Question

Golden Enterprises, Inc. (the Company) is a holding company which owns all of the issued and outstanding capital stock of Golden Flake Snack Foods, Inc.

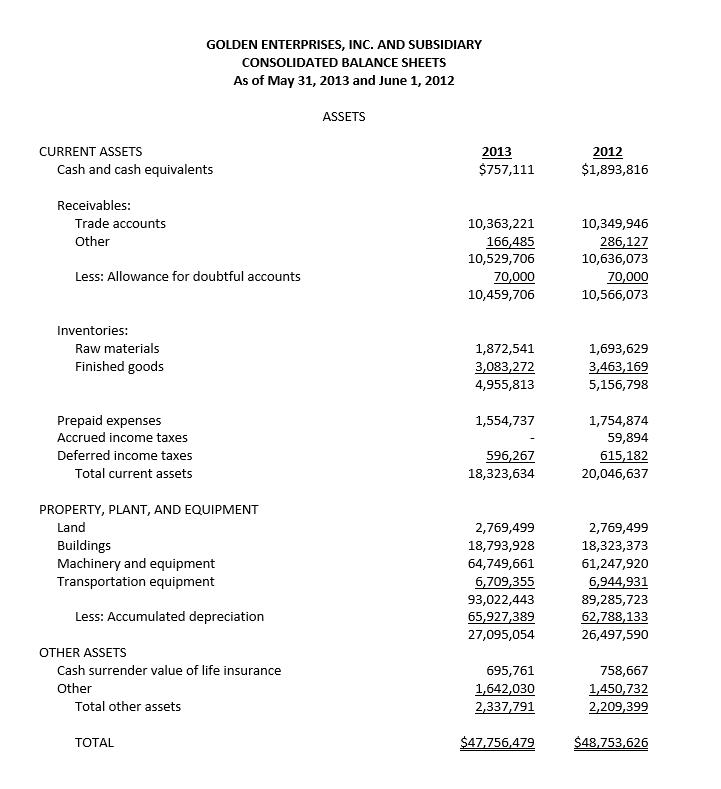

Golden Enterprises, Inc. (the "Company") is a holding company which owns all of the issued and outstanding capital stock of Golden Flake Snack Foods, Inc. Golden Flake Snack Foods, Inc. ("Golden Flake") is a Delaware corporation with its principal place of business and home office located at One Golden Flake Drive, Birmingham, Alabama. Golden Flake has been a premiere producer, marketer, and distributor of snack products in the Southeastern United States since 1923. The Company manufactures and distributes a full line of high quality salted snack items, such as potato chips, tortilla chips, corn chips, fried pork skins, baked and fried cheese curls, onion rings, and puff corn. Golden Flake also sells canned dips, pretzels, peanut butter crackers, cheese crackers, dried meat products, and nuts packaged by other manufacturers using the Golden Flake label. (Source: 2013 Form 10-K)

