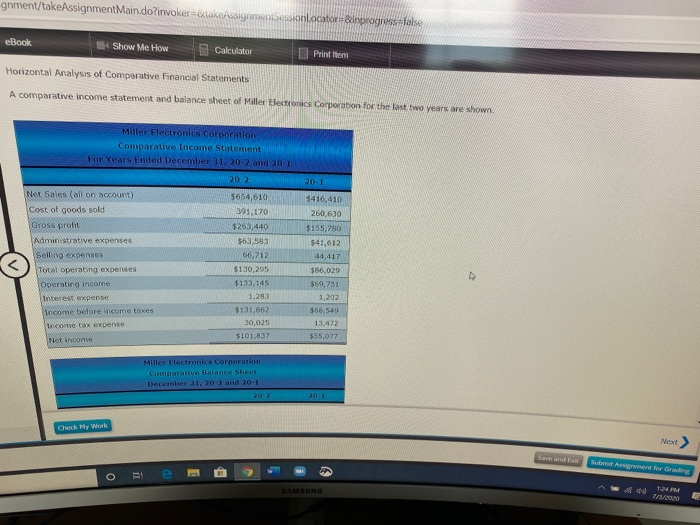

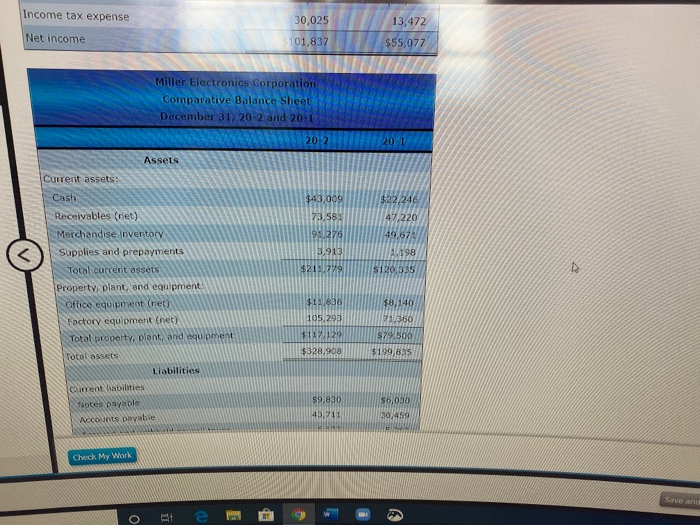

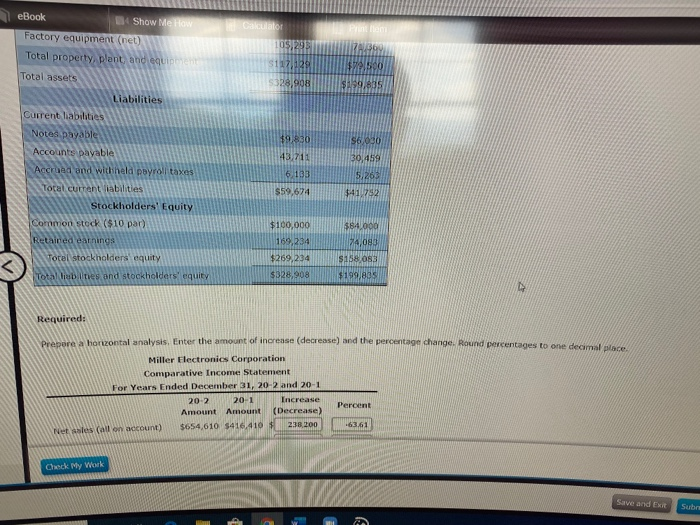

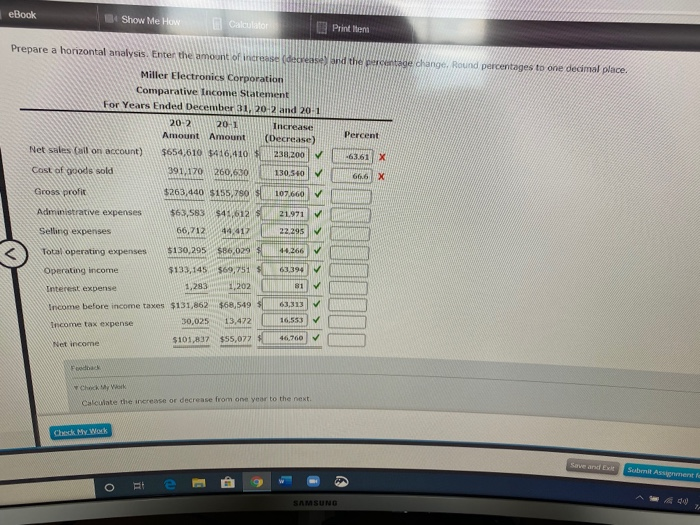

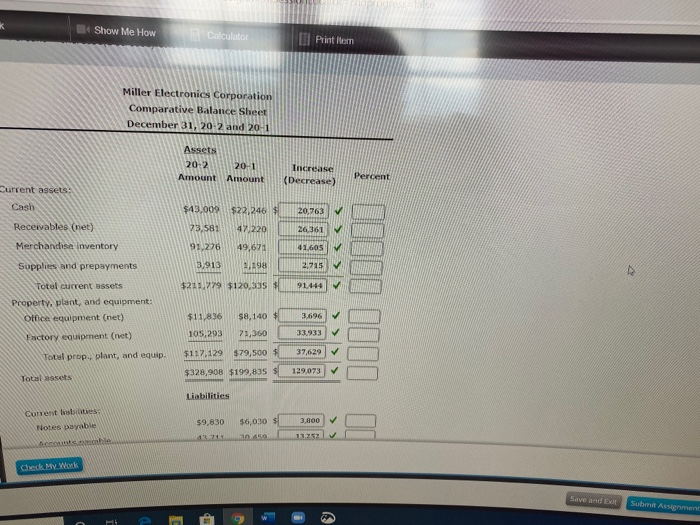

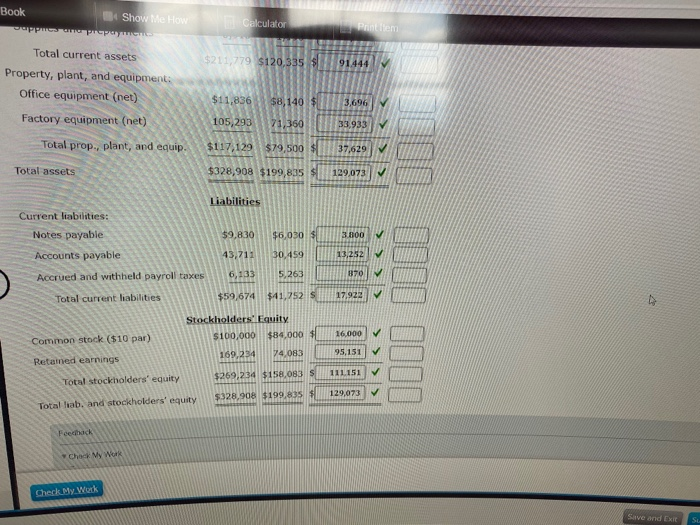

gnment/takeAssignmentMain.do?invoker=&lakeAssignment Session Locator=&inprogress false eBook 34 Show Me How Calculator Print Item Horizontal Analysis of Comparative financial Statements A comparative income statement and balance sheet of Miller Electronics Corporation for the last two years are shown. Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 202 and 20-1 20-2 201 Net Sales (all on account) Cost of goods sold Gross profit Administrative expenses Selling expenses Total operating expenses Operating income Interest expense income before income taxes Income tax expense $654,610 391.170 $263,440 $63,503 66,712 $130,295 $133,145 1,283 $131,862 30,025 $101,837 $416,010 260,630 $155,780 $41,612 44,417 $86,029 $69,751 1,202 $68,549 13,472 $55,077 Not one Miller Electronics Corporation Comparative Balance Sheet December 31, 202 and 20-1 2012 201 Cock My Work Next Submat Atene for Grace E! 0 SAMSUNG 7/1/2020 Income tax expense 30,025 13,472 Net income 5101,837 $55,077 Miller Electronics Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 20-2 Assets Current assets: $22,246 $43,009 73,581 9:0276 47/220 49,674 198 3.913 Cash Receivables (net) Merchandise inventory Supplies and prepayments Total current assets Property, plant, and equipment: Office equipment (net) Factory equipment (net) Total property, plant, and equipment $210779 S120,335 $11,836 105,293 $117,129 $328.908 $8,140 71.350 $79.500 Total assets $199,825 Liabilities Current abilities Notes payable Accounts payable 59,830 43,711 $6,000 30,459 Chuck My Work Save and O Calculator Printiem eBook Show Me How Factory equipment (net) Total property, plant and equipment Total assets 7006 S1129 e 100 5328,908 $199,835 Liabilities Current liabilities Notes payable $6,030 19,830 43,711 6133 30.459 5,263 Accounts payable Accro and withield payroll taxes Total current liabilities Stockholders' Equity Common stock ($10 par) Retailed earnings $59,674 41792 $84.000 $100,000 169,234 $269,234 $328,908 Totel stockholders equity 74,080 5158 083 $199.885 Totallites and stockholders' equity Required: Prepare a horizontal analysis, Enter the amount of increase (decrease) and the percentage change. Round centages to one decimal place Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 Increase Percent Amount Amount (Decrease) $654,610 $416,410 Nesles (all account) 230 200 163.61 Check My Work Save and Exit Sube eBook 3 Show Me How Calculator Print Item Prepare a horizontal analysis. Enter the amount of increase (decrease, and the percentage change. Round percentages to one decimal place. Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 Increase Percent Amount Amount (Decrease) Net sales Call on account) $654,610 $416,410 230.200 -6361 X Cost of woods sold 391,170 260,630 130,510 66.6 x Gross profit $263,440 $155,790 107,660 21.971 Administrative expenses Selling expenses $63,583 $41,612 66,712 44.417 22 Total operating expenses 44.266 Operating income $130,295 $86,029 $133,145 $69,751 1,283 1,202 63394 81 Internet expense 63,313 Income before income taxes $131,862 $68,549 Income tax expense 30,025 13,472 Net income $101,837 $55,077 16,553 46,760 Foad CheckMy Work Calcuinte the increase or decrease from one year to the next Chuck My Work Save and Sub Assignment o RE SAMSUNG 34 Show Me How Calculator L Print Item Miller Electronics Corporation Comparative Balance Sheet December 31, 20 2 and 20-1 Assets 20-2 201 Amount Amount Increase (Decrease) Percent Current assets Cash $43,000 $22,246 20,763 Receivables (net) 73,581 47.220 26.361 Merchandise inventory 91,276 49,671 41405 3,913 1,198 2,715 $211.779 $120,335 # 91.444 Supples and prepayments Total current assets Property, plant, and equipment: office equipment (net) $11,836 3,696 $8,140 $ 71,360 105,293 Factory equipment (net) 33.933 37,629 1111 Tocal prop, plant, and equip. $117,129 $79,500 $328,900 $199,835 129,073 Total sets Liabilities Current states Notes payable $9,830 3,800 $6,030 an 13 711 heute Check My Work Save and Et Submit Assignment Book Show Me How P Calculator Printem $211,779 $120,335 $ 91.444 Total current assets Property, plant, and equipment: Office equipment (net) $11,836 $8,140 $ 3,696 Factory equipment (net) 105,293 71,360 33.933 Total prop., plant, and equip. $117.129 $79,500 $ 37,629 Total assets $328,908 $199,835 129,073 Liabilities Current liabilities: Notes payable $9,830 $6,030 $ 3.800 Accounts payable 43,711 30,459 13,252 Accrued and withheld payroll taxes 6,133 5,263 870 Total current liabilities $59.674 $41,752 S 17,922 16.000 Common stock ($10 par) Stockholders' Equity $100,000 $84.000 169,234 24.083 95,151 Retained earnings 111151 $269,234 $158,083 S Total