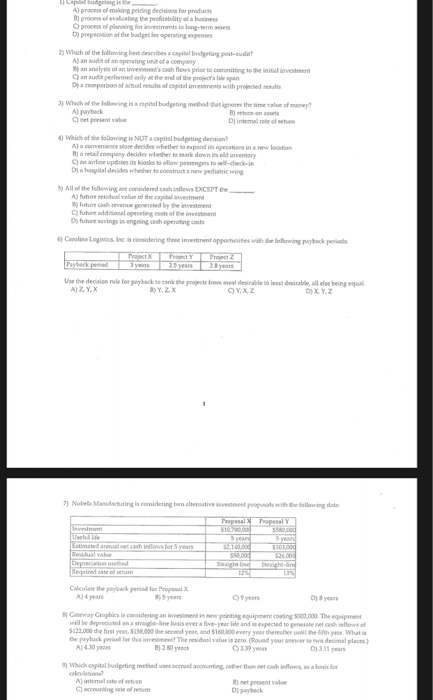

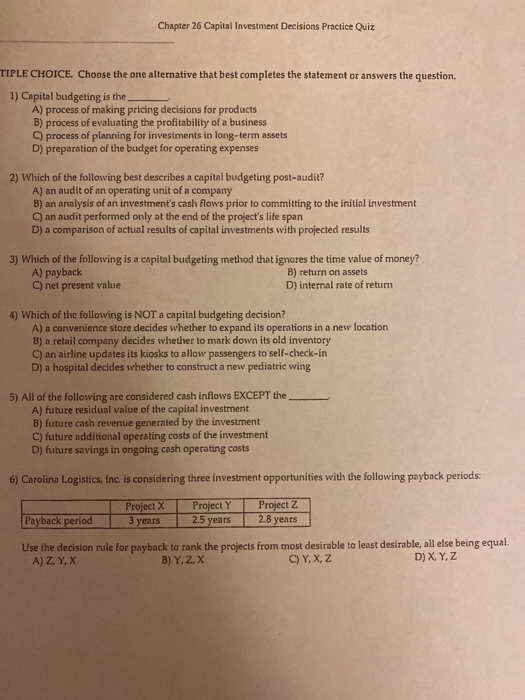

Gm Alm ofadas the b usiness on the b eness Anot com mo AM D isegningen Car d ering the opposite wock 3 XYZ 25 28 years Use the decision rule for A2YX some remed QYXZ i es being D A Bet presente Chapter 26 Capital Investment Decisions Practice Quiz TIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Capital budgeting is the A) process of making pricing decisions for products B) process of evaluating the profitability of a business C) process of planning for investments in long-term assets D) preparation of the budget for operating expenses 2) Which of the following best describes a capital budgeting post-audit? A) an audit of an operating unit of a company B) an analysis of an investment's cash flows prior to committing to the initial investment C) an audit performed only at the end of the project's life span D) a comparison of actual results of capital investments with projected results 3) Which of the following is a capital budgeting method that ignores the time value of money? A) payback B) return on assets C) net present value D) internal rate of return 4) Which of the following is NOT a capital budgeting decision? A) a convenience store decides whether to expand its operations in a new location B) a retail company decides whether to mark down its old inventory C) an airline updates its kiosks to allow passengers to self-check-in D) a hospital decides whether to construct a new pediatric wing 5) All of the following are considered cash inflows EXCEPT the A) future residual value of the capital investment B) future cash revenue generated by the investment C) future additional operating costs of the investment D) future savings in ongoing cash operating costs 6) Carolina Logistics, Inc. is considering three investment opportunities with the following payback periods: Project X 3 years Project Y 2.5 years Project Z 2.8 years Payback period Use the decision rule for payback to rank the projects from most desirable to least desirable, all else being equal A) Z, Y, X B) Y.Z.X C)Y,X, Z D) X, Y, Z