Good Afternoon Tutor,

I am reaching out as I am experiencing difficulty on a few questions, they are quite straight forward however this is out of my area of knowledge therefore any guidance/support/explanations help. I always ensure to give a GREAT RATING, THUMBS UP, AND THANK YOU.

Which picture is not clear and I need anwsers,

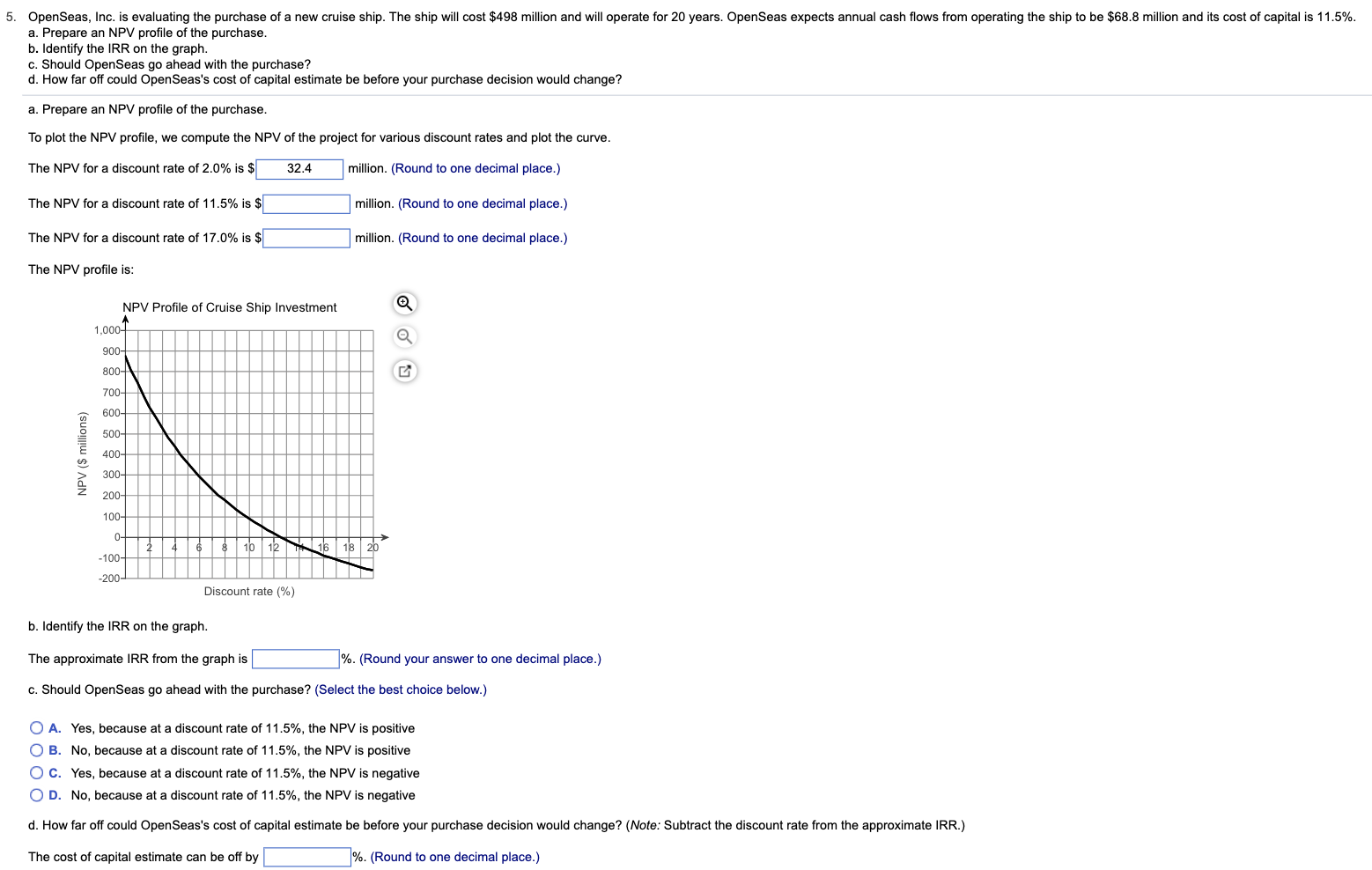

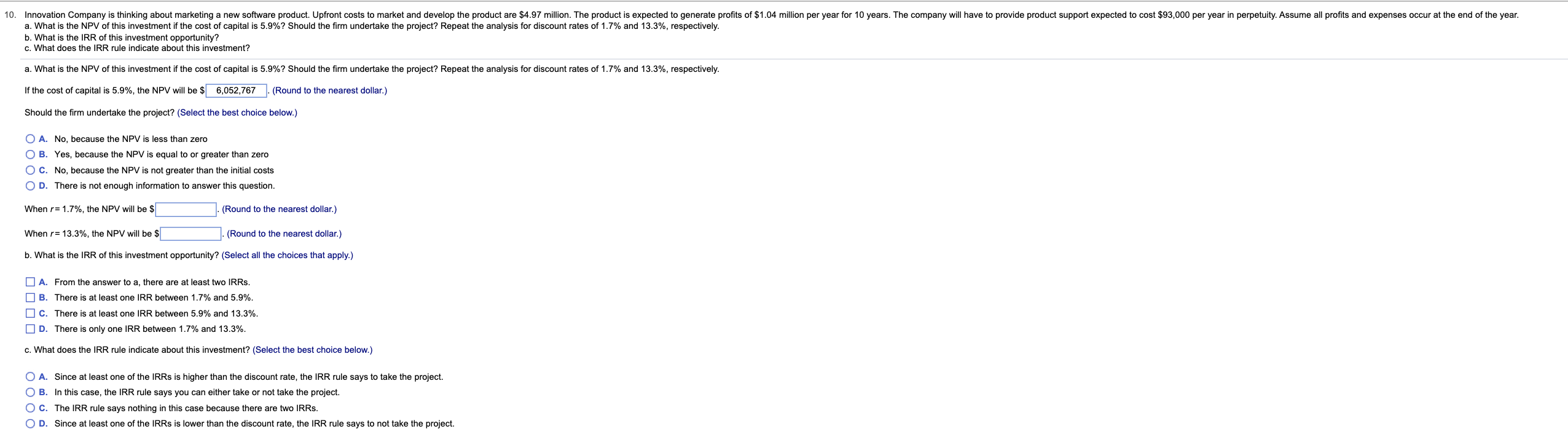

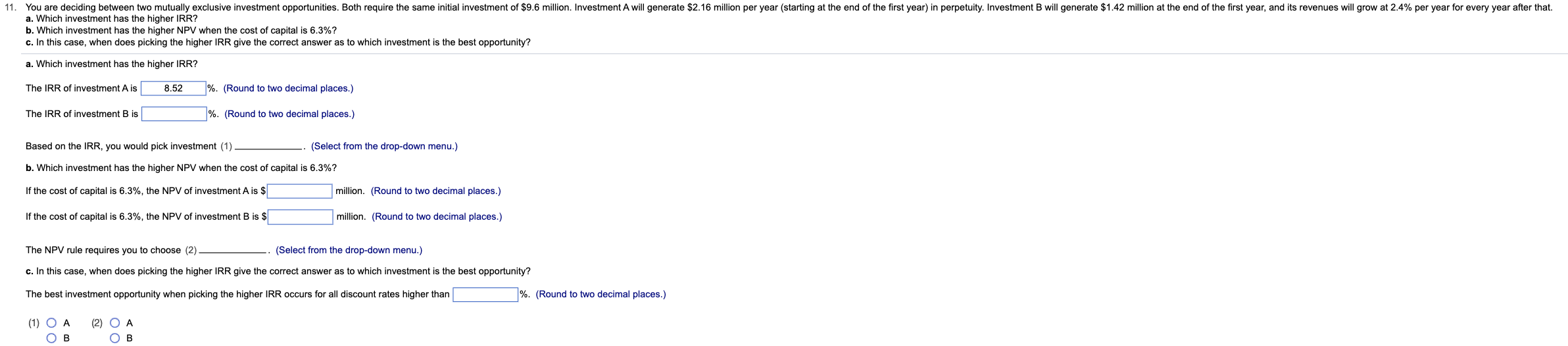

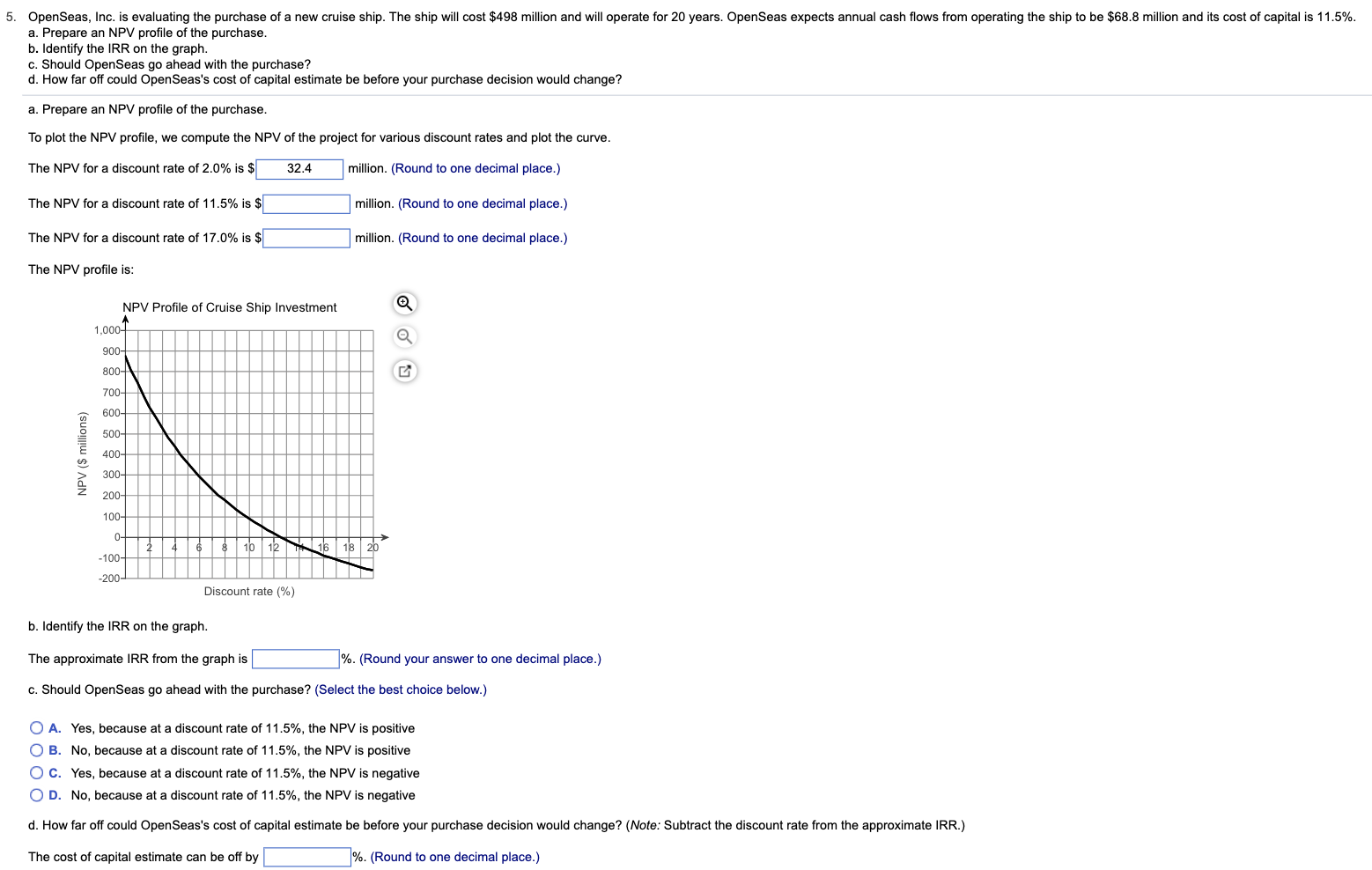

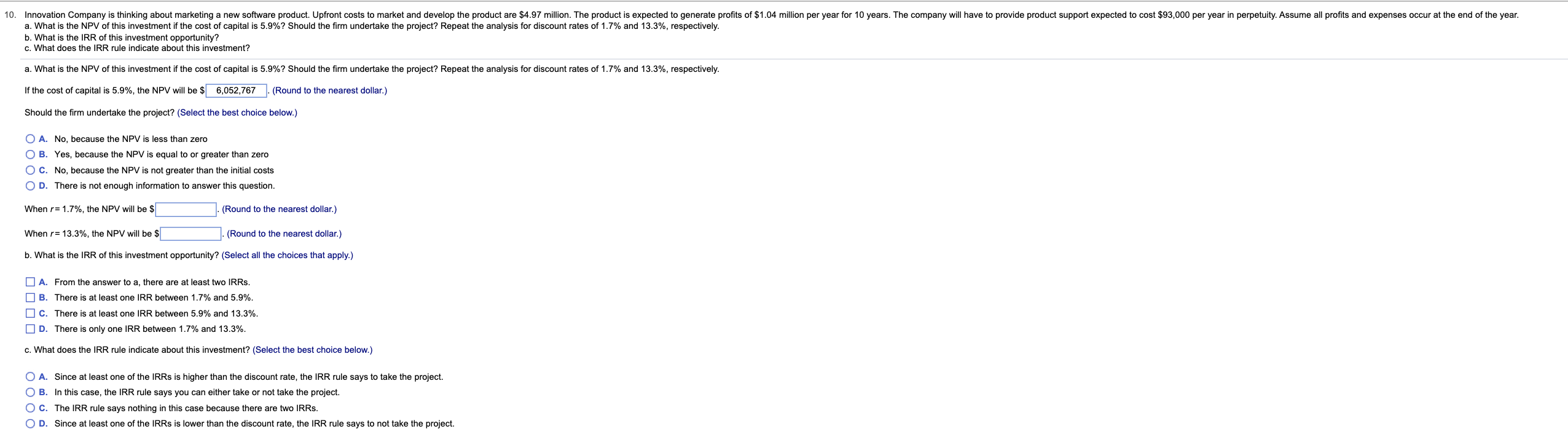

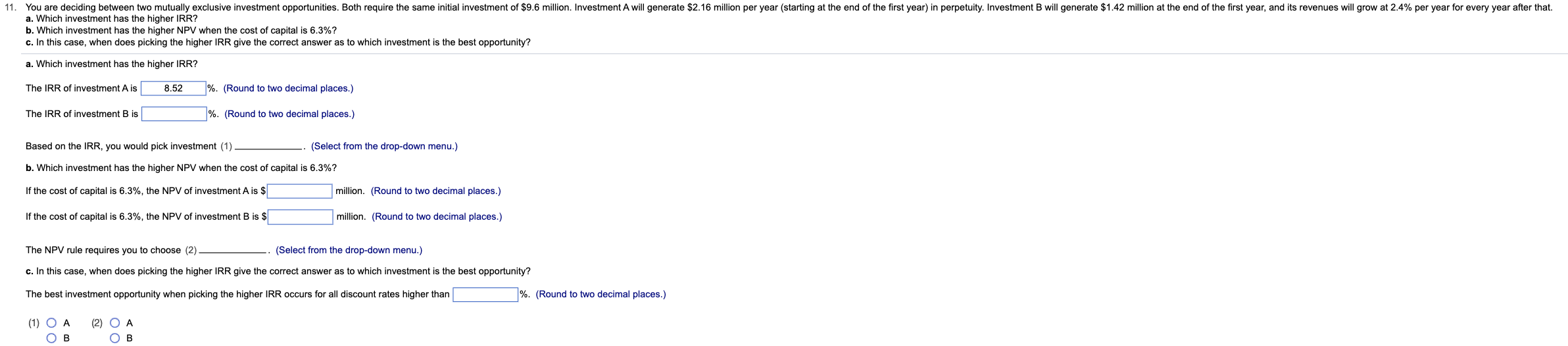

5. OpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship will cost $498 million and will operate for 20 years. OpenSeas expects annual cash flows from operating the ship to be $68.8 million and its cost of capital is 11.5%. a. Prepare an NPV profile of the purchase. b. Identify the IRR on the graph. c. Should OpenSeas go ahead with the purchase? d. How far off could OpenSeas's cost of capital estimate be before your purchase decision would change? a. Prepare an NPV profile of the purchase. To plot