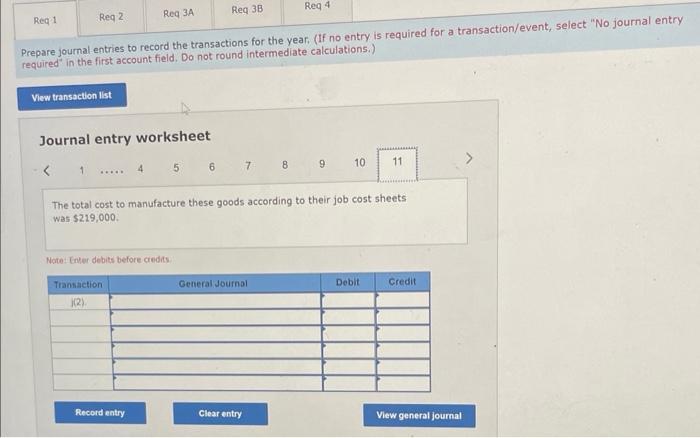

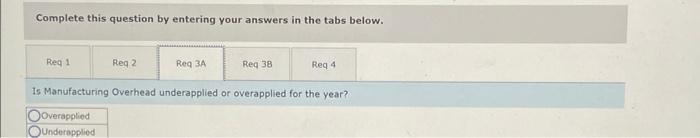

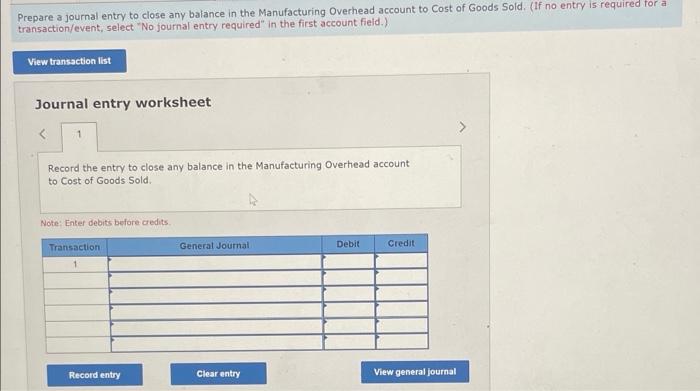

Gold Nest Company of Guandong. China, is a family-owned enterprise that makes birdcages for the South China market. The company sells its birdcages through an extensive network of street vendors who recelve commissions on their sales. The company uses a job-order costing system in which overhead is applied to jobs on the basis of direct labor cost. its predotermined overhead rate is based on a cost formula that estimated $85,500 of manufacturing overnead for an estimated activity level of $45,000 direct lobor dollars. At the beginning of the year, the inventory balances were as follows: During the year, the following transactions were comploted: a. Raw materials purchased for cash, $164,000. b. Raw materials used in production, $142,000 (materials costing $124,000 were charged directly to jobs; the remalining materials were indirect) c. Cash paid to employees as follows: a. Cash paid for rent during the year was $18,100i$13,800 of this amount related to factory operations, and the remainder related to solling and administrative activities). c. Cash pald for utility costs in the factory, $20,000 t. Cash paid for advertising, $10,000. 9. Depreciation recorded on equipment, $24,000. (\$16,000 of this amount related to equipment used in factory operations: the remaining $8,000 related to equipment used in seiling and administrative activities.) h. Manufacturing overhead cost was applied to jobs, \$? 1. Goods that had cost $228,000 to manufacture occording to their job cost sheets were completed. 1. Sales for the veat fall baid in cashi totaled $502.000. The total cost to manufacture these goods accordina to their iob cost sheets Prepare journal entries to record the transactions for the year. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Do not round intermediate calculations.) Journal entry worksheet The total cost to manufacture these goods according to their job cost sheets was 5229,000. Note: Gner debits before credits Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journat entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts). (Do not cound intermediate calculations.) Complete this question by entering your answers in the tabs below. Is Manufacturing Overhead underapplied or overapplied for the year? Overapplied Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. (If no entry is required tor a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. Note: Enter debits before credits. Prepare an income statement for the year. (All of the information needed for the income statement is available in the journal entries and T-accounts you have prepared.)