Answered step by step

Verified Expert Solution

Question

1 Approved Answer

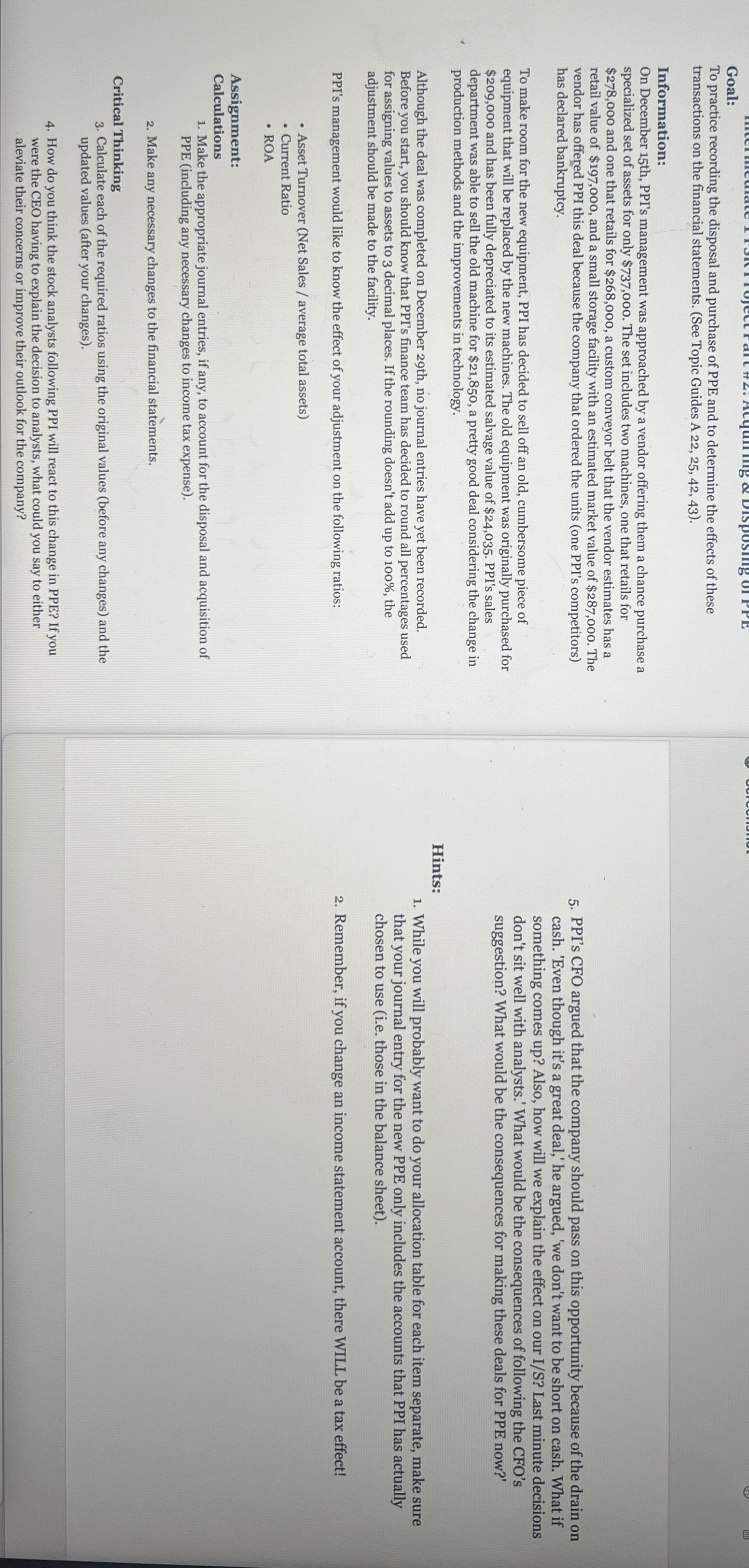

Goal: To practice recording the disposal and purchase of PPE and to determine the effects of these transactions on the financial statements. ( See Topic

Goal:

To practice recording the disposal and purchase of PPE and to determine the effects of these transactions on the financial statements. See Topic Guides A

Information:

On December th PPI's management was approached by a vendor offering them a chance purchase a specialized set of assets for only $ The set includes two machines, one that retails for $ and one that retails for $ a custom conveyor belt that the vendor estimates has a retail value of $ and a small storage facility with an estimated market value of $ The vendor has offered PPI this deal because the company that ordered the units one PPI's competitors has declared bankruptcy.

To make room for the new equipment, PPI has decided to sell off an old, cumbersome piece of equipment that will be replaced by the new machines. The old equipment was originally purchased for $ and has been fully depreciated to its estimated salvage value of $ PPI's sales department was able to sell the old machine for $ a pretty good deal considering the change in production methods and the improvements in technology.

Although the deal was completed on December th no journal entries have yet been recorded. Before you start, you should know that PPI's finance team has decided to round all percentages used for assigning values to assets to decimal places. If the rounding doesn't add up to the adjustment should be made to the facility.

PPI's management would like to know the effect of your adjustment on the following ratios:

Asset Turnover Net Sales average total assets

Current Ratio

ROA

Assignment:

Calculations

Make the appropriate journal entries, if any, to account for the disposal and acquisition of PPE including any necessary changes to income tax expense

Make any necessary changes to the financial statements.

Critical Thinking

Calculate each of the required ratios using the original values before any changes and the updated values after your changes

How do you think the stock analysts following PPI will react to this change in PPE? If you were the CEO having to explain the decision to analysts, what could you say to either aleviate their concerns or improve their outlook for the company?

PPI's CFO argued that the company should pass on this opportunity because of the drain on cash. 'Even though it's a great deal, he argued, we don't want to be short on cash. What if something comes up Also, how will we explain the effect on our IS Last minute decisions don't sit well with analysts. What would be the consequences of following the CFO's suggestion? What would be the consequences for making these deals for PPE now?

Hints:

While you will probably want to do your allocation table for each item separate, make sure that your journal entry for the new PPE only includes the accounts that PPI has actually chosen to use ie those in the balance sheet

Remember, if you change an income statement account, there WILL be a tax effect! Please address every calculation and critical question correctly and fully in a similar display for easing reading. Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started