Answered step by step

Verified Expert Solution

Question

1 Approved Answer

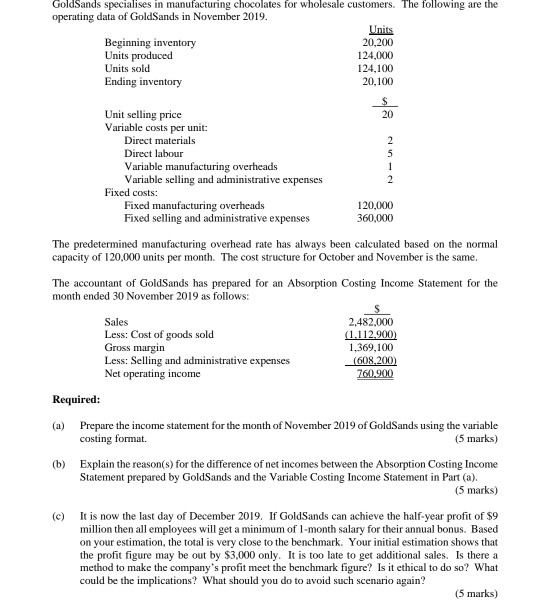

GoldSands specialises in manufacturing chocolates for wholesale customers. The following are the operating data of GoldSands in November 2019. Beginning inventory Units produced Units

GoldSands specialises in manufacturing chocolates for wholesale customers. The following are the operating data of GoldSands in November 2019. Beginning inventory Units produced Units sold Ending inventory Unit selling price Variable costs per unit: Direct materials Direct labour Variable manufacturing overheads Variable selling and administrative expenses Fixed costs: Fixed manufacturing overheads Fixed selling and administrative expenses Units 20,200 124,000 124,100 20,100 Sales Less: Cost of goods sold Gross margin Less: Selling and administrative expenses Net operating income 20 5 1 120,000 360,000 The predetermined manufacturing overhead rate has always been calculated based on the normal capacity of 120,000 units per month. The cost structure for October and November is the same. The accountant of GoldSands has prepared for an Absorption Costing Income Statement for the month ended 30 November 2019 as follows: 2,482,000 (1.112.900) 1,369,100 (608,200) 760.900 Required: Prepare the income statement for the month of November 2019 of GoldSands using the variable costing format. (5 marks) (b) Explain the reason(s) for the difference of net incomes between the Absorption Costing Income Statement prepared by GoldSands and the Variable Costing Income Statement in Part (a). (5 marks) It is now the last day of December 2019. If GoldSands can achieve the half-year profit of $9 million then all employees will get a minimum of 1-month salary for their annual bonus. Based on your estimation, the total is very close to the benchmark. Your initial estimation shows that the profit figure may be out by $3,000 only. It is too late to get additional sales. Is there a method to make the company's profit meet the benchmark figure? Is it ethical to do so? What could be the implications? What should you do to avoid such scenario again? (5 marks)

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a INCOME STATEMENT VARIABLE COSTING FORMAT Sales Revenue 2482000 12410020 Variable Costs Direct ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started