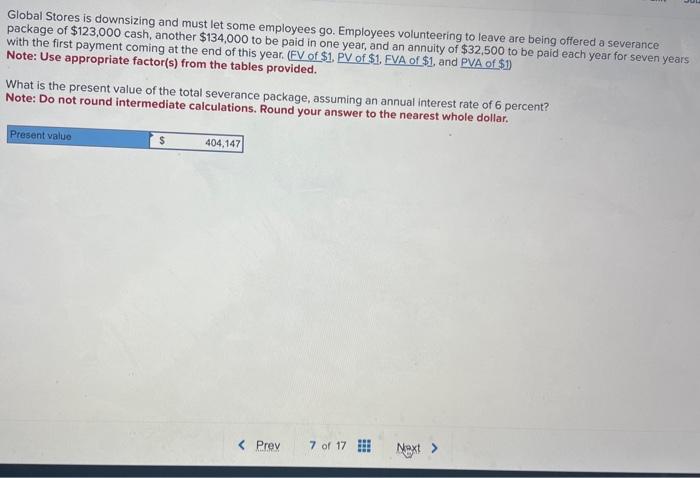

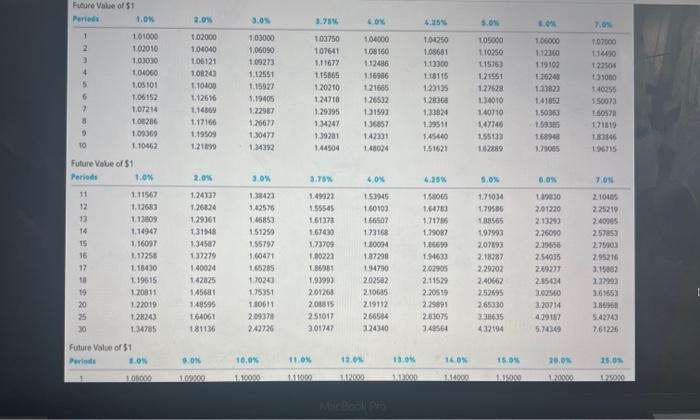

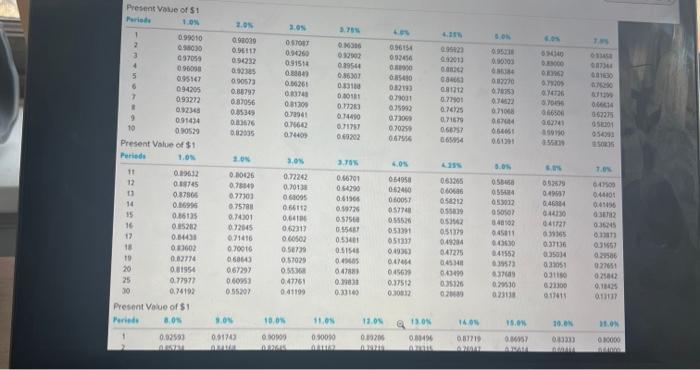

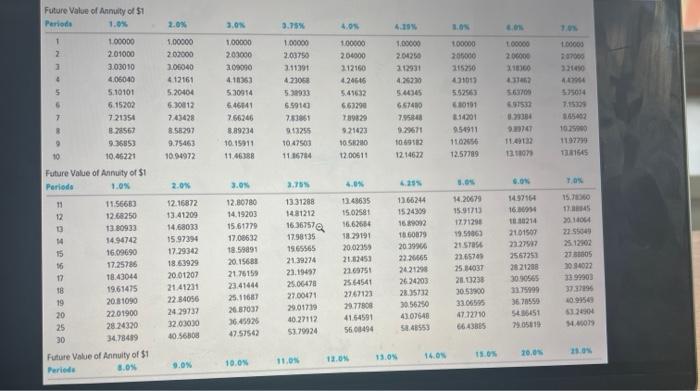

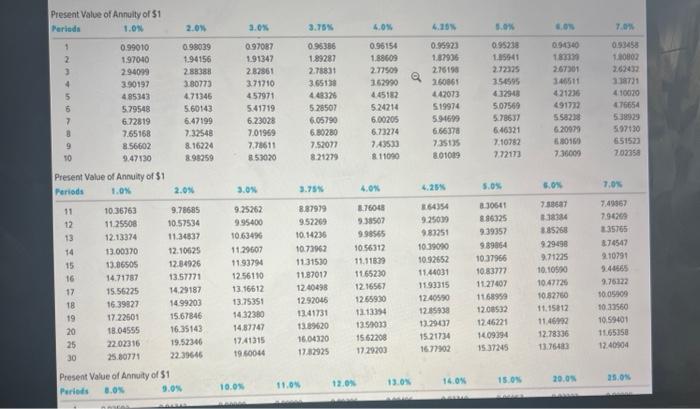

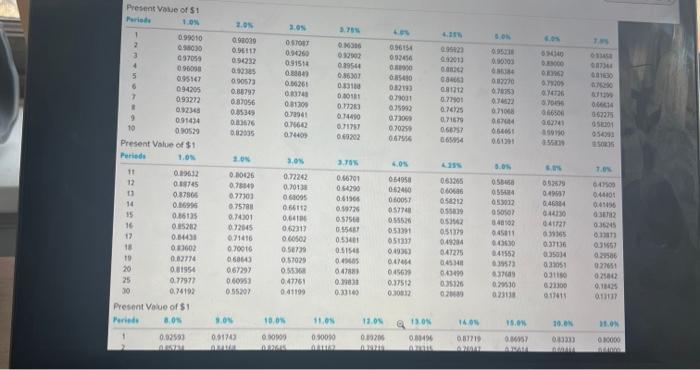

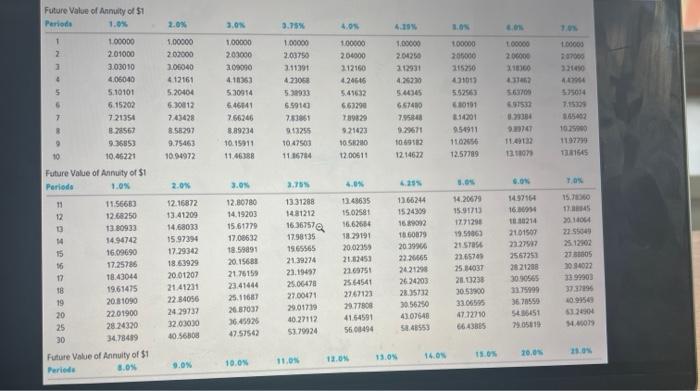

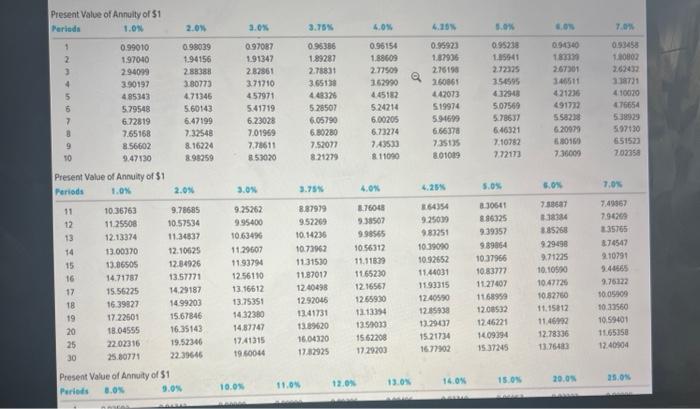

Global Stores is downsizing and must let some employees go. Employees voluntering to leave are being offered a severance package of $123,000 cash, another $134,000 to be paid in one year, and an annuity of $32,500 to be paid each year for seven years with the first payment coming at the end of this year. (FV of $1, PV of $1, FVA of $1, and PVA of \$1) Note: Use appropriate factor(s) from the tables provided. What is the present value of the total severance package, assuming an annual interest rate of 6 percent? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \begin{tabular}{l} Future Va \\ Perioda \end{tabular} & \multicolumn{8}{|c|}{ Future Value of Annulty of \$1 } & lin \\ \hline t & 100000 & 1,00000 & 1,00000 & 1,09000 & 100000 & 1,00000 & 100000 & t00000 & 100000 \\ \hline 2 & 2.01000 & 200000 & 200900 & 2.01750 & 204000 & 20425 & zotcose & 200000 & inroes \\ \hline 3 & 302010 & 206040 & 30009 & 3.1129t & 212160 & 2.12931 & 21520 & x1000 & 221010 \\ \hline 4 & 4.06040 & 4.12161 & 4.15363 & 4.3068 & 4.245+5 & 4630 & 41013 & 4xah? & Aimes \\ \hline 5 & 5.10101 & 5.20404 & 5.30914 & 5.2093 & 5.41632 & s.46365 & 5.52663 & s.6inces & 375014 \\ \hline 5 & 6.15202 & 6. x ad 12 & 6.46441 & 55914 & 