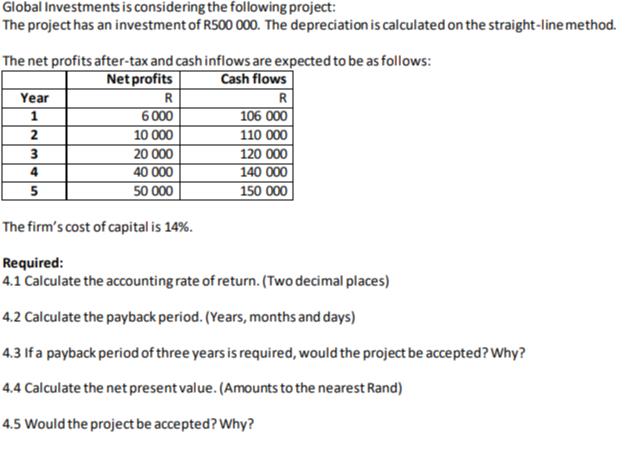

Global Investments is considering the following project: The project has an investment of R500 000. The depreciation is calculated on the straight-line method. The net profits after-tax and cash inflows are expected to be as follows: Net profits Cash flows Year R R 1 6 000 106 000 2 10 000 110 000 3 20 000 120 000 4 40 000 140 000 5 50 000 150 000 The firm's cost of capital is 14%. Required: 4.1 Calculate the accounting rate of return. (Two decimal places) 4.2 Calculate the payback period. (Years, months and days) 4.3 If a payback period of three years is required, would the project be accepted? Why? 4.4 Calculate the net present value. (Amounts to the nearest Rand) 4.5 Would the project be accepted? Why?

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Given E Project cost 2 R 500000 Depreciation method Straightline method Project term 5 yrs De...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started