stockholders' equity $328,908 $199,835 129,073 Total liab, and stockholders' equity Feedback Cho My War Check My Wuck Save and EME SU gnment/takeAssignmentMain.do?invoker=&lakeAssignment Session Locator=&inprogress false eBook 34 Show Me How Calculator Print Item Horizontal Analysis of Comparative financial Statements A comparative income statement and balance sheet of Miller Electronics Corporation for the last two years are shown. Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 202 and 20-1 20-2 201 Net Sales (all on account) Cost of goods sold Gross profit Administrative expenses Selling expenses Total operating expenses Operating income Interest expense income before income taxes Income tax expense $654,610 391.170 $263,440 $63,503 66,712 $130,295 $133,145 1,283 $131,862 30,025 $101,837 $416,010 260,630 $155,780 $41,612 44,417 $86,029 $69,751 1,202 $68,549 13,472 $55,077 Not one Miller Electronics Corporation Comparative Balance Sheet December 31, 202 and 20-1 2012 201 Cock My Work Next Submat Atene for Grace E! 0 SAMSUNG 7/1/2020 Income tax expense 30,025 13,472 Net income 5101,837 $55,077 Miller Electronics Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 20-2 Assets Current assets: $22,246 $43,009 73,581 9:0276 47/220 49,674 198 3.913 Cash Receivables (net) Merchandise inventory Supplies and prepayments Total current assets Property, plant, and equipment: Office equipment (net) Factory equipment (net) Total property, plant, and equipment $210779 S120,335 $11,836 105,293 $117,129 $328.908 $8,140 71.350 $79.500 Total assets $199,825 Liabilities Current abilities Notes payable Accounts payable 59,830 43,711 $6,000 30,459 Chuck My Work Save and O Calculator Printiem eBook Show Me How Factory equipment (net) Total property, plant and equipment Total assets 7006 S1129 e 100 5328,908 $199,835 Liabilities Current liabilities Notes payable $6,030 19,830 43,711 6133 30.459 5,263 Accounts payable Accro and withield payroll taxes Total current liabilities Stockholders' Equity Common stock ($10 par) Retailed earnings $59,674 41792 $84.000 $100,000 169,234 $269,234 $328,908 Totel stockholders equity 74,080 5158 083 $199.885 Totallites and stockholders' equity Required: Prepare a horizontal analysis, Enter the amount of increase (decrease) and the percentage change. Round centages to one decimal place Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 Increase Percent Amount Amount (Decrease) $654,610 $416,410 Nesles (all account) 230 200 163.61 Check My Work Save and Exit Sube eBook 3 Show Me How Calculator Print Item Prepare a horizontal analysis. Enter the amount of increase (decrease, and the percentage change. Round percentages to one decimal place. Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 Increase Percent Amount Amount (Decrease) Net sales Call on account) $654,610 $416,410 230.200 -6361 X Cost of woods sold 391,170 260,630 130,510 66.6 x Gross profit $263,440 $155,790 107,660 21.971 Administrative expenses Selling expenses $63,583 $41,612 66,712 44.417 22 Total operating expenses 44.266 Operating income $130,295 $86,029 $133,145 $69,751 1,283 1,202 63394 81 Internet expense 63,313 Income before income taxes $131,862 $68,549 Income tax expense 30,025 13,472 Net income $101,837 $55,077 16,553 46,760 Foad CheckMy Work Calcuinte the increase or decrease from one year to the next Chuck My Work Save and Sub Assignment o RE SAMSUNG 34 Show Me How Calculator L Print Item Miller Electronics Corporation Comparative Balance Sheet December 31, 20 2 and 20-1 Assets 20-2 201 Amount Amount Increase (Decrease) Percent Current assets Cash $43,000 $22,246 20,763 Receivables (net) 73,581 47.220 26.361 Merchandise inventory 91,276 49,671 41405 3,913 1,198 2,715 $211.779 $120,335 # 91.444 Supples and prepayments Total current assets Property, plant, and equipment: office equipment (net) $11,836 3,696 $8,140 $ 71,360 105,293 Factory equipment (net) 33.933 37,629 1111 Tocal prop, plant, and equip. $117,129 $79,500 $328,900 $199,835 129,073 Total sets Liabilities Current states Notes payable $9,830 3,800 $6,030 an 13 711 heute Check My Work Save and Et Submit Assignment Book Show Me How P Calculator Printem $211,779 $120,335 $ 91.444 Total current assets Property, plant, and equipment: Office equipment (net) $11,836 $8,140 $ 3,696 Factory equipment (net) 105,293 71,360 33.933 Total prop., plant, and equip. $117.129 $79,500 $ 37,629 Total assets $328,908 $199,835 129,073 Liabilities Current liabilities: Notes payable $9,830 $6,030 $ 3.800 Accounts payable 43,711 30,459 13,252 Accrued and withheld payroll taxes 6,133 5,263 870 Total current liabilities $59.674 $41,752 S 17,922 16.000 Common stock ($10 par) Stockholders' Equity $100,000 $84.000 169,234 24.083 95,151 Retained earnings 111151 $269,234 $158,083 S Total stockholders' equity $328,908 $199,835 129,073 Total liab, and stockholders' equity Feedback Cho My War Check My Wuck Save and EME SU