Answered step by step

Verified Expert Solution

Question

1 Approved Answer

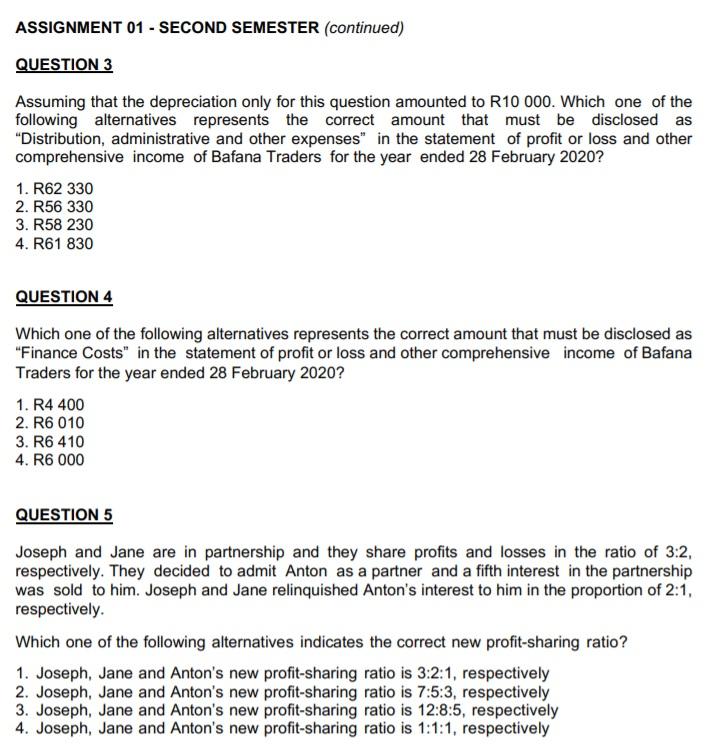

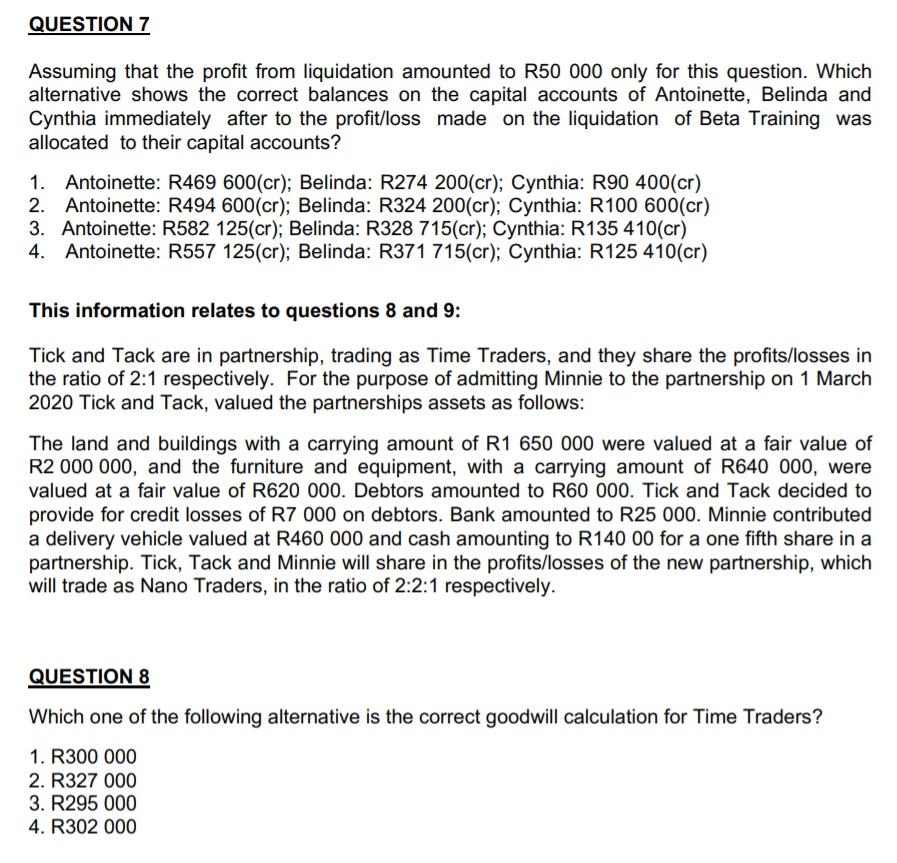

Good day, Would you please guide me, in how I would go about answering the following question. The first part has to do with partnerships.

Good day, Would you please guide me, in how I would go about answering the following question. The first part has to do with partnerships.

The second with ratios and the second Goodwill.

If you could please guide me systematically, how you would answer this question, so that I can learn and also do it myself - I would appreciate it.

