Answered step by step

Verified Expert Solution

Question

1 Approved Answer

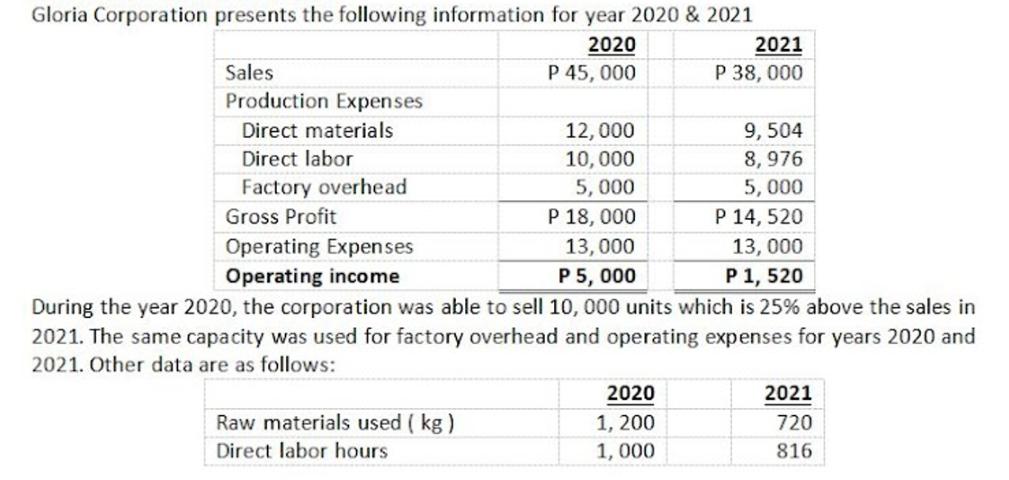

Gloria Corporation presents the following information for year 2020 & 2021 Sales Production Expenses Direct materials Direct labor Gross Profit Factory overhead Operating Expenses

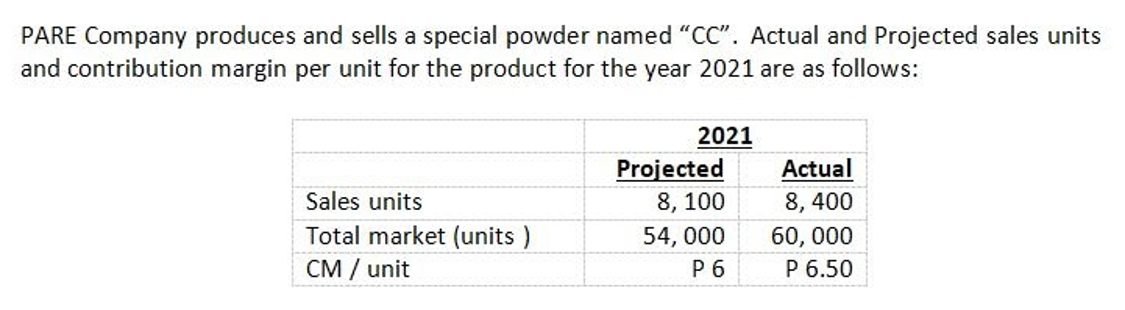

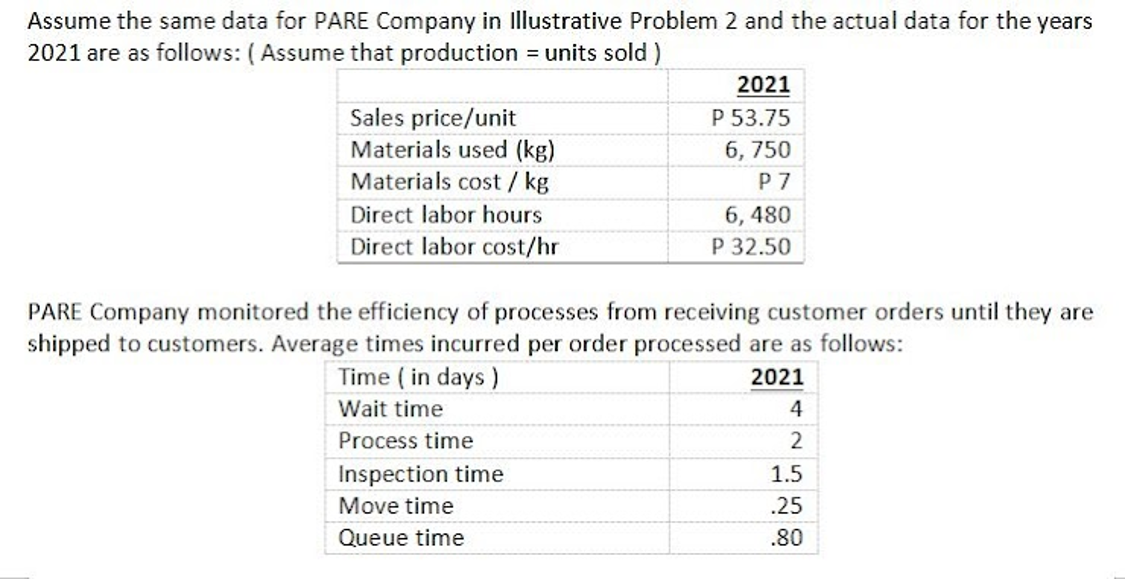

Gloria Corporation presents the following information for year 2020 & 2021 Sales Production Expenses Direct materials Direct labor Gross Profit Factory overhead Operating Expenses 2020 P 45,000 2021 P 38,000 12,000 9,504 10,000 8,976 5,000 5,000 P 18,000 P 14,520 13,000 Operating income 13,000 P 5,000 P 1, 520 During the year 2020, the corporation was able to sell 10, 000 units which is 25% above the sales in 2021. The same capacity was used for factory overhead and operating expenses for years 2020 and 2021. Other data are as follows: Raw materials used (kg) Direct labor hours 2020 2021 1,200 720 1,000 816 PARE Company produces and sells a special powder named "CC". Actual and Projected sales units and contribution margin per unit for the product for the year 2021 are as follows: 2021 Projected Actual Sales units 8,100 8,400 Total market (units) 54,000 60,000 CM / unit P6 P 6.50 Assume the same data for PARE Company in Illustrative Problem 2 and the actual data for the years 2021 are as follows: (Assume that production = units sold ) Sales price/unit Materials used (kg) Materials cost / kg 2021 P 53.75 6,750 P7 Direct labor hours 6,480 Direct labor cost/hr P 32.50 PARE Company monitored the efficiency of processes from receiving customer orders until they are shipped to customers. Average times incurred per order processed are as follows: Time (in days) Wait time Process time Inspection time Move time Queue time 2021 4 2 1.5 .25 .80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the data provided lets calculate the direct material cost per kilogram and the direct lab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started