Answered step by step

Verified Expert Solution

Question

1 Approved Answer

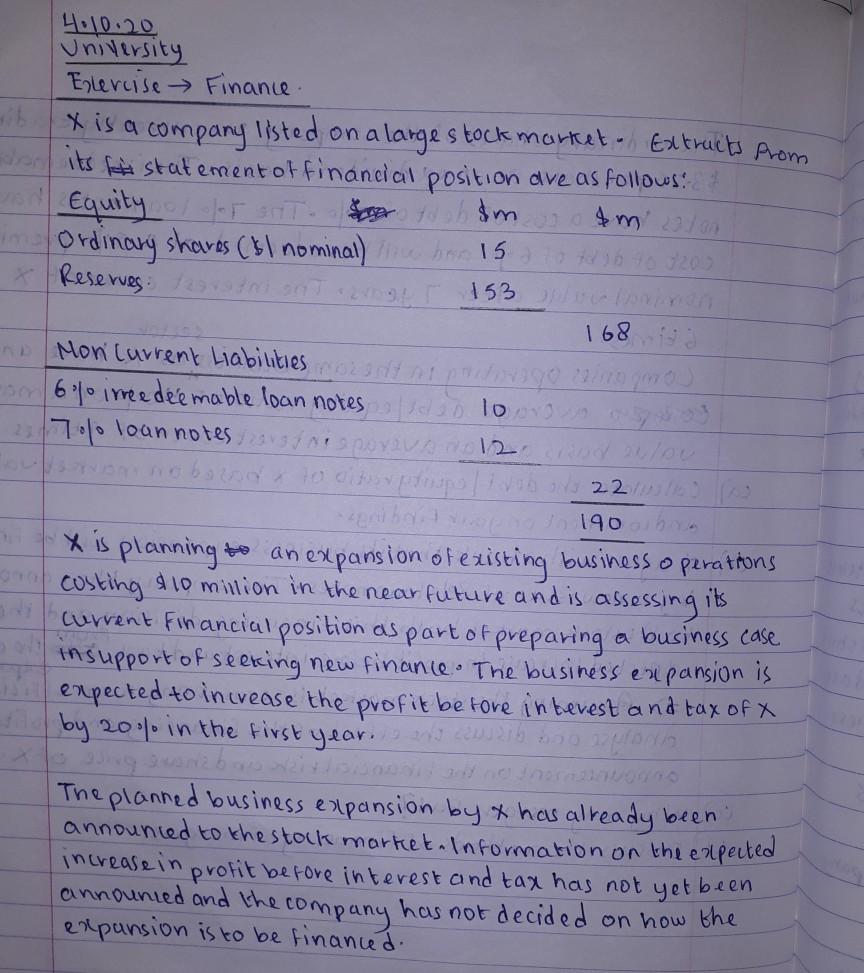

4.10.20 University Exercise Finance listed on on a large stock market - Extracts Prom on its statement of financial position are as follows: on

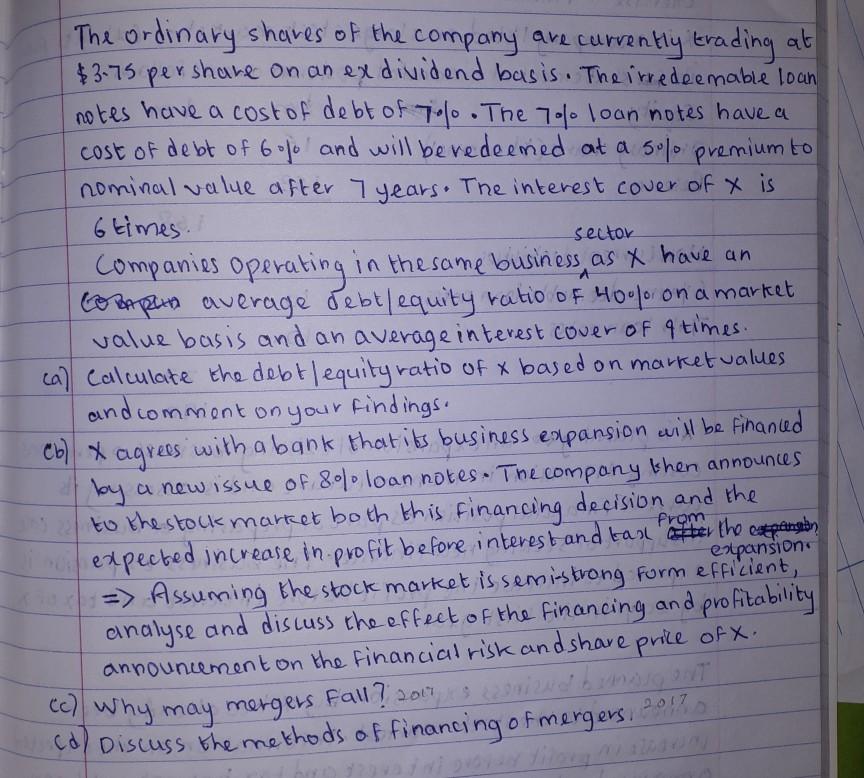

4.10.20 University Exercise Finance listed on on a large stock market - Extracts Prom on its statement of financial position are as follows: on Equity OF SHT- h&m&m/ 22/04 15 to 7436 40 7209 ima Ordinary shares ($) nominal) / * Reserves: 153 [orimman x is a company 168 Mon Current Liabilities mozantni om 6% irree deemable loan notes at padmago reina qma idad lorowo qu 23070/0 loan notes/2013/Ni povod 20/ou Toulsavam no bazed to diterptips|tab od 22/113/10 (13 zenbaia waping to 190 ouboe X is planning to an expansion of existing business operations custing $ 10 million in the near future and is assessing its Current Financial position as part of preparing a business case insupport of seeking new finance. The business expansion is expected to increase the profit before interest and tax of X by 20% in the first year. 23 cewek bo pono is going smAnzbois skirtoisaagid and no theranos The planned business expansion by x has already been. announced to the stock market. Information on the expected increase in profit before interest and tax has not yet been announced and the company has not decided on how the expansion is to be financed. The ordinary shares of the company are currently trading at $3-75 pershare on an ex dividend basis. The irredeemable loan notes have a cost of debt of 7%. The 7% loan notes have a cost of debt of 6o and will be redeemed at a 50% premium to nominal value after 7 years. The interest cover of X is 6 times. / sector Companies operating in the same business, as X have an Can average debt/equity ratio of 40% on a market value basis and an average interest cover of 9 times. ca) Calculate the debt /equity ratio of x based on market values and comment on your findings. from Cb) x agrees with a bank that its business expansion will be financed by a new issue of 800 loan notes. The company then announces to the stock market both this financing decision and the expected increase in profit before interest and tax after the expansion => Assuming the stock market is semi-strong form efficient, analyse and discuss the effect of the financing and profitability announcement on the financial risk and share price of X. cc) Why may mergers Fall ? 2017 expansion cd) Discuss the methods of financing of mergers, 2017

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer a DebtEquity Ratio of X 6168 0036 The debtequity ratio of X is lower than the sector average ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started