Answered step by step

Verified Expert Solution

Question

1 Approved Answer

good day, Please may you assist with this asap, thanks Carling Ltd (hereafter 'Carling') is a soft-drink manufacturer located in Johannesburg. The company produces, bottles

good day, Please may you assist with this asap, thanks

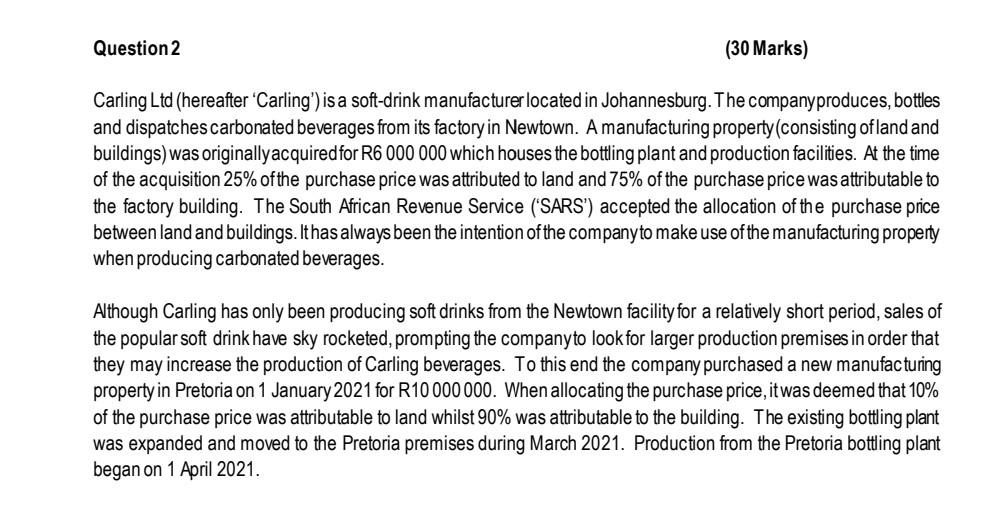

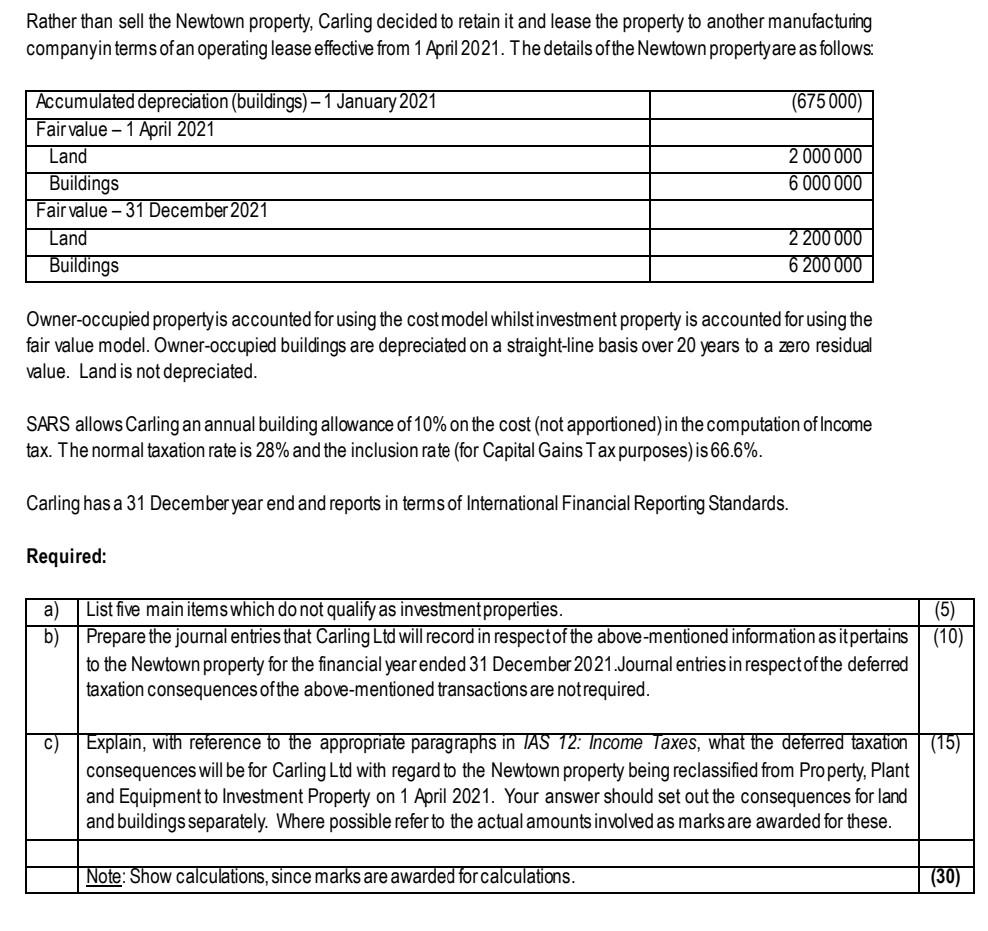

Carling Ltd (hereafter 'Carling') is a soft-drink manufacturer located in Johannesburg. The company produces, bottles and dispatchescarbonated beverages from its factory in Newtown. A manufacturing property (consisting ofland and buildings) was originallyacquiredfor R6000000 which houses the bottling plant and production facilities. At the time of the acquisition 25% of the purchase price was attributed to land and 75% of the purchase price was attributable to the factory building. The South African Revenue Service ('SARS') accepted the allocation of the purchase price between land and buildings. Ithas always been the intention of the companyto make use of the manufacturing property when producing carbonated beverages. Although Carling has only been producing soft drinks from the Newtown facility for a relatively short period, sales of the popular soft drink have sky rocketed, prompting the companyto lookfor larger production premises in order that they may increase the production of Carling beverages. To this end the company purchased a new manufacturing property in Pretoria on 1 January 2021 for R10000000. When allocating the purchase price, it was deemed that 10% of the purchase price was attributable to land whilst 90% was attributable to the building. The existing bottling plant was expanded and moved to the Pretoria premises during March 2021. Production from the Pretoria bottling plant began on 1 April 2021. Rather than sell the Newtown property, Carling decided to retain it and lease the property to another manufacturing companyin terms of an operating lease effective from 1 April 2021. The details of the Newtown propertyare as follows: Owner-occupied propertyis accounted for using the cost model whilstinvestment property is accounted for using the fair value model. Owner-occupied buildings are depreciated on a straight-line basis over 20 years to a zero residual value. Land is not depreciated. SARS allows Carling an annual building allowance of 10% on the cost (not apportioned) in the computation of Income tax. The normal taxation rate is 28% and