Answered step by step

Verified Expert Solution

Question

1 Approved Answer

global tax. (AU) do it immediately Ill PayPal u 20$. Thx! You are a graduate traince of a professional tax consultancy firm in Sydney. One

global tax. (AU)

global tax. (AU)

do it immediately Ill PayPal u 20$. Thx!

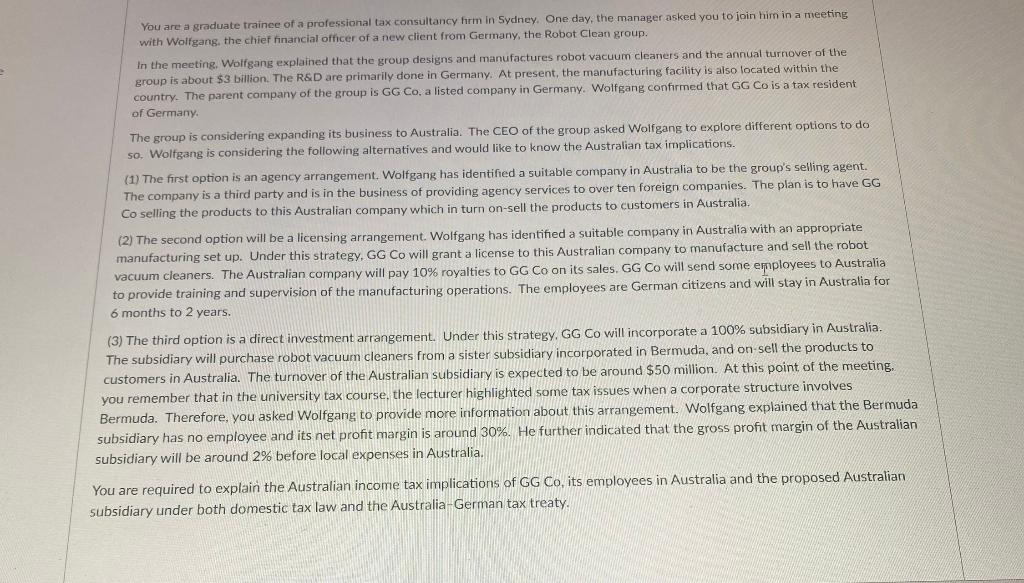

You are a graduate traince of a professional tax consultancy firm in Sydney. One day, the manager asked you to join him in a meeting with Wolfgang, the chief financial officer of a new client from Germany, the Robot Clean group. In the meeting. Wolfgang explained that the group designs and manufactures robot vacuum cleaners and the annual turnover of the group is about $3 billion. The RSD are primarily done in Germany. At present, the manufacturing facility is also located within the country. The parent company of the group is GG Co, a listed company in Germany. Wolfgang confirmed that GG Co is a tax resident of Germany. The group is considering expanding its business to Australia. The CEO of the group asked Wolfgang to explore different options to do so. Wolfgang is considering the following alternatives and would like to know the Australian tax implications. (1) The first option is an agency arrangement. Wolfgang has identified a suitable company in Australia to be the group's selling agent. The company is a third party and is in the business of providing agency services to over ten foreign companies. The plan is to have GG Co selling the products to this Australian company which in turn on-sell the products to customers in Australia. (2) The second option will be a licensing arrangement. Wolfgang has identified a suitable company in Australia with an appropriate manufacturing set up. Under this strategy, GG Co will grant a license to this Australian company to manufacture and sell the robot vacuum cleaners. The Australian company will pay 10% royalties to GG Co on its sales. GG Co will send some employees to Australia to provide training and supervision of the manufacturing operations. The employees are German citizens and will stay in Australia for 6 months to 2 years. (3) The third option is a direct investment arrangement. Under this strategy, GG Co will incorporate a 100% subsidiary in Australia. The subsidiary will purchase robot vacuum cleaners from a sister subsidiary incorporated in Bermuda, and on-sell the products to customers in Australia. The turnover of the Australian subsidiary is expected to be around $50 million. At this point of the meeting, rou remember that in the university tax course, the lecturer highlighted some tax issues when a corporate structure involves iermuda. Therefore, you asked Wolfgang to provide more information about this arrangement. Wolfgang explained that the Bermud: dbsidiary has no employee arid its net profit margin is around 30%. He further indicated that the gross profit margin of the Australian absidiary will be around 2% before local expenses in Australia. U are required to explain the Australian income tax implications of GG Co, its employees in Australia and the proposed Australian bsidiary under both domestic tax law and the Australia-German tax treaty. You are a graduate traince of a professional tax consultancy firm in Sydney. One day, the manager asked you to join him in a meeting with Wolfgang, the chief financial officer of a new client from Germany, the Robot Clean group. In the meeting. Wolfgang explained that the group designs and manufactures robot vacuum cleaners and the annual turnover of the group is about $3 billion. The RSD are primarily done in Germany. At present, the manufacturing facility is also located within the country. The parent company of the group is GG Co, a listed company in Germany. Wolfgang confirmed that GG Co is a tax resident of Germany. The group is considering expanding its business to Australia. The CEO of the group asked Wolfgang to explore different options to do so. Wolfgang is considering the following alternatives and would like to know the Australian tax implications. (1) The first option is an agency arrangement. Wolfgang has identified a suitable company in Australia to be the group's selling agent. The company is a third party and is in the business of providing agency services to over ten foreign companies. The plan is to have GG Co selling the products to this Australian company which in turn on-sell the products to customers in Australia. (2) The second option will be a licensing arrangement. Wolfgang has identified a suitable company in Australia with an appropriate manufacturing set up. Under this strategy, GG Co will grant a license to this Australian company to manufacture and sell the robot vacuum cleaners. The Australian company will pay 10% royalties to GG Co on its sales. GG Co will send some employees to Australia to provide training and supervision of the manufacturing operations. The employees are German citizens and will stay in Australia for 6 months to 2 years. (3) The third option is a direct investment arrangement. Under this strategy, GG Co will incorporate a 100% subsidiary in Australia. The subsidiary will purchase robot vacuum cleaners from a sister subsidiary incorporated in Bermuda, and on-sell the products to customers in Australia. The turnover of the Australian subsidiary is expected to be around $50 million. At this point of the meeting, rou remember that in the university tax course, the lecturer highlighted some tax issues when a corporate structure involves iermuda. Therefore, you asked Wolfgang to provide more information about this arrangement. Wolfgang explained that the Bermud: dbsidiary has no employee arid its net profit margin is around 30%. He further indicated that the gross profit margin of the Australian absidiary will be around 2% before local expenses in Australia. U are required to explain the Australian income tax implications of GG Co, its employees in Australia and the proposed Australian bsidiary under both domestic tax law and the Australia-German tax treatyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started