Answered step by step

Verified Expert Solution

Question

1 Approved Answer

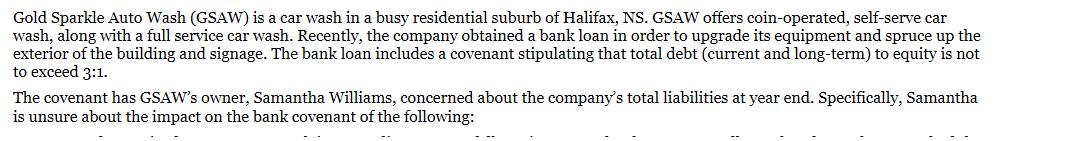

Gold Sparkle Auto Wash (GSAW) is a car wash in a busy residential suburb of Halifax, NS. GSAW offers coin-operated, self-serve car wash, along

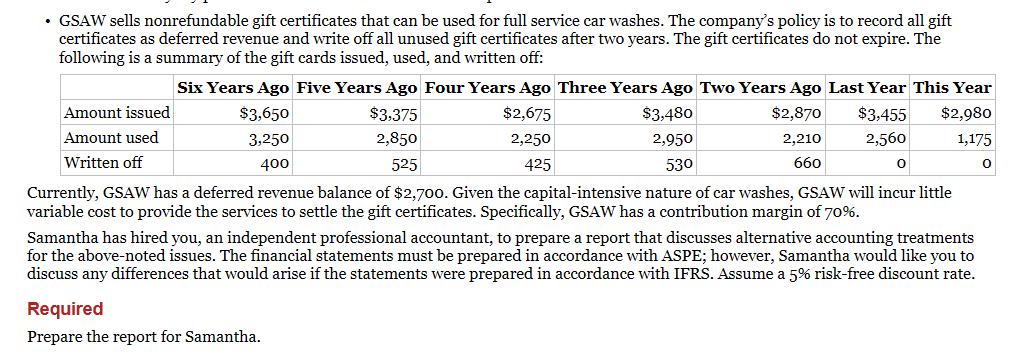

Gold Sparkle Auto Wash (GSAW) is a car wash in a busy residential suburb of Halifax, NS. GSAW offers coin-operated, self-serve car wash, along with a full service car wash. Recently, the company obtained a bank loan in order to upgrade its equipment and spruce up the exterior of the building and signage. The bank loan includes a covenant stipulating that total debt (current and long-term) to equity is not to exceed 3:1. The covenant has GSAW's owner, Samantha Williams, concerned about the company's total liabilities at year end. Specifically, Samantha is unsure about the impact on the bank covenant of the following: GSAW sells nonrefundable gift certificates that can be used for full service car washes. The company's policy is to record all gift certificates as deferred revenue and write off all unused gift certificates after two years. The gift certificates do not expire. The following is a summary of the gift cards issued, used, and written off: Six Years Ago Five Years Ago Four Years Ago Three Years Ago Two Years Ago Last Year This Year $3,650 $2,675 $2,870 $3,455 $2,980 $3,375 2,850 $3,480 2,950 3,250 2,250 2,560 1,175 400 525 425 530 0 0 Currently, GSAW has a deferred revenue balance of $2,700. Given the capital-intensive nature of car washes, GSAW will incur little variable cost to provide the services to settle the gift certificates. Specifically, GSAW has a contribution margin of 70%. Amount issued Amount used Written off 2,210 660 Samantha has hired you, an independent professional accountant, to prepare a report that discusses alternative accounting treatments for the above-noted issues. The financial statements must be prepared in accordance with ASPE; however, Samantha would like you to discuss any differences that would arise if the statements were prepared in accordance with IFRS. Assume a 5% risk-free discount rate. Required Prepare the report for Samantha.

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Samantha Thank you for hiring me to prepare a report discussing alternative accounting treatments for the issues related to the Gift Cards issued by G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started