6.61290 & 657469 & 610101 & 6.9159 & 1, 18369 \\ \hline 7 & 721354 & 7.03428 & 766246 & 7x3esi & tagka & & travol & & 145499 \\ \hline 8 & B 24567 & 858207 & 8.89234 & 913255 & 9.21023 & & Q.54911 & & 10xsing \\ \hline 9 & 525853 & 9.75463 & 10.15911 & 1047503 & 10 sman & 106912 & 1102556 & I1.4012 & 119779 \\ \hline 10 & 10,45221 & 1094972 & 11.46388 & 1136714 & 1200511 & 12.1462 & 12.57799 & 13.10n & nises \\ \hline \multicolumn{10}{|c|}{ Future Value of Ainuity or \$1 } \\ \hline Periodo & 1.0% & 2.0N & 3.05 & 2.355 & 4.0% & 4.255 & 0.64 & sen & t.ak \\ \hline 11 & 11.56683 & 12.16872 & 12.80780 & 1331288 & 1243635 & 1165244 & 14.20679 & 149716 & is.reve \\ \hline 12 & 12co250 & 13.41209 & 14.19203 & 1481212 & 15.02581 & 1524309 & 1591713 & 16 semp & 1) aEs45 \\ \hline 13 & 13.00933 & 14.68033 & 15.61779 & 1636757Q & 16.62684 & 16 sion? & 1271294 & tisa214 & nuos \\ \hline 4 & 1494742 & 15.97394 & 17,00632 & 1798135 & 1820191 & 1560279 & 19.546 & 2101597 & 2155049 \\ \hline 15 & 16.09690 & 1729342 & 18.59891 & 1565365 & 20.02353 & 203990 & 215704 & n2rem & \\ \hline 16 & 17.25786 & 18.63929 & 20. 1963 & 2139274 & 21:22453 & 22655 & & 2567251 & 21 statos \\ \hline n & 18.43044 & 2001207 & 2175159 & 23.19497 & nestsi & 24.21254 & 25 t.403 & 2121298 & xog4022 \\ \hline 18 & 19.61475 & 21.41231 & 23.41444 & 25.06478 & & 26,24703 & 21.0238 & 3090665 & 139990: \\ \hline 19 & 201090 & n. 84056 & 25.11687 & 27.00471 & 2767123 & 28.25732 & 3053960 & 1175999 & \\ \hline 20 & 2201900 & 24.2973? & 2087097 & 20.01739 & 277858 & 30.56250 & 330658 & 367559 & 40.2.54: \\ \hline 25 & 28.24320 & 32.09030 & 3645925 & 40.2711? & 41.54591 & 4) 07648 . & 47.72710 & & 61.2400 \\ \hline 30 & 3478459 & 40.56806 & 47.51562 & 53.79924 & 5604494 & 93.46553 & C6.43665 & 3.05+19: & M.w.019 \\ \hline \multicolumn{10}{|c|}{ Future Value of Annuity of \$1 } \\ \hline Perieds & & 0.0% & 10.0s & 11,0% & 13.0N & 14.05 & is on & re.015 & nax \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Present Value of Annulty of \$1 } \\ \hline Rerieds & 1.0 & 2.014 & 2.01 & 3.754 & 4.0% & & 5.0% & cos & \\ \hline 1 & 0.99010 & 0.90039 & 097067 & 095386 & 0.96154 & 0.5093 & 0.95238 & 0.94340 & 0.93458 \\ \hline 2 & 197040 & 1.94156 & 1.91347 & 18928 & 1.88009 & & 145941 & 1sin & 120802 \\ \hline 3 & 294099 & 288383 & 282861 & 278831 & 271900 & (27819 & 27225 & 267301 & 262477. \\ \hline 4 & 390197 & 380m & 371710 & 3.6512 & 162990 & Q. 260001 & 354595 & 346511 & 318m1 \\ \hline 5 & 4.85343 & 4.71346 & 457971 & 4.43326 & 4.4518 & 4.47013 & 4.3213 & 421236 & 4.10020 \\ \hline 6 & 5.79548 & 5.60143 & 5.41719 & 528507 & 524214 & 519974 & 507569 & 4917 & 476654 \\ \hline 7 & 672819 & 6.47199 & 6.23028 & 6.05790 & 600205 & 594699 & 5.78537 & 5sen8 & 538929 \\ \hline B & 7.65168 & 7.32548 & 7.01969 & 6.30280 & 6.73274 & 6.6637 & 646321 & 6.2009 & 527+30 \\ \hline 9 & 8.56602 & 8.16224 & 7.78611 & 7.520n & 1.4353 & 735125 & 7,10752 & 016) & 651523 \\ \hline 10 & 9.47130 & 895259 & 853070 & 8.21279 & 811090 & 8.01089 & mm & 736009 & ronss \\ \hline \multicolumn{10}{|c|}{ Present Value of Annulity of \$1 } \\ \hline Feriods & 1.0x & 2.0% & 2.01 & 3.75x & 4.0x & 4.25s & 5.05 & sos & 1,05 \\ \hline 11 & 10.36763 & 9.78685 & 9.25262 & 8.87919 & :.76043 & 164354 & a. 30641 & 7sseat & 7.40367 \\ \hline 12 & 11.25506 & 10.57534 & 9.95400 & 952269 & 930507 & 925000 & 8.85325 & 1.3834 & 1.96769 \\ \hline 13 & 12.13374 & 11.34537 & 10.634% & 10.14235 & 990565 & 987251 & 239357 & 185768 & 135765 \\ \hline 14 & 13.00370 & 12.10625 & 1120607 & 10.73062 & 1056312 & 1035010 & 959054 & 929498 & 874547 \\ \hline 15 & 13.06505 & 1204926 & 1193794 & 11.31510 & 11,11B3 & 1092652 & 10.37966 & 97125 & 2.10791 \\ \hline 16 & 1471787 & 13.5m1 & 1256110 & 11.87017 & 116520 & 11,44031 & 1083m & 10.105% & 2.44565 \\ \hline 17 & 15.56275 & 14.29187 & 13.16612 & 1240498 & 12.16581 & 1893315 & 11.27407 & 10.4775 & 9.75122 \\ \hline 18 & 16.39327 & 1499203 & 13.75351 & 1292045 & 1265930 & 12.40590 & 1168989 & 10.52750 & 10.05909 \\ \hline 19 & 17.22501 & 15.67846 & 1432360 & 1341731 & 1213334 & 1245938 & 12.08532 & 11.15812 & 10.37560 \\ \hline 20 & 18.04555 & 16.35143 & 14.87747 & 1389620 & 1350033 & & 12.46221 & 11.46m2 & 1059401 \\ \hline 25 & 2202316 & 19.52346 & 17.41315 & 16.04320 & 1552208 & 15.21734 & 1609394 & 1278336 & 1165350 \\ \hline 30 & 25.80771 & 2239646 & 1950044 & 17:2025 & 1720200 & 16.7192 & 1537245 & 13.7643 & 12.40504 \\ \hline \multicolumn{10}{|c|}{\begin{tabular}{l} 3025.8077122.39646 \\ Present Value of Annuty of $1 \end{tabular}} \\ \hline Perieds & 8.01 & 9.0% & 10.05 & 11.01 & 13.0x & 16.0% & 15.0s & 20.05 & 25.0s \\ \hline \end{tabular}