the NPV profile, we compute the NPV of the project for various discount rates and plot the curve. The NPV for a discount rate of 2.0% is $ 32.4 million. (Round to one decimal place.) The NPV for a discount rate of 11.5% is $ million. (Round to one decimal place.) The NPV for a discount rate of 17.0% is $ million. (Round to one decimal place.) The NPV profile is: NPV Profile of Cruise Ship Investment Q 1,000- Q 900- 800- 700- 600- 500- 400- 300- 200- 100- 0- 10 12 18 -100- -200- Discount rate (%) b. Identify the IRR on the graph. The approximate IRR from the graph is %. (Round your answer to one decimal place.) c. Should OpenSeas go ahead with the purchase? (Select the best choice below.) A. Yes, because at a discount rate of 11.5%, the NPV is positive B. No, because at a discount rate of 11.5%, the NPV is positive OC. Yes, because at a discount rate of 11.5%, the NPV is negative O D. No, because at a discount rate of 11.5%, the NPV is negative d. How far off could OpenSeas's cost of capital estimate be before your purchase decision would change? (Note: Subtract the discount rate from the approximate IRR.) The cost of capital estimate can be off by %. (Round to one decimal place.) NPV ($ millions) 10. Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $4.97 million. The product is expected to generate profits of $1.04 million per year for 10 years. The company will have to provide product support expected to cost $93,000 per year in perpetuity. Assume all profits and expenses occur at the end of the year. a. What is the NPV of this investment if the cost of capital is 5.9%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.7% and 13.3%, respectively. b. What is the IRR of this investment opportunity? c. What does the IRR rule indicate about this investment? a. What is the NPV of this investment if the cost of capital is 5.9%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.7% and 13.3%, respectively. If the cost of capital is 5.9%, the NPV will be $ 6,052,767 (Round to the nearest dollar.) Should the firm undertake the project? (Select the best choice below.) OA. No, because the NPV is less than zero OB. Yes, because the NPV is equal to or greater