Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Go to Statement of Financial Position (otherwise known as the balance sheet) on page 37 in the above link. Use Targets balance sheet to prepare

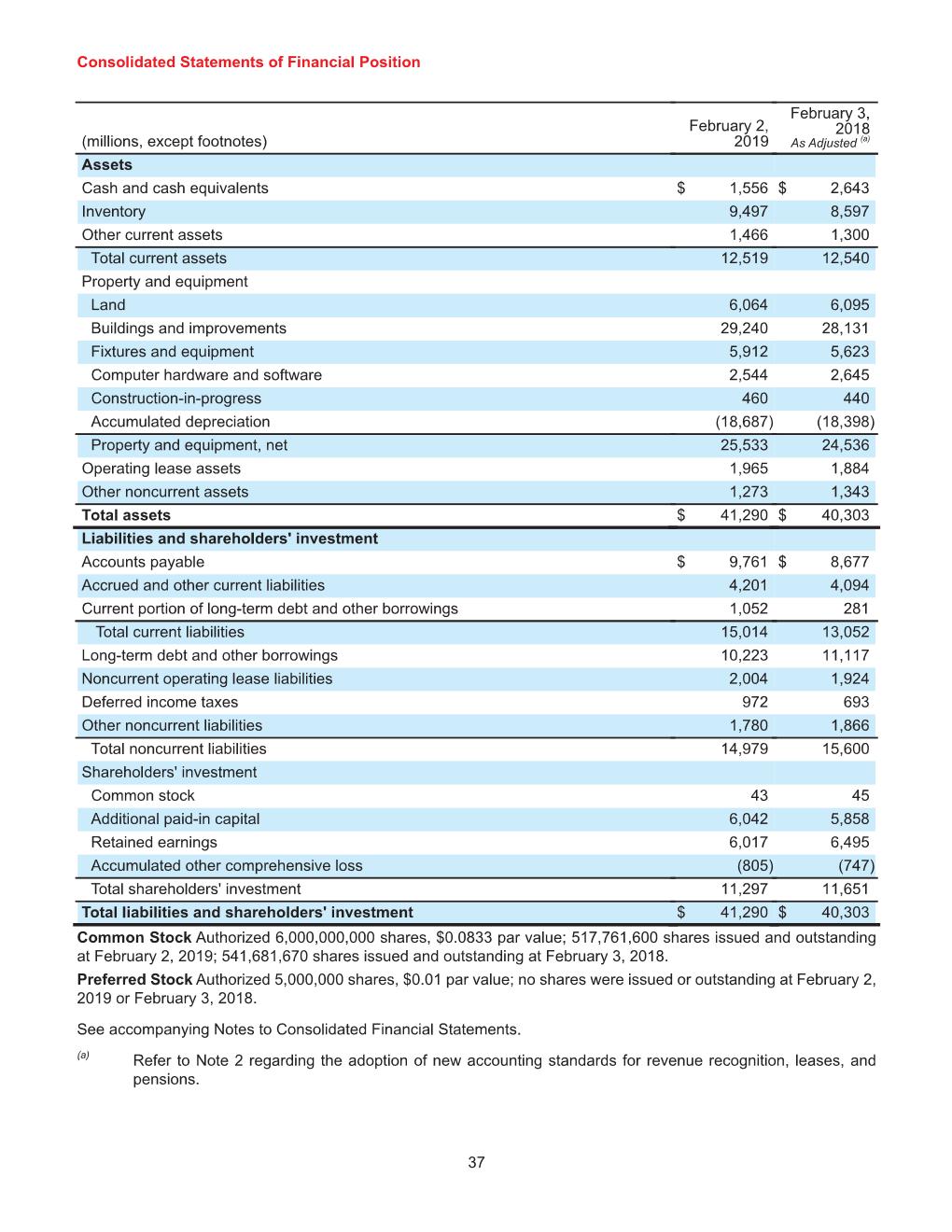

Go to “Statement of Financial Position” (otherwise known as the balance sheet) on page 37 in the above link. Use Target’s balance sheet to prepare a vertical analysis for the two most recent years.

Consolidated Statements of Financial Position February 2, 2019 February 3, 2018 As Adjusted (millions, except footnotes) Assets Cash and cash equivalents 2$ 1,556 $ 2,643 Inventory 9,497 8,597 Other current assets 1,466 1,300 Total current assets 12,519 12,540 Property and equipment Land 6,064 6,095 28,131 Buildings and improvements Fixtures and equipment 29,240 5,912 5,623 Computer hardware and software Construction-in-progress Accumulated depreciation 2,544 2,645 460 440 (18,687) (18,398) Property and equipment, net Operating lease assets 25,533 24,536 1,965 1,884 Other noncurrent assets 1,273 1,343 Total assets 41,290 $ 40,303 Liabilities and shareholders' investment Accounts payable $ 9,761 $ 8,677 Accrued and other current liabilities 4,201 4,094 Current portion of long-term debt and other borrowings 1,052 281 Total current liabilities 15,014 13,052 Long-term debt and other borrowings 10,223 11,117 Noncurrent operating lease liabilities 2,004 1,924 Deferred income taxes 972 693 Other noncurrent liabilities 1,780 1,866 Total noncurrent liabilities 14,979 15,600 Shareholders' investment Common stock 43 45 Additional paid-in capital Retained earnings 6,042 5,858 6,017 6,495 Accumulated other comprehensive loss (805) (747) Total shareholders' investment 11,297 11,651 Total liabilities and shareholders' investment 41,290 $ 40,303 Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 517,761,600 shares issued and outstanding at February 2, 2019; 541,681,670 shares issued and outstanding at February 3, 2018. Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 2, 2019 or February 3, 2018. See accompanying Notes to Consolidated Financial Statements. (a) Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. 37 Consolidated Statements of Financial Position February 2, 2019 February 3, 2018 As Adjusted (millions, except footnotes) Assets Cash and cash equivalents 2$ 1,556 $ 2,643 Inventory 9,497 8,597 Other current assets 1,466 1,300 Total current assets 12,519 12,540 Property and equipment Land 6,064 6,095 28,131 Buildings and improvements Fixtures and equipment 29,240 5,912 5,623 Computer hardware and software Construction-in-progress Accumulated depreciation 2,544 2,645 460 440 (18,687) (18,398) Property and equipment, net Operating lease assets 25,533 24,536 1,965 1,884 Other noncurrent assets 1,273 1,343 Total assets 41,290 $ 40,303 Liabilities and shareholders' investment Accounts payable $ 9,761 $ 8,677 Accrued and other current liabilities 4,201 4,094 Current portion of long-term debt and other borrowings 1,052 281 Total current liabilities 15,014 13,052 Long-term debt and other borrowings 10,223 11,117 Noncurrent operating lease liabilities 2,004 1,924 Deferred income taxes 972 693 Other noncurrent liabilities 1,780 1,866 Total noncurrent liabilities 14,979 15,600 Shareholders' investment Common stock 43 45 Additional paid-in capital Retained earnings 6,042 5,858 6,017 6,495 Accumulated other comprehensive loss (805) (747) Total shareholders' investment 11,297 11,651 Total liabilities and shareholders' investment 41,290 $ 40,303 Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 517,761,600 shares issued and outstanding at February 2, 2019; 541,681,670 shares issued and outstanding at February 3, 2018. Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 2, 2019 or February 3, 2018. See accompanying Notes to Consolidated Financial Statements. (a) Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. 37 Consolidated Statements of Financial Position February 2, 2019 February 3, 2018 As Adjusted (millions, except footnotes) Assets Cash and cash equivalents 2$ 1,556 $ 2,643 Inventory 9,497 8,597 Other current assets 1,466 1,300 Total current assets 12,519 12,540 Property and equipment Land 6,064 6,095 28,131 Buildings and improvements Fixtures and equipment 29,240 5,912 5,623 Computer hardware and software Construction-in-progress Accumulated depreciation 2,544 2,645 460 440 (18,687) (18,398) Property and equipment, net Operating lease assets 25,533 24,536 1,965 1,884 Other noncurrent assets 1,273 1,343 Total assets 41,290 $ 40,303 Liabilities and shareholders' investment Accounts payable $ 9,761 $ 8,677 Accrued and other current liabilities 4,201 4,094 Current portion of long-term debt and other borrowings 1,052 281 Total current liabilities 15,014 13,052 Long-term debt and other borrowings 10,223 11,117 Noncurrent operating lease liabilities 2,004 1,924 Deferred income taxes 972 693 Other noncurrent liabilities 1,780 1,866 Total noncurrent liabilities 14,979 15,600 Shareholders' investment Common stock 43 45 Additional paid-in capital Retained earnings 6,042 5,858 6,017 6,495 Accumulated other comprehensive loss (805) (747) Total shareholders' investment 11,297 11,651 Total liabilities and shareholders' investment 41,290 $ 40,303 Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 517,761,600 shares issued and outstanding at February 2, 2019; 541,681,670 shares issued and outstanding at February 3, 2018. Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 2, 2019 or February 3, 2018. See accompanying Notes to Consolidated Financial Statements. (a) Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. 37 Consolidated Statements of Financial Position February 2, 2019 February 3, 2018 As Adjusted (millions, except footnotes) Assets Cash and cash equivalents 2$ 1,556 $ 2,643 Inventory 9,497 8,597 Other current assets 1,466 1,300 Total current assets 12,519 12,540 Property and equipment Land 6,064 6,095 28,131 Buildings and improvements Fixtures and equipment 29,240 5,912 5,623 Computer hardware and software Construction-in-progress Accumulated depreciation 2,544 2,645 460 440 (18,687) (18,398) Property and equipment, net Operating lease assets 25,533 24,536 1,965 1,884 Other noncurrent assets 1,273 1,343 Total assets 41,290 $ 40,303 Liabilities and shareholders' investment Accounts payable $ 9,761 $ 8,677 Accrued and other current liabilities 4,201 4,094 Current portion of long-term debt and other borrowings 1,052 281 Total current liabilities 15,014 13,052 Long-term debt and other borrowings 10,223 11,117 Noncurrent operating lease liabilities 2,004 1,924 Deferred income taxes 972 693 Other noncurrent liabilities 1,780 1,866 Total noncurrent liabilities 14,979 15,600 Shareholders' investment Common stock 43 45 Additional paid-in capital Retained earnings 6,042 5,858 6,017 6,495 Accumulated other comprehensive loss (805) (747) Total shareholders' investment 11,297 11,651 Total liabilities and shareholders' investment 41,290 $ 40,303 Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 517,761,600 shares issued and outstanding at February 2, 2019; 541,681,670 shares issued and outstanding at February 3, 2018. Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 2, 2019 or February 3, 2018. See accompanying Notes to Consolidated Financial Statements. (a) Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. 37 Consolidated Statements of Financial Position February 2, 2019 February 3, 2018 As Adjusted (millions, except footnotes) Assets Cash and cash equivalents 2$ 1,556 $ 2,643 Inventory 9,497 8,597 Other current assets 1,466 1,300 Total current assets 12,519 12,540 Property and equipment Land 6,064 6,095 28,131 Buildings and improvements Fixtures and equipment 29,240 5,912 5,623 Computer hardware and software Construction-in-progress Accumulated depreciation 2,544 2,645 460 440 (18,687) (18,398) Property and equipment, net Operating lease assets 25,533 24,536 1,965 1,884 Other noncurrent assets 1,273 1,343 Total assets 41,290 $ 40,303 Liabilities and shareholders' investment Accounts payable $ 9,761 $ 8,677 Accrued and other current liabilities 4,201 4,094 Current portion of long-term debt and other borrowings 1,052 281 Total current liabilities 15,014 13,052 Long-term debt and other borrowings 10,223 11,117 Noncurrent operating lease liabilities 2,004 1,924 Deferred income taxes 972 693 Other noncurrent liabilities 1,780 1,866 Total noncurrent liabilities 14,979 15,600 Shareholders' investment Common stock 43 45 Additional paid-in capital Retained earnings 6,042 5,858 6,017 6,495 Accumulated other comprehensive loss (805) (747) Total shareholders' investment 11,297 11,651 Total liabilities and shareholders' investment 41,290 $ 40,303 Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 517,761,600 shares issued and outstanding at February 2, 2019; 541,681,670 shares issued and outstanding at February 3, 2018. Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 2, 2019 or February 3, 2018. See accompanying Notes to Consolidated Financial Statements. (a) Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. 37

Step by Step Solution

★★★★★

3.27 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Vertical Analysis is a method of financial statement where each item of fnancial statement is shown ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started