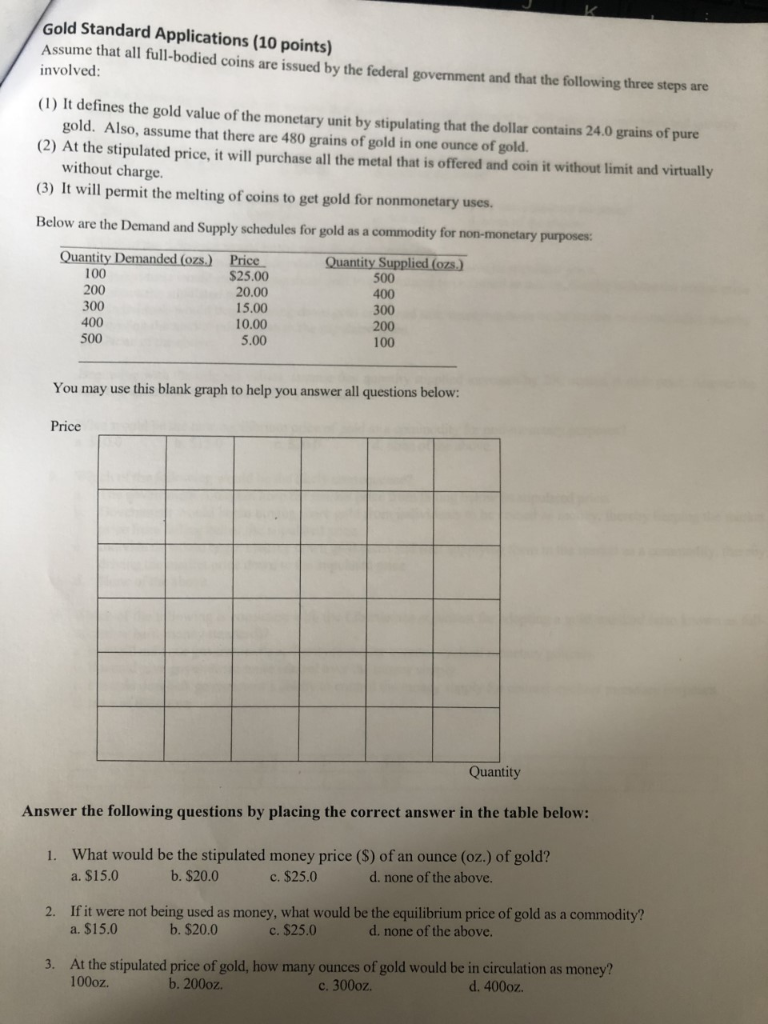

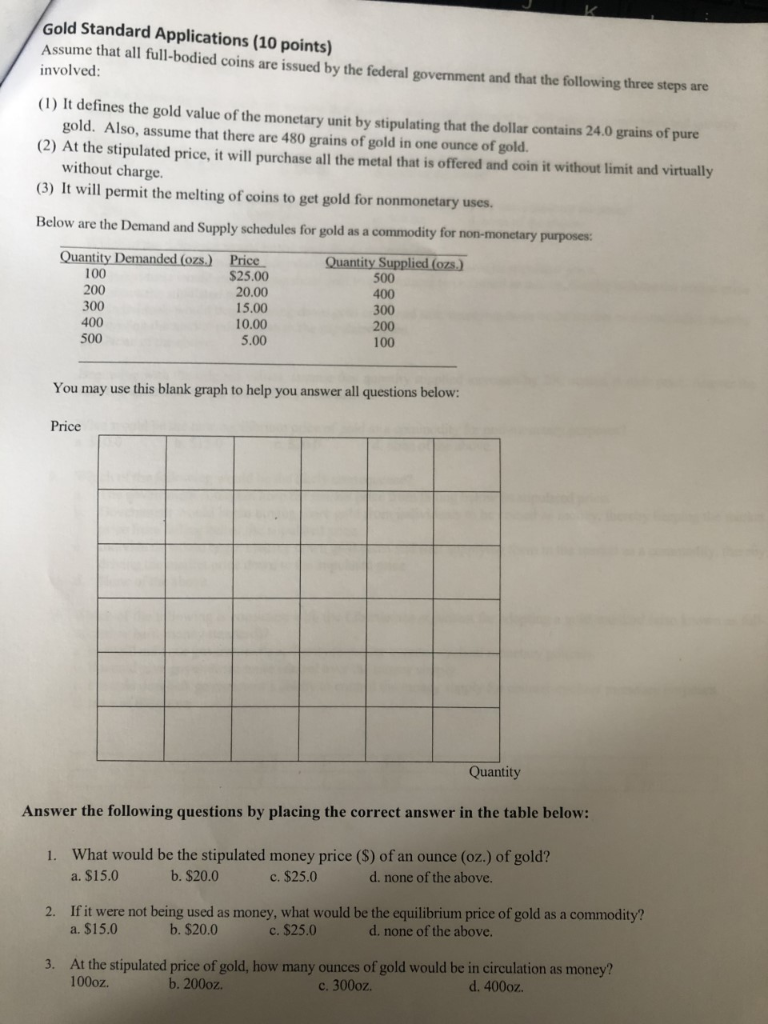

Gold Standard Applications (10 points) Assume that all full-bodied coins are issued by the federal government and that the following three steps are involved: (1) It defines the gold value of the monetary unit by stipul ating that the dollar contains 24.0 grains of pure gold. Also, assume that there are 480 grains of gold in one ounce of gold. (2) At the stipulated price, it will purchase all the metal that is offered and coin it without limit and virtually without charge. (3) It will permit the melting of coins to get gold for nonmonetary uses. Below are the Demand and Supply schedules for gold as a commodity for non-monetary purposes: Quantity Demanded (ozs.) Quantity Supplied (ozs.) 500 400 Price $25.00 100 200 20.00 300 15.00 300 200 10.00 400 100 5.00 500 You may use this blank graph to help you answer all questions below: Price Quantity Answer the following questions by placing the correct answer in the table below: What would be the stipulated money price ($) of an ounce (oz.) of gold? $25.0 d. none of the above. b. $20.0 a. $15.0 If it were not being used as money, what would be the equilibrium price of gold as a commodity? a. $15.0 2. d. none of the above. c. $25.0 b. $20.0 3. At the stipulated price of gold, how many ounces of gold would be in circulation as money? 100oz. d. 400oz b. 200oz. c. 3000z Gold Standard Applications (10 points) Assume that all full-bodied coins are issued by the federal government and that the following three steps are involved: (1) It defines the gold value of the monetary unit by stipul ating that the dollar contains 24.0 grains of pure gold. Also, assume that there are 480 grains of gold in one ounce of gold. (2) At the stipulated price, it will purchase all the metal that is offered and coin it without limit and virtually without charge. (3) It will permit the melting of coins to get gold for nonmonetary uses. Below are the Demand and Supply schedules for gold as a commodity for non-monetary purposes: Quantity Demanded (ozs.) Quantity Supplied (ozs.) 500 400 Price $25.00 100 200 20.00 300 15.00 300 200 10.00 400 100 5.00 500 You may use this blank graph to help you answer all questions below: Price Quantity Answer the following questions by placing the correct answer in the table below: What would be the stipulated money price ($) of an ounce (oz.) of gold? $25.0 d. none of the above. b. $20.0 a. $15.0 If it were not being used as money, what would be the equilibrium price of gold as a commodity? a. $15.0 2. d. none of the above. c. $25.0 b. $20.0 3. At the stipulated price of gold, how many ounces of gold would be in circulation as money? 100oz. d. 400oz b. 200oz. c. 3000z