Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Golden Harvest Ltd. has investment of tk. 18 million ($18,000,000) of which $3.6million ($3,600,000) has been raised by issuing debt. Currently its debt is

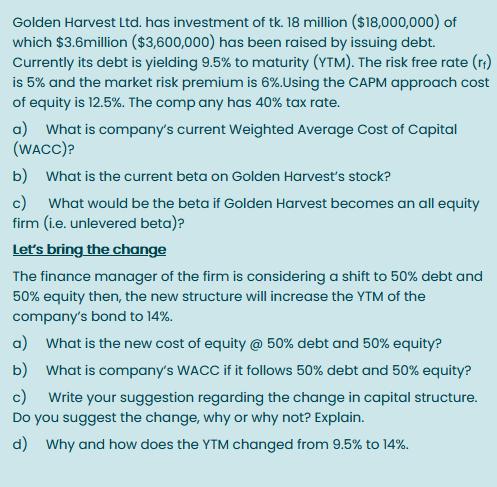

Golden Harvest Ltd. has investment of tk. 18 million ($18,000,000) of which $3.6million ($3,600,000) has been raised by issuing debt. Currently its debt is yielding 9.5% to maturity (YTM). The risk free rate (ri) is 5% and the market risk premium is 6%.Using the CAPM approach cost of equity is 12.5%. The company has 40% tax rate. a) What is company's current Weighted Average Cost of Capital (WACC)? b) What is the current beta on Golden Harvest's stock? c) What would be the beta if Golden Harvest becomes an all equity firm (i.e. unlevered beta)? Let's bring the change The finance manager of the firm is considering a shift to 50% debt and 50% equity then, the new structure will increase the YTM of the company's bond to 14%. a) What is the new cost of equity @ 50% debt and 50% equity? b) What is company's WACC if it follows 50% debt and 50% equity? c) Write your suggestion regarding the change in capital structure. Do you suggest the change, why or why not? Explain. d) Why and how does the YTM changed from 9.5% to 14%.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Current Weighted Average Cost of Capital WACC WACC is calculated as the weighted average of the cost of debt and the cost of equity taking into acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started