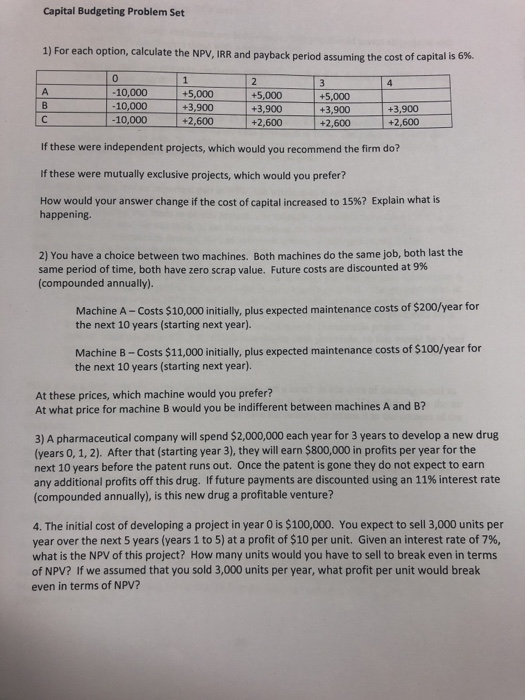

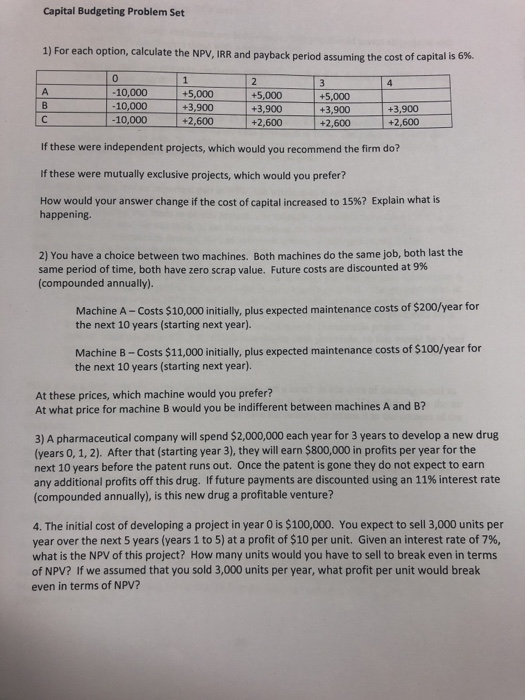

GLOBAL PRIVATE BANK-QUESTIONS Sitting down in your office, coffee in hand, you jot down some questions you think might come up during the day's discussions. Prepare a report, using the report guidelines from the course website, which incorporates the answers to these questions. Q. 1. How does the forecast for 2006 compare with the historical performance of the economy? The spreadsheet Global Private Bank, found on the course website, provides quarterly data for nominal and real GDP. Use this data set to compare the projected quarterly growth rates of the economy during 2006 with the average since 1990 (which measure of GDP do you want to use?). Does this explain why investors are concerned? Determine the rate of inflation expected for 2006. Investors are expecting the Federal Reserve to take action. Discuss the strategy you expect the Federal Reserve to follow and broadly what you predict it will do. You would want to analyze the strategy using aggregate demand-aggregate supply. Of course, you also want to be able to answer the question using less technical language. Q. 2. The Federal Reserve's strategy will require changing the money supply. How does the Federal Reserve do this, and how (and why) does this affect interest rates? Q. 3. Q.4. If the Federal Reserve decides to act, how will that affect investors that deal with Globa Private Bank? Limit your answer to issues discussed in the case. One of the assertions is that changes in Federal Reserve policy can affect inflation. the data support a connection between the rate of increase in the money supply and inflation? Using the data on the growth rate of M2 and inflation in your spreadsheet, run a regression of the rate of inflation on the rate of growth of the money supply. What does the coefficient on the money supply variable tell you? What is the meaning of the p- value? Is the regression coefficient significant? is faster money growth always associated with higher inflation? Do Q. 5. Capital Budgeting Problem Set 1) For each option, calculate the NPV, IRR and payback period assuming the cost of capital is 6%. 10,000 10,000 -10,000 +5,000 +3,900 +2,600 +5,000 +3,900 +2,600 +5,000 +3,900 +2,600 +3,900 +2,600 If these were independent projects, which would you recommend the firm do? If these were mutually exclusive projects, which would you prefer? How would your answer change if the cost of capital increased to 15%? Explain what is happening 2) You have a choice between two machines. Both machines do the same job, both last the same period of time, both have zero scrap value. Future costs are discounted at 9% (compounded annually). Machine A -Costs $10,000 initially, plus expected maintenance costs of $200/year for the next 10 years (starting next year). Machine B -Costs $11,000 initially, plus expected maintenance costs of $100/year for the next 10 years (starting next year). At these prices, which machine would you prefer? At what price for machine B would you be indifferent between machines A and B? 3) A pharmaceutical company will spend $2,000,000 each year for 3 years to develop a new drug (years 0, 1, 2). After that (starting year 3), they will earn $800,000 in profits per year for the next 10 years before the patent runs out. Once the patent is gone they do not expect to earn any additional profits off this drug. If future payments are discounted using an 11% interest rate (compounded annually), is this new drug a profitable venture? 