Answered step by step

Verified Expert Solution

Question

1 Approved Answer

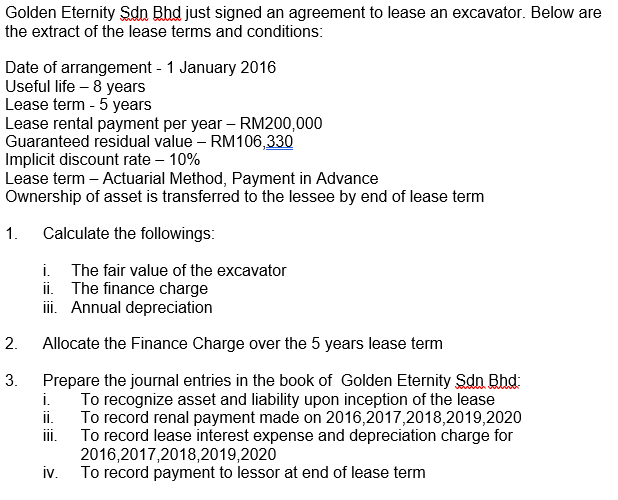

Golden Eternity Sdn Bhd just signed an agreement to lease an excavator. Below are the extract of the lease terms and conditions: Date of

Golden Eternity Sdn Bhd just signed an agreement to lease an excavator. Below are the extract of the lease terms and conditions: Date of arrangement - 1 January 2016 Useful life -8 years Lease term - 5 years Lease rental payment per year - RM200,000 Guaranteed residual value - RM106,330 Implicit discount rate - 10% Lease term - Actuarial Method, Payment in Advance Ownership of asset is transferred to the lessee by end of lease term Calculate the followings: 1. 2. 3. i. ii. The finance charge iii. Annual depreciation Allocate the Finance Charge over the 5 years lease term Prepare the journal entries in the book of Golden Eternity Sdn Bhd: To recognize asset and liability upon inception of the lease To record renal payment made on 2016,2017,2018,2019,2020 To record lease interest expense and depreciation charge for 2016,2017,2018,2019,2020 iv. To record payment to lessor at end of lease term The fair value of the excavator i. ii. iii.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 i The fair value of the excavator RM200000 x 8 years 1 108 RM1096330 ii The finance ch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started