Question

Good Day Sir.I need to solve this case study. Please help me by provide this answer. Word file will be easy to understand. Thank you.FICO:

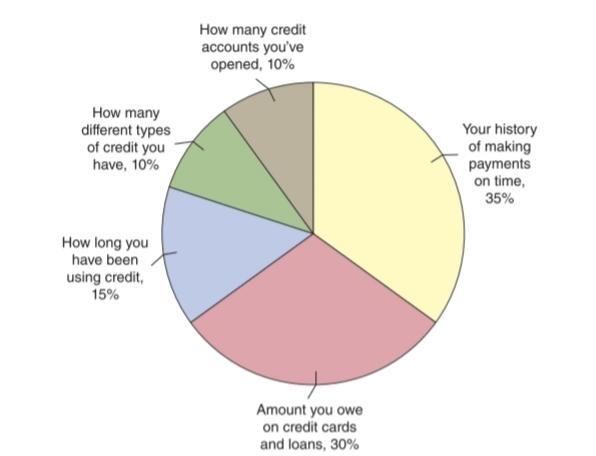

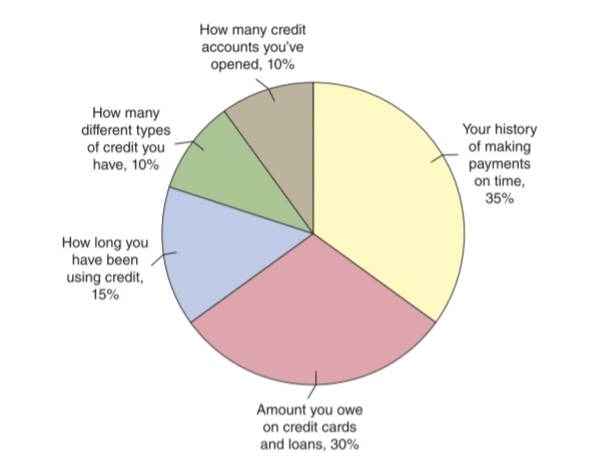

Good Day Sir.I need to solve this case study. Please help me by provide this answer. Word file will be easy to understand. Thank you.FICO: Can One Number Forecast Your Financial Life?and Your Romantic Life?The interest rate you pay on a loan to buy a car or a house, or whether you receive the loan at all, can depend almost entirely on one three-digit number?your FICO score. (FICO is pronounced with a long i: fico.) FICO is an abbreviation of the Fair Isaac Corporation, founded in 1956 by engineer William Fair and mathematician Earl Isaac. At the time the company started, there were no nationwide banks, and credit cards were not widely available. As a result, most households and small businesses depended on bank loans for credit. Bank loan officers typically relied to a significant extent on subjective judgments when granting loans. Because of asymmetric information problems, poor credit risks sometimes received loans and good credit risks were sometimes denied loans.Fair and Isaac realized that advances in computer technology made it possible to use information on borrowers' credit histories to more accurately forecast whether borrowers would make their payments on time. Today, the company produces several credit scores, but the most widely used FICO score is a three-digit number ranging from 300 to 850, with a higher score indicating a better credit history. Your FICO score is based on information Fair and Isaac gather from the three major credit reporting agencies: Equifax, Experian, and TransUnion. Each agency compiles a credit report on anyone who uses a credit card, applies for a loan, or opens a bank account. Nearly every adult has a credit report, although some college students may not. Your credit report includes how much you owe on loans, how many credit cards you have and what their balances are, how reliably you pay your bills on time, where you live, and Who you work for. (You can get a free copy of your credit report by going to the web site of the U.S. Federal Trade Commission: consumer.ftc.govlarticlesl()15 5-free-credit-reports.)For many years, consumers typically did not know their FICO scores because they were not included in the versions of credit reports made available to the public. Beginning in 2002, you could find out your FICO score by obtaining a copy of your credit report. Since 2015, many lenders will provide you with your FICO score for free. While Fair and Isaac do not make public the exact calculations they use in computing scores, they do explain how they weight broad categories of information they obtain from credit reports. The following graph shows these weights. The most important factor in determining your FICO score, with a weight of 35%, is whether you have a history of paying your bills on time, The next most important factor is how much you currently owe on your loans and credit cards.Most people have FICO scores between 600 and 750, Typically, you will need a score above 740 to qualify for the best interest rate on a car loan or mortgage loan from a bank. With a score below 620, you may have trouble getting a mortgage loan from a bank, in part because the government-sponsored enterprises Fannie Mae and Freddie Mac usually do not buy mortgages that banks have made to borrowers with lower scores. Since the financial crisis of 2007?2009, Fannie Mae and Freddie Mac have bought nearly all the mortgages that are securitized, making their requirements the ones that most banks follow.Use of credit scores has spread beyond banks and credit card companies. Insurance companies use scores when they are deciding whether they are willing to offer policies to some applicants and in setting premiums. Some employers use credit scores to decide whether to make job Offers, and some landlords use credit scores to determine who they will rent apartments to. Researchers at the Federal Reserve have even discovered that couples who have similar credit scores at the beginning of their relationship are more likely to stay together than are couples with very different scores. They conclude that apparently "credit scores reveal an individual's relationship skill and level of commitment." Time will tell whether this research leads to a new topic of conversation on first dates!Some Of the new fintech firms, such as Social Finance (SOFi), that have developed web sites for matching borrowers and lenders online are more skeptical Of the usefulness of credit scores. These companies argue that credit scores are too backward looking? focusing on what people have done in the past rather than what they are likely to do in the future. In making lending decisions, SOFi, for instance, focuses on how much of their income borrowers have left after paying their bills, their employment history, and their level of education.Despite these attempts to develop alternative measures of creditworthiness, to this point FICO scores continue to be used in evaluating 90% of credit applications.Question of Case StudyAccording to an opinion column in the Wall Street Journal: "Former Google staffers founded the online lender Upstart, which [makes loans] based on [a borrower's] grade-point average, SAT score, college attended and even major." How does this approach to credit scoring differ from the approach Fair Isaac uses? Is it likely that Upstart is targeting a particular type of borrower? Briefly explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started