than zero O C. No, because the NPV is not greater than the initial costs O D. There is not enough information to answer this question. When r= 1.7%, the NPV will be $ (Round to the nearest dollar.) When r= 13.3%, the NPV will be $ (Round to the nearest dollar.) b. What is the IRR of this investment opportunity? (Select all the choices that apply.) A. From the answer to a, there are at least two IRRs. B. There is at least one IRR between 1.7% and 5.9%. C. There is at least one IRR between 5.9% and 13.3%. D. There is only one IRR between 1.7% and 13.3%. c. What does the IRR rule indicate about this investment? (Select the best choice below.) O A. Since at least one of the IRRS is higher than the discount rate, the IRR rule says to take the project. OB. In this case, the IRR rule says you can either take or not take the project. OC. The IRR rule says nothing in this case because there are two IRRs. O D. Since at least one of the IRRS is lower than the discount rate, the IRR rule says to not take the project. 11. You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $9.6 million. Investment A will generate $2.16 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.42 million at the end of the first year, and its revenues will grow at 2.4% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 6.3%? c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity? a. Which investment has the higher IRR? The IRR of investment A is 8.52 %. (Round to two decimal places.) The IRR of investment B is %. (Round to two decimal places.) Based on the IRR, you would pick investment (1) (Select from the drop-down menu.) b. Which investment has the higher NPV when the cost of capital is 6.3%? If the cost of capital is 6.3%, the NPV of investment A is $ million. (Round to two decimal places.) If the cost of capital is 6.3%, the NPV of investment B is $ million. (Round to two decimal places.) The NPV rule requires you to choose (2) (Select from the drop-down menu.) c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity? The best investment opportunity when picking the higher IRR occurs for all discount rates higher than %. (Round to two decimal places.) (1) O A (2) OB B