Thank you for your help - let me know if need anything else

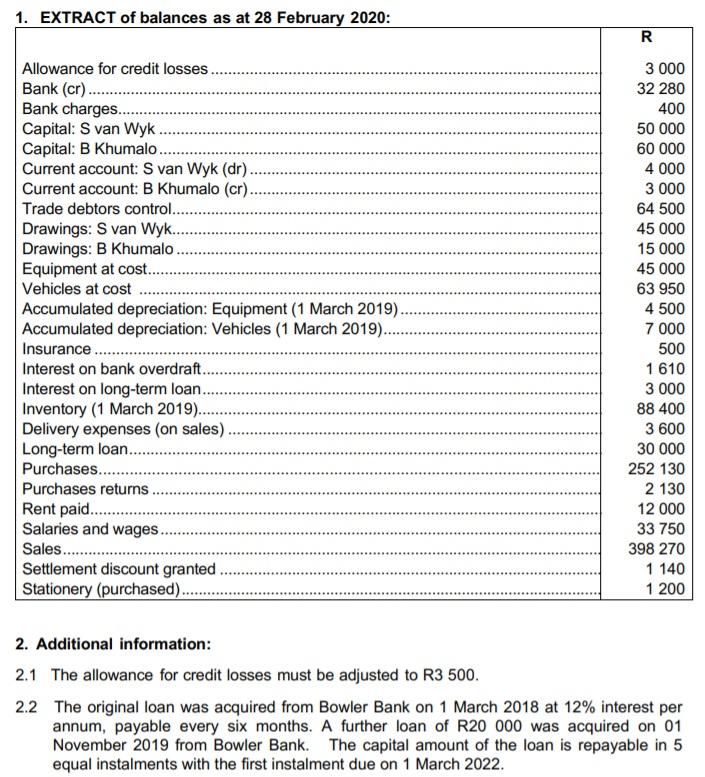

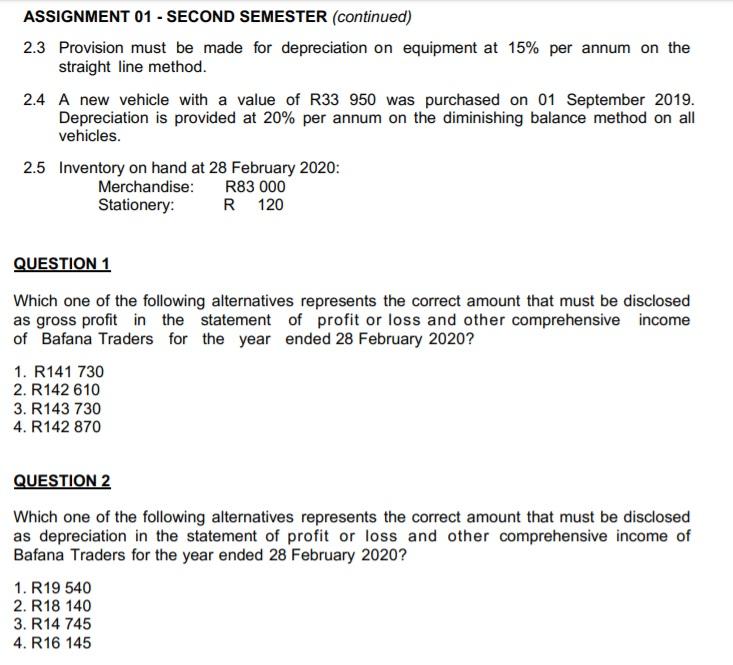

1. EXTRACT of balances as at 28 February 2020: Allowance for credit losses.. Bank (cr)... Bank charges... Capital: S van Wyk. Capital: B Khumalo...... Current account: S van Wyk (dr). Current account: B Khumalo (cr). Trade debtors control.... Drawings: S van Wyk........... Drawings: B Khumalo. Equipment at cost....... Vehicles at cost Accumulated depreciation: Equipment (1 March 2019).. Accumulated depreciation: Vehicles (1 March 2019).. Insurance.......... Interest on bank overdraft... Interest on long-term loan... Inventory (1 March 2019)... Delivery expenses (on sales). Long-term loan.... Purchases........ Purchases returns. Rent paid............ Salaries and wages.. Sales......... Settlement discount granted .. Stationery (purchased).. R3 3 000 32 280 400 50 000 60 000 4 000 3 000 64 500 45 000 15 000 45 000 63 950 4 500 7 000 500 1 610 3 000 88 400 3 600 30 000 252 130 2 130 12 000 33 750 398 270 1 140 1 200 2. Additional information: 2.1 The allowance for credit losses must be adjusted to R3 500. 2.2 The original loan was acquired from Bowler Bank on 1 March 2018 at 12% interest per annum, payable every six months. A further loan of R20 000 was acquired on 01 November 2019 from Bowler Bank. The capital amount of the loan is repayable in 5 equal instalments with the first instalment due on 1 March 2022.

Step by Step Solution

★★★★★

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 Gross profit Sales Inventory as on 28th Feb 2020 Inventory as on 1st March