Question

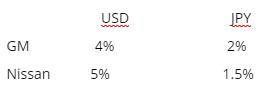

GM and Nissan have the following current borrowing terms in their respective short-term markets. Both desire a three-year loan; GM in JPY terms and Nissan

GM and Nissan have the following current borrowing terms in their respective short-term markets. Both desire a three-year loan; GM in JPY terms and Nissan in USD terms.

1. Both agree on a swap. GM will borrow the notional principal for three years in USD from its outside lender. What rate will they pay?

2. Nissan will borrow the notional principal in JPY for three years. What rate will they pay?

3. In the swap, GM agrees to take the JPY and pay Nissan 1.75%. Nissan agrees to take the USD and pay GM 4.5%.

4. What will be the net borrowing costs for each company after the swap?

How much did each company save over directly borrowing in their respective markets? Diagram the flows between GM, Nissan, and their respective outside lenders using the four boxes.

USD JPY GM 4% 2% Nissan 5% 1.5%

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a GM will pay 4 on USD borrowing b Nissan will pay 15 on JPY borrowing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started