Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Going private e process by which a public company ceases to be a public company is referred to as going private. The entire equity of

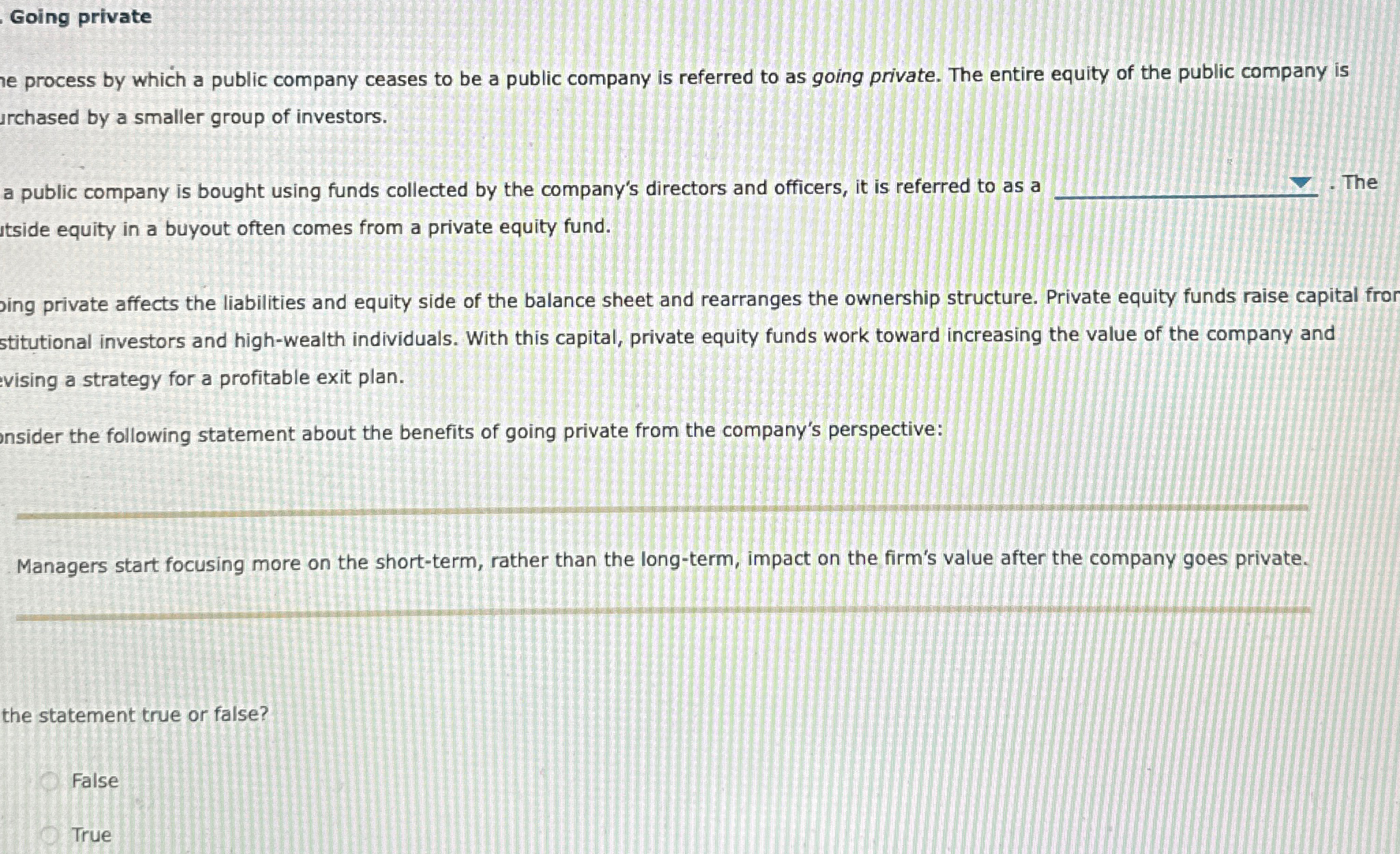

Going private

e process by which a public company ceases to be a public company is referred to as going private. The entire equity of the public company is urchased by a smaller group of investors.

a public company is bought using funds collected by the company's directors and officers, it is referred to as a

The

utside equity in a buyout often comes from a private equity fund.

oing private affects the liabilities and equity side of the balance sheet and rearranges the ownership structure. Private equity funds raise capital fror stitutional investors and highwealth individuals. With this capital, private equity funds work toward increasing the value of the company and vising a strategy for a profitable exit plan.

onsider the following statement about the benefits of going private from the company's perspective:

Managers start focusing more on the shortterm, rather than the longterm, impact on the firm's value after the company goes private.

the statement true or false?

False

True

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started