the inclusion rate (for Capital Gains Tax purposes) is 66.6%. Carling has a 31 December year end and reports in terms of International Financial Reporting Standards. Carling Ltd (hereafter 'Carling') is a soft-drink manufacturer located in Johannesburg. The company produces, bottles and dispatchescarbonated beverages from its factory in Newtown. A manufacturing property (consisting ofland and buildings) was originallyacquiredfor R6000000 which houses the bottling plant and production facilities. At the time of the acquisition 25% of the purchase price was attributed to land and 75% of the purchase price was attributable to the factory building. The South African Revenue Service ('SARS') accepted the allocation of the purchase price between land and buildings. Ithas always been the intention of the companyto make use of the manufacturing property when producing carbonated beverages. Although Carling has only been producing soft drinks from the Newtown facility for a relatively short period, sales of the popular soft drink have sky rocketed, prompting the companyto lookfor larger production premises in order that they may increase the production of Carling beverages. To this end the company purchased a new manufacturing property in Pretoria on 1 January 2021 for R10000000. When allocating the purchase price, it was deemed that 10% of the purchase price was attributable to land whilst 90% was attributable to the building. The existing bottling plant was expanded and moved to the Pretoria premises during March 2021. Production from the Pretoria bottling plant began on 1 April 2021. Rather than sell the Newtown property, Carling decided to retain it and lease the property to another manufacturing companyin terms of an operating lease effective from 1 April 2021. The details of the Newtown propertyare as follows: Owner-occupied propertyis accounted for using the cost model whilstinvestment property is accounted for using the fair value model. Owner-occupied buildings are depreciated on a straight-line basis over 20 years to a zero residual value. Land is not depreciated. SARS allows Carling an annual building allowance of 10% on the cost (not apportioned) in the computation of Income tax. The normal taxation rate is 28% and the inclusion rate (for Capital Gains Tax purposes) is 66.6%. Carling has a 31 December year end and reports in terms of International Financial Reporting StandardsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started