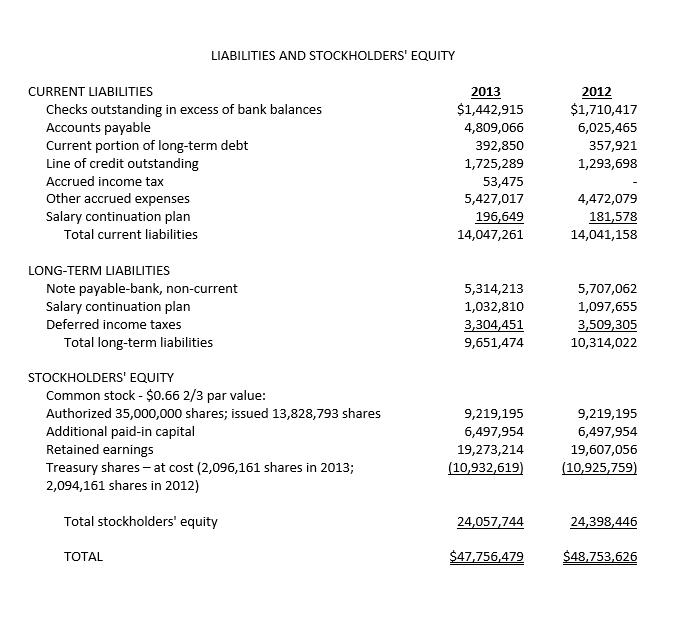

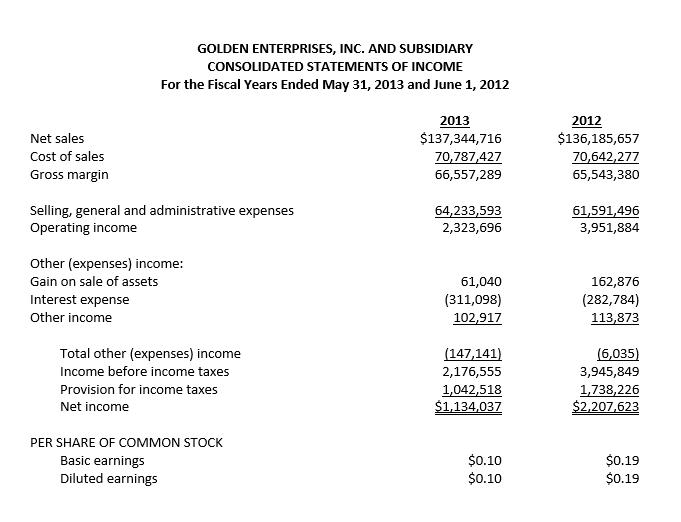

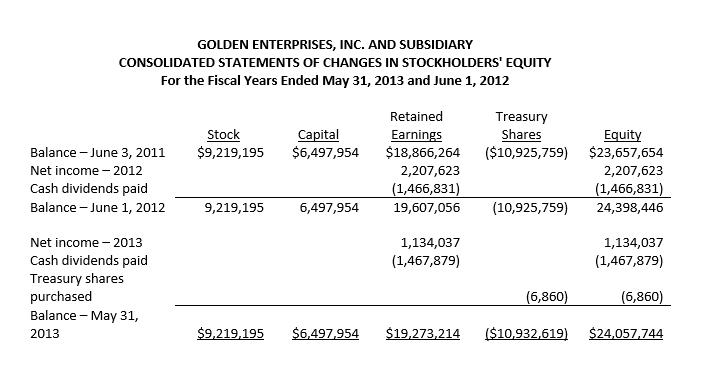

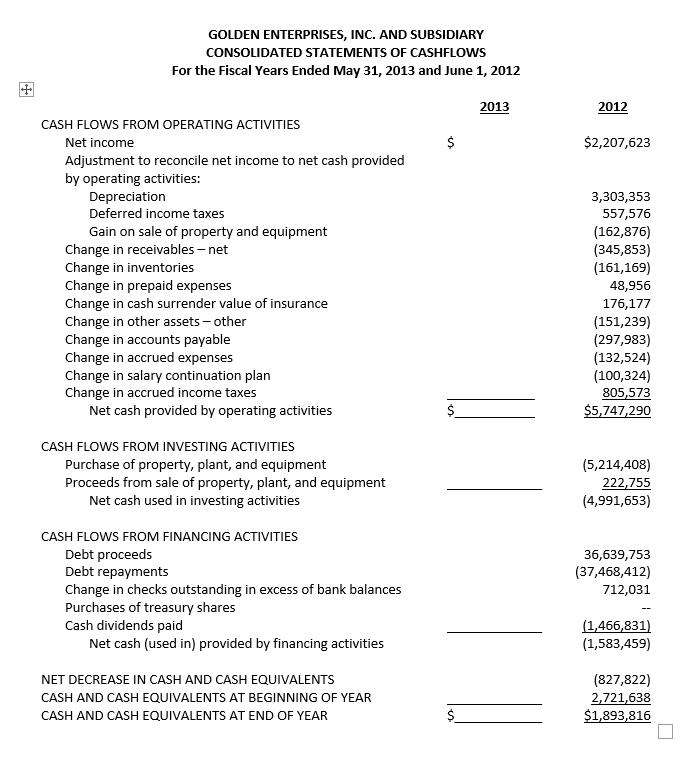

Refer to the financial statements of Golden Enterprises, Inc.

Concepts

- What information does the statement of cash flows provide? How is this different from the information contained in the income statement?

- What are the two different methods for preparing the statement of cash flows? Which method does Golden Enterprises use? How do you know? Why do you think most companies prepare their statement of cash flows using the indirect method?

- What are the three sections of the statement of cash flows?

- How do each of the three sections of the statement of cash flows relate to the balance sheet?

- The balance sheet includes an item called "Cash and cash equivalents." What are "cash equivalents"?

- Net income is determined on an accrual basis. Yet, net income is the first item on the statement of cash flows. Explain this apparent inconsistency.

