Question: c. Show how accounts receivable would appear on the December 31, 2021, balance sheet. Partial Balance sheet Assets Current assets: Iniversity B McGraw Hill

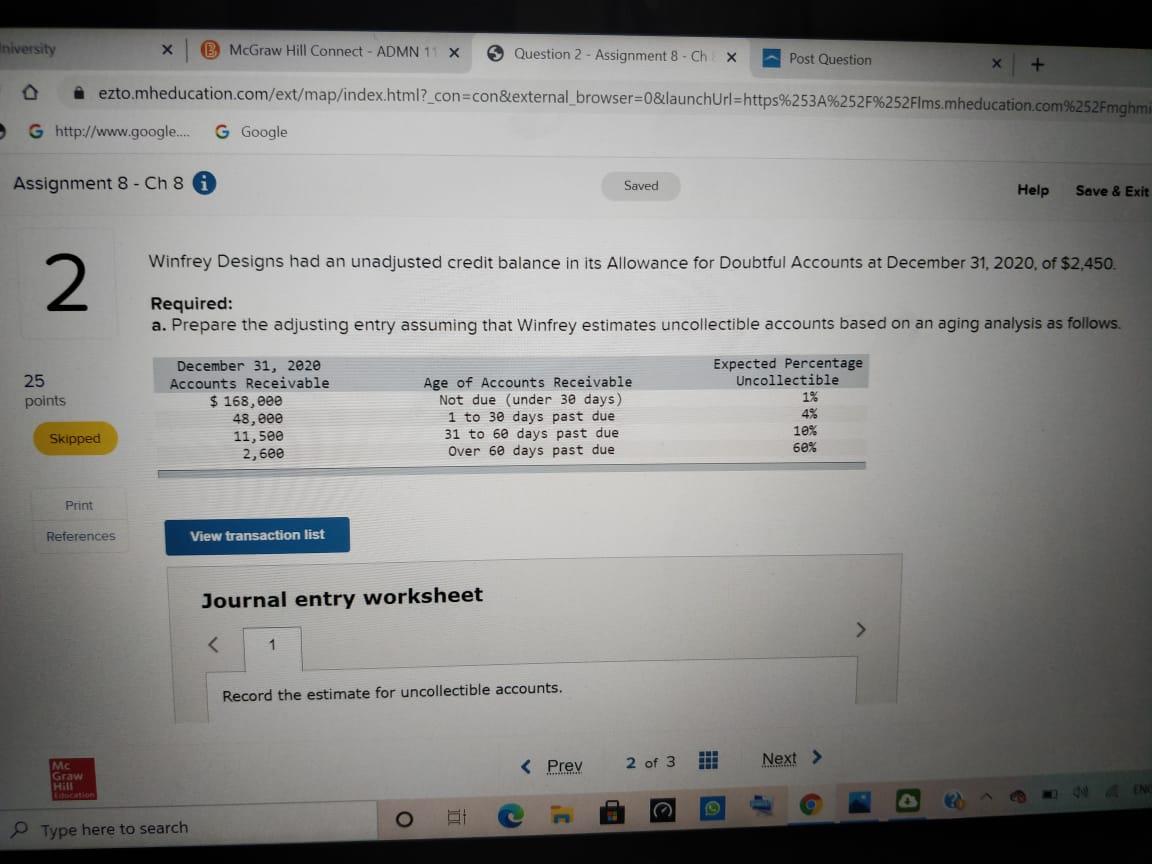

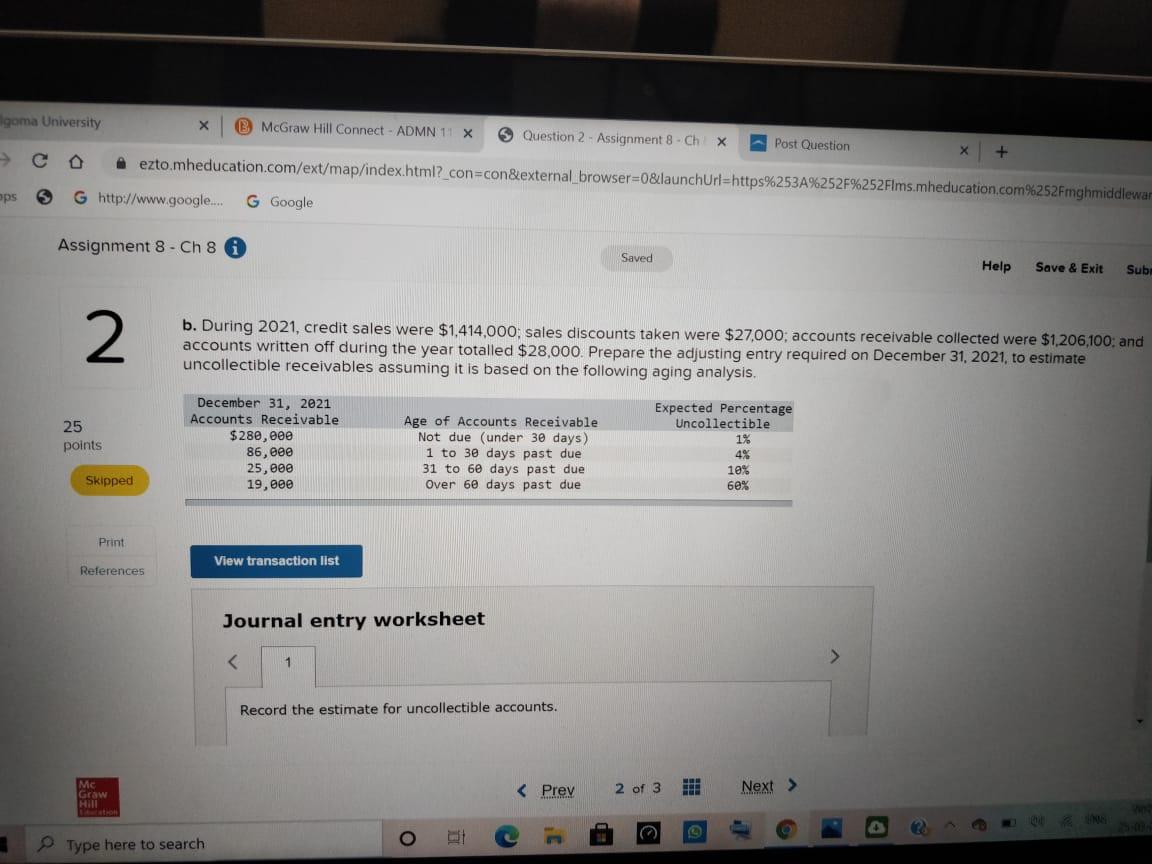

c. Show how accounts receivable would appear on the December 31, 2021, balance sheet. Partial Balance sheet Assets Current assets: Iniversity B McGraw Hill Connect - ADMN 11 X 9 Question 2 - Assignment 8 - Ch APost Question i ezto.mheducation.com/ext/map/index.html?_con%3Dcon&external_browser%3D0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmi G http://www.google.. G Google Assignment 8 - Ch 8 6 Saved Help Save & Exit Winfrey Designs had an unadjusted credit balance in its Allowance for Doubtful Accounts at December 31, 2020, of $2,450. 2 Required: a. Prepare the adjusting entry assuming that Winfrey estimates uncollectible accounts based on an aging analysis as follows. Expected Percentage Uncollectible 1% December 31, 2020 Accounts Receivable $ 168, e0e 48, 000 11,500 2,600 25 Age of Accounts Receivable Not due (under 30 days) 1 to 30 days past due 31 to 60 days past due Over 60 days past due points 4% 10% Skipped 60% Print References View transaction list Journal entry worksheet Record the estimate for uncollectible accounts. < Prev 2 of 3 Next > Mc Graw Hill ENC P Type here to search lgoma University B McGraw Hill Connect - ADMN 11 X O Question 2 - Assignment 8 - Ch A Post Question A ezto.mheducation.com/ext/map/index.html?_con%3con&external browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddlewar ops G http://www.google.. G Google Assignment 8 - Ch 8 6 Saved Help Save & Exit Sub 2 b. During 2021, credit sales were $1,414,000; sales discounts taken were $27,000; accounts receivable collected were $1,206,100; and accounts written off during the year totalled $28,000. Prepare the adjusting entry required on December 31, 2021, to estimate uncollectible receivables assuming it is based on the following aging analysis. December 31, 2021 Accounts Receivable $280, 000 86, e0e 25,000 19,000 Expected Percentage Uncollectible Age of Accounts Receivable Not due (under 30 days) 1 to 30 days past due 25 1% points 4% 10% 31 to 60 days past due Over 60 days past due Skipped 60% Print View transaction list References Journal entry worksheet Record the estimate for uncollectible accounts. Mc Graw < Prev 2 of 3 Next > P Type here to search

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts