Answered step by step

Verified Expert Solution

Question

1 Approved Answer

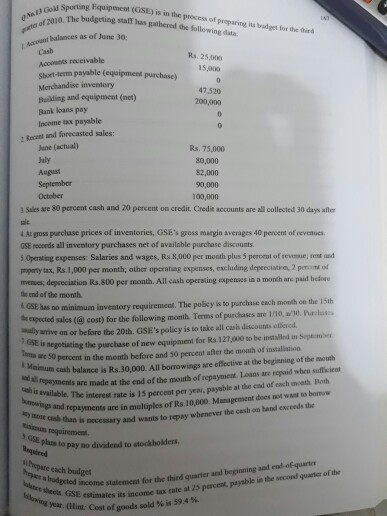

Gold sporting Equipment (GSE) is in the process of preparing its budget for the third grater of 2010. The budgeting staff has gathered the following

Gold sporting Equipment (GSE) is in the process of preparing its budget for the third grater of 2010. The budgeting staff has gathered the following data: Accounts balance as of June 30: Recent and forecasted sales: Sales are 80 percent cash and 20 percent on credit. Credit accounts are all collected 30 days after sale. At gross purchase prices of inventories, GSEs gross margin averages 40 percent of revenues. GSE records all inventory purchases net of available purchase discounts. Operating expenses: Salaries and wages, Rs.8,000 per month plus 5 percent of revenue: rent and property tax, Rs.1,000 per month: other operating expenses, excluding depreciation, 2 percent of revenues: depreciation Rs.800 per month. All cash operating expenses in a month are paid before the end of the month. GSE has no minimum inventory requirement. The policy is to purchase each month on the 15th the expected sales (@ cost) for the following month. Terms of purchases are 1/10, n/30. Purchases usually arrive on or before the 20th. GSEs policy is to take all cash discounts offered. GSE is negotiating the purchase of new equipment for Rs.127,000 to be installed in September. Terms are 50 percent in the month before and 50 percent after the month of installation. Minimum cash balance is Rs.30,000. All borrowings are effective at the beginning of the month and all repayments are made at the end of the month of repayment. Loans are repaid when sufficient cash is available. The interest rate is 15 percent per year, payable at the end of each month. Both borrowings and repayments are in multiples of Rs.10,000. Management does not want to borrow any more cash than is necessary and wants to repay whenever the cash on hand exceeds the minimum requirement. GSE plans to pay no dividend to stockholders. a) Prepare each budget Prepare a budgeted income statement for the third quarter and beginning and end-of-quarter balance sheets. GSE estimates its income tax rate at 25 percent, payable in the second quarter of the following year. Gold sporting Equipment (GSE) is in the process of preparing its budget for the third grater of 2010. The budgeting staff has gathered the following data: Accounts balance as of June 30: Recent and forecasted sales: Sales are 80 percent cash and 20 percent on credit. Credit accounts are all collected 30 days after sale. At gross purchase prices of inventories, GSEs gross margin averages 40 percent of revenues. GSE records all inventory purchases net of available purchase discounts. Operating expenses: Salaries and wages, Rs.8,000 per month plus 5 percent of revenue: rent and property tax, Rs.1,000 per month: other operating expenses, excluding depreciation, 2 percent of revenues: depreciation Rs.800 per month. All cash operating expenses in a month are paid before the end of the month. GSE has no minimum inventory requirement. The policy is to purchase each month on the 15th the expected sales (@ cost) for the following month. Terms of purchases are 1/10, n/30. Purchases usually arrive on or before the 20th. GSEs policy is to take all cash discounts offered. GSE is negotiating the purchase of new equipment for Rs.127,000 to be installed in September. Terms are 50 percent in the month before and 50 percent after the month of installation. Minimum cash balance is Rs.30,000. All borrowings are effective at the beginning of the month and all repayments are made at the end of the month of repayment. Loans are repaid when sufficient cash is available. The interest rate is 15 percent per year, payable at the end of each month. Both borrowings and repayments are in multiples of Rs.10,000. Management does not want to borrow any more cash than is necessary and wants to repay whenever the cash on hand exceeds the minimum requirement. GSE plans to pay no dividend to stockholders. a) Prepare each budget Prepare a budgeted income statement for the third quarter and beginning and end-of-quarter balance sheets. GSE estimates its income tax rate at 25 percent, payable in the second quarter of the following year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started