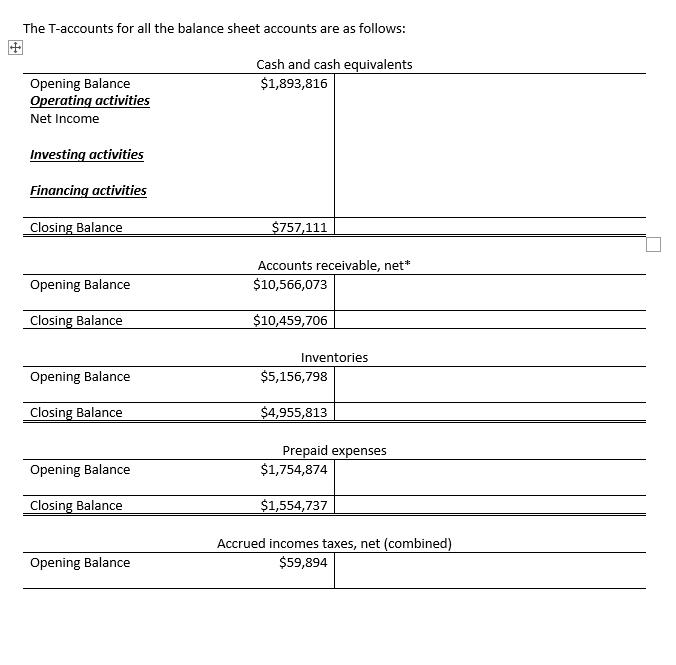

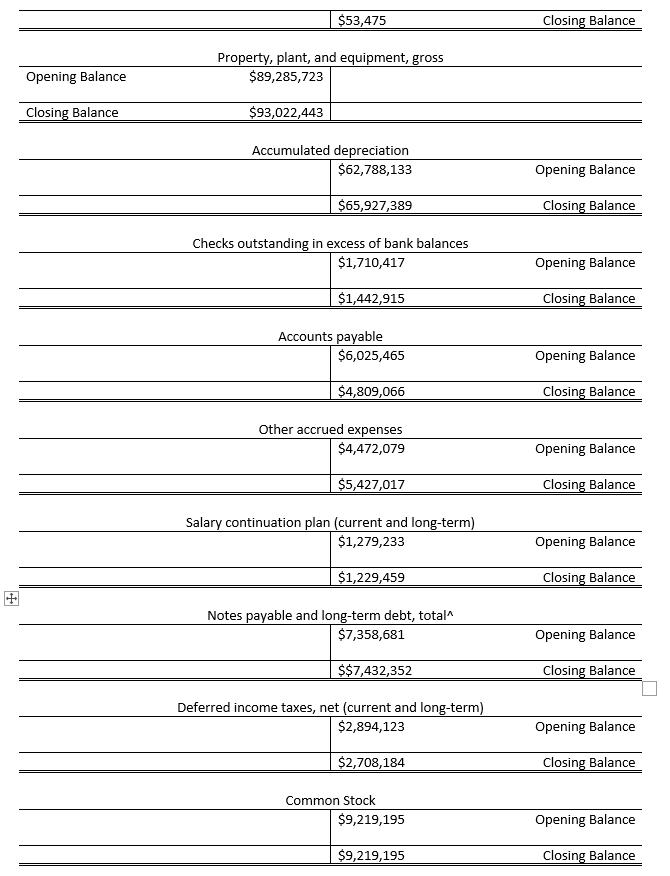

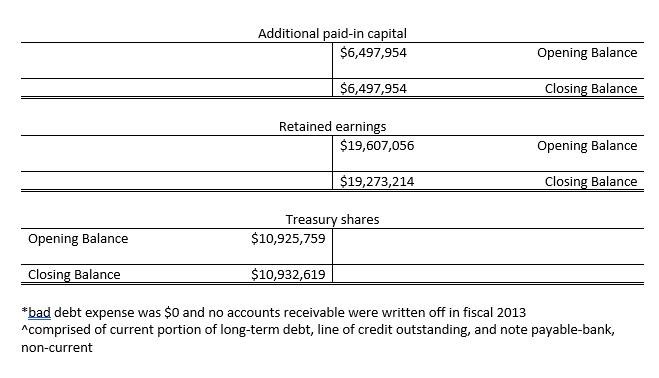

The T-accounts for all the balance sheet accounts are as follows: Cash and cash equivalents $1,893,816 Opening Balance Operating activities Net Income Investing activities Financing activities Closing Balance $757,111 Accounts receivable, net* Opening Balance $10,566,073 Closing Balance $10,459,706 Inventories Opening Balance $5,156,798 Closing Balance $4,955,813 Prepaid expenses $1,754,874 Opening Balance Closing Balance $1,554,737 Accrued incomes taxes, net (combined) $59,894 Opening Balance

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Cash flow statement provides information of cash inflow in to he business and cash outflows from t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started