Question

Go through ALL FIVE STEPS of the allocation process starting with a reconciliation of the physical units, and ending with the assignment of costs between

Go through ALL FIVE STEPS of the allocation process starting with a reconciliation of the physical units, and ending with the assignment of costs between EWIP and Completed/transferred. (What is the cost pool? (what are we allocating), What are the cost objects? (where are we allocating to), What is the base?, What is the rate?, Apply the rates)

1. Prepare a production cost report using the FIFO method & weighted average method

a. Reconcile the physical units (units to account for and units accounted for)

b. Determine TOTAL costs to account for

c. Compute the allocation base - the equivalent units of production for both material and conversion

d. Compute allocation rate - the cost per equivalent unit for both materials and conversion

e. Determine the costs of goods transferred and ending work in process inventory

[ 1 ] Under the weighted-average method, how much conversion cost did A.P. Hill transfer out of Department Two during February?

[ 2 ] Under the weighted-average method, how much materials cost did A.P. Hill transfer out of Department Two during February?

[ 3 ] Under the weighted-average method, what is the total of equivalent units for A.P. Hills transferred-in costs for the month?

[ 4 ] Assume that the company uses the first-in, first-out (FIFO) method of inventory valuation. Under FIFO, how much conversion cost did A.P. Hill transfer out of Department Two during February?

[ 5 ] Assuming the company uses the FIFO method of inventory valuation, conversion costs included in A.P. Hills ending work-in-process inventory equal

[ 6 ] Assume that the company uses the first-in, first-out (FIFO) method of inventory valuation. Under FIFO, how much materials cost did A.P. Hill transfer out of Department Two during February?

[ 7 ] Assuming the company uses the FIFO method of inventory valuation, what amount of materials cost is included in A.P. Hills ending work-in-process inventory?

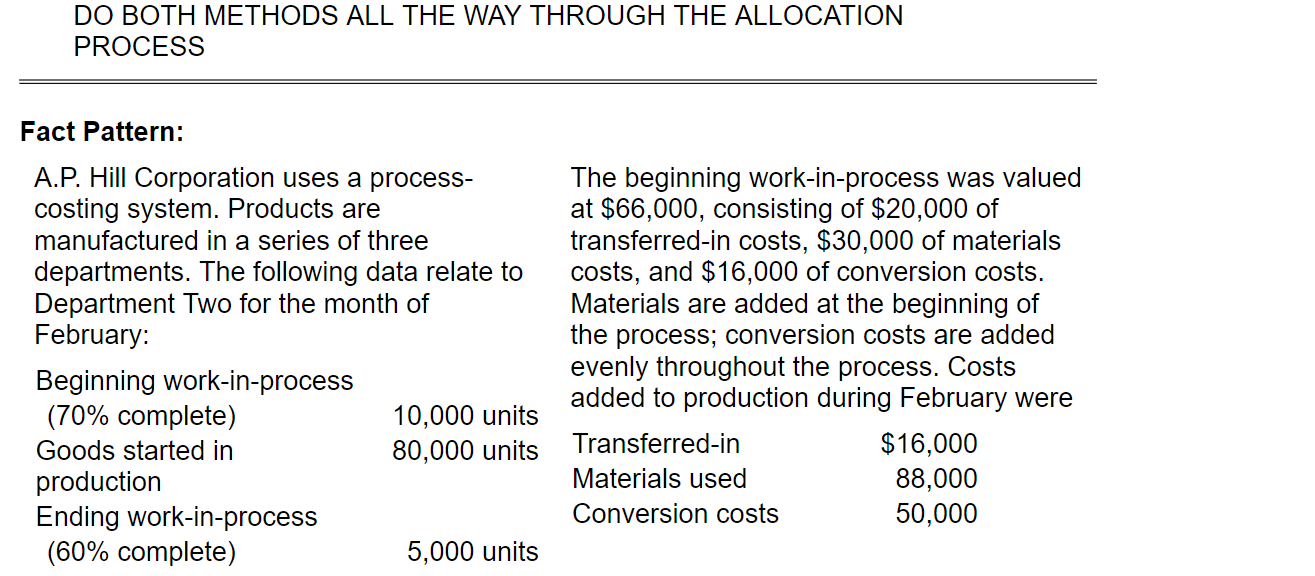

DO BOTH METHODS ALL THE WAY THROUGH THE ALLOCATION PROCESS Fact Pattern: A.P. Hill Corporation uses a process- costing system. Products are manufactured in a series of three departments. The following data relate to Department Two for the month of February: Beginning work-in-process (70% complete) 10,000 units Goods started in 80,000 units production Ending work-in-process (60% complete) 5,000 units The beginning work-in-process was valued at $66,000, consisting of $20,000 of transferred-in costs, $30,000 of materials costs, and $16,000 of conversion costs. Materials are added at the beginning of the process; conversion costs are added evenly throughout the process. Costs added to production during February were Transferred-in $16,000 Materials used 88,000 Conversion costs 50,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started