Question

Goldman Sachs SEC filing for the quarter ended March 31, 2019, report contains the following lease footnote. Leases (ASC 842). In February 2016, the FASB

Goldman Sachs’ SEC filing for the quarter ended March 31, 2019, report contains the following lease footnote.

Leases (ASC 842). In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). This ASU requires that, for leases longer than one year, a lessee recognize in the statements of financial condition a right-of-use asset and a lease liability. It also requires that for finance leases, a lessee recognize interest expense on the lease liability, separately from the amortization of the right-of-use asset in the statements of earnings, while for operating leases, such amounts should be recognized as a combined expense. The firm adopted this ASU in January 2019 under a modified retrospective approach.

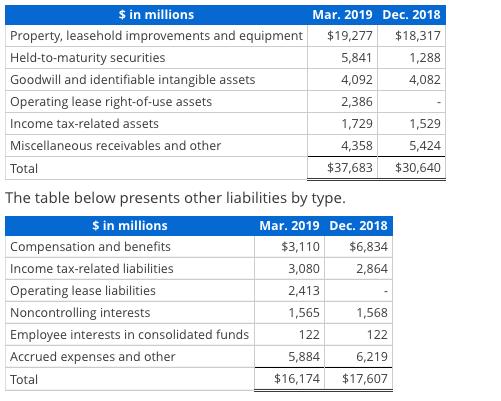

The table below presents other assets by type.

Required

a). Explain in plain language what “right-to-use assets” are; that is, how do they convey an economic benefit to the company?

b). What operating lease liability did Goldman Sachs report for the quarter ended March 31, 2019?

c). How does Goldman Sachs determine the amount of operating lease liabilities to add to its balance sheet?

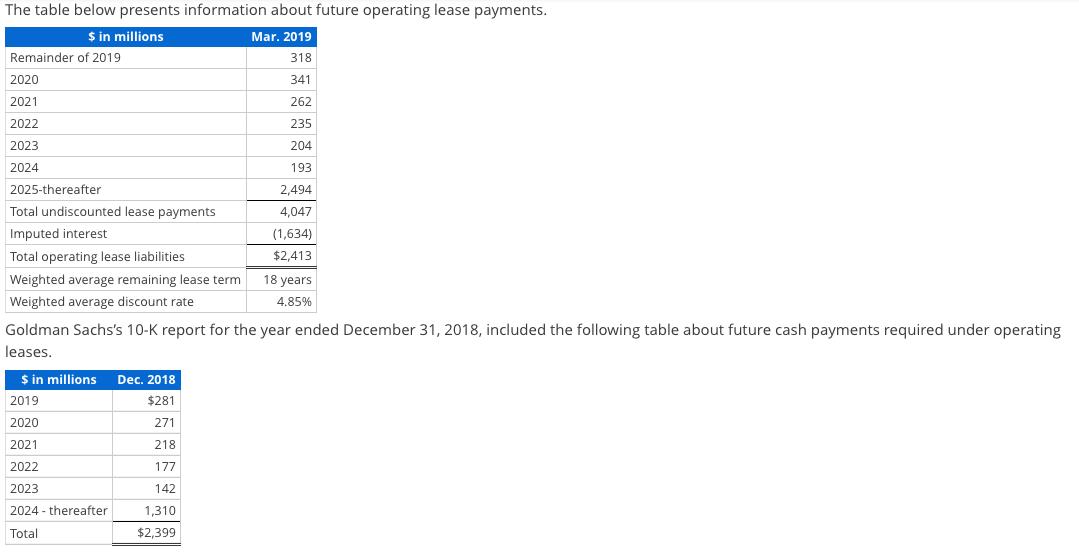

d). Use an Excel spreadsheet and the information on future operating lease payments to verify the total liabilities of $2,413 million on the 2019 Form 10-Q. Hint: The amount might not be exactly $2,413.

e). What right-of-use assets did Goldman Sachs report for the quarter ended March 31, 2019? Given Goldman Sachs’ business, what does the company lease under its operating leases?

f). Why might the right-of-use asset amount that Goldman Sachs added to the January 2019 balance sheet differ from the related operating lease liabilities?

g). Use the information on rental payments from the December 2018 Form 10-K, to calculate the present value of future payments at year-end. Use the same average weighted lease term and discount rate Goldman Sachs discloses in the 2019 Form 10-Q.

h). How would we adjust the December 2018 balance sheet to enhance comparability?

$ in millions Mar. 2019 Dec. 2018 Property, leasehold improvements and equipment $19,277 $18,317 Held-to-maturity securities 5,841 1,288 Goodwill and identifiable intangible assets 4,092 4,082 Operating lease right-of-use assets 2,386 Income tax-related assets 1,729 1,529 Miscellaneous receivables and other 4,358 5,424 Total $37,683 $30,640 The table below presents other liabilities by type. $ in millions Mar. 2019 Dec. 2018 Compensation and benefits $3,110 $6,834 Income tax-related liabilities 3,080 2,864 Operating lease liabilities 2,413 Noncontrolling interests 1,565 1,568 Employee interests in consolidated funds 122 122 Accrued expenses and other 5,884 6,219 Total $16,174 $17,607

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a A right of use asset means the amount recognized by the lessee in its balance sheet which represents its right to use the property under the lease a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started