Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Goldsport Berhad (Goldsport) is a sports wear retailer which is a large company whose shares are listed on the Main Market of the Bursa

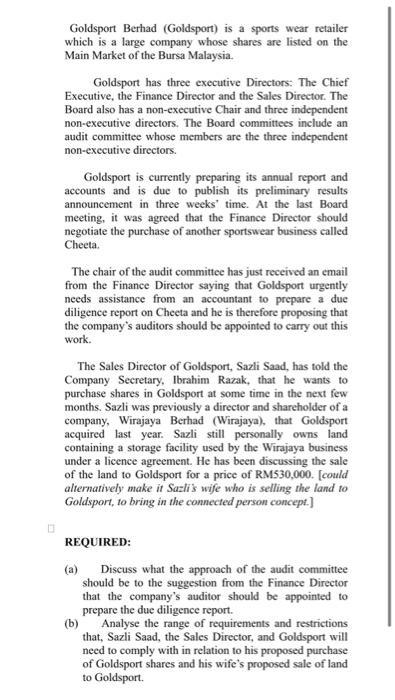

Goldsport Berhad (Goldsport) is a sports wear retailer which is a large company whose shares are listed on the Main Market of the Bursa Malaysia. Goldsport has three executive Directors: The Chief Executive, the Finance Director and the Sales Director. The Board also has a non-executive Chair and three independent non-executive directors. The Board committees include an audit committee whose members are the three independent non-executive directors. Goldsport is currently preparing its annual report and accounts and is due to publish its preliminary results announcement in three weeks' time. At the last Board meeting, it was agreed that the Finance Director should negotiate the purchase of another sportswear business called Cheeta. The chair of the audit committee has just received an email from the Finance Director saying that Goldsport urgently needs assistance from an accountant to prepare a due diligence report on Cheeta and he is therefore proposing that the company's auditors should be appointed to carry out this work. The Sales Director of Goldsport, Sazli Saad, has told the Company Secretary, Ibrahim Razak, that he wants to purchase shares in Goldsport at some time in the next few months. Sazli was previously a director and shareholder of a company, Wirajaya Berhad (Wirajaya), that Goldsport acquired last year. Sazli still personally owns land containing a storage facility used by the Wirajaya business under a licence agreement. He has been discussing the sale of the land to Goldsport for a price of RM530,000. [could alternatively make it Sazli's wife who is selling the land to Goldsport, to bring in the connected person concept.] REQUIRED: Discuss what the approach of the audit committee should be to the suggestion from the Finance Director that the company's auditor should be appointed to prepare the due diligence report. (b) Analyse the range of requirements and restrictions that, Sazli Saad, the Sales Director, and Goldsport will need to comply with in relation to his proposed purchase of Goldsport shares and his wife's proposed sale of land to Goldsport.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The approach of the audit committee should be to carefully consider the Finance Directors suggestion and evaluate whether it is a suitable course of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started