Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Golf Inc. is a public company that has been in business since the 1980s. It owns and operates over 40 golf courses across Canada.

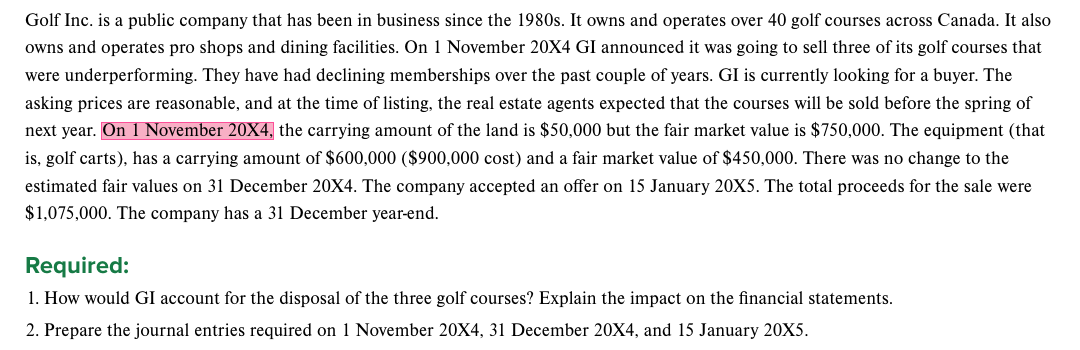

Golf Inc. is a public company that has been in business since the 1980s. It owns and operates over 40 golf courses across Canada. It also owns and operates pro shops and dining facilities. On 1 November 20X4 GI announced it was going to sell three of its golf courses that were underperforming. They have had declining memberships over the past couple of years. GI is currently looking for a buyer. The asking prices are reasonable, and at the time of listing, the real estate agents expected that the courses will be sold before the spring of next year. On 1 November 20X4, the carrying amount of the land is $50,000 but the fair market value is $750,000. The equipment (that is, golf carts), has a carrying amount of $600,000 ($900,000 cost) and a fair market value of $450,000. There was no change to the estimated fair values on 31 December 20X4. The company accepted an offer on 15 January 20X5. The total proceeds for the sale were $1,075,000. The company has a 31 December year-end. Required: 1. How would GI account for the disposal of the three golf courses? Explain the impact on the financial statements. 2. Prepare the journal entries required on 1 November 20X4, 31 December 20X4, and 15 January 20X5.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer To account for the disposal of the three golf courses Golf Inc GI would follow the accounting treatment for the sale of assets Heres how GI wou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started