4. The initial cost of developing a project in year 0 is $100,000. You expect to sell 3,000 units per year over the next 5 years (years 1 to 5) at a profit of $10 per unit. Given an interest rate of 7%, what is the NPV of this project? How many units would you have to sell to break even in terms of NPV? If we assumed that you sold 3,000 units per year, what profit per unit would break even in terms of NPV? GLOBAL PRIVATE BANK-QUESTIONS Sitting down in your office, coffee in hand, you jot down some questions you think might come up during the day's discussions. Prepare a report, using the report guidelines from the course website, which incorporates the answers to these questions. Q. 1. How does the forecast for 2006 compare with the historical performance of the economy? The spreadsheet Global Private Bank, found on the course website, provides quarterly data for nominal and real GDP. Use this data set to compare the projected quarterly growth rates of the economy during 2006 with the average since 1990 (which measure of GDP do you want to use?). Does this explain why investors are concerned? Determine the rate of inflation expected for 2006. Investors are expecting the Federal Reserve to take action. Discuss the strategy you expect the Federal Reserve to follow and broadly what you predict it will do. You would want to analyze the strategy using aggregate demand-aggregate supply. Of course, you also want to be able to answer the question using less technical language. Q. 2. The Federal Reserve's strategy will require changing the money supply. How does the Federal Reserve do this, and how (and why) does this affect interest rates? Q. 3. Q.4. If the Federal Reserve decides to act, how will that affect investors that deal with Globa Private Bank? Limit your answer to issues discussed in the case. One of the assertions is that changes in Federal Reserve policy can affect inflation. the data support a connection between the rate of increase in the money supply and inflation? Using the data on the growth rate of M2 and inflation in your spreadsheet, run a regression of the rate of inflation on the rate of growth of the money supply. What does the coefficient on the money supply variable tell you? What is the meaning of the p- value? Is the regression coefficient significant? is faster money growth always associated with higher inflation? Do Q. 5. Capital Budgeting Problem Set 1) For each option, calculate the NPV, IRR and payback period assuming the cost of capital is 6%. 10,000 10,000 -10,000 +5,000 +3,900 +2,600 +5,000 +3,900 +2,600 +5,000 +3,900 +2,600 +3,900 +2,600 If these were independent projects, which would you recommend the firm do? If these were mutually exclusive projects, which would you prefer? How would your answer change if the cost of capital increased to 15%? Explain what is happening 2) You have a choice between two machines. Both machines do the same job, both last the same period of time, both have zero scrap value. Future costs are discounted at 9% (compounded annually). Machine A -Costs $10,000 initially, plus expected maintenance costs of $200/year for the next 10 years (starting next year). Machine B -Costs $11,000 initially, plus expected maintenance costs of $100/year for the next 10 years (starting next year). At these prices, which machine would you prefer? At what price for machine B would you be indifferent between machines A and B? 3) A pharmaceutical company will spend $2,000,000 each year for 3 years to develop a new drug (years 0, 1, 2). After that (starting year 3), they will earn $800,000 in profits per year for the next 10 years before the patent runs out. Once the patent is gone they do not expect to earn any additional profits off this drug. If future payments are discounted using an 11% interest rate (compounded annually), is this new drug a profitable venture? 4. The initial cost of developing a project in year 0 is $100,000. You expect to sell 3,000 units per year over the next 5 years (years 1 to 5) at a profit of $10 per unit. Given an interest rate of 7%, what is the NPV of this project? How many units would you have to sell to break even in terms of NPV? If we assumed that you sold 3,000 units per year, what profit per unit would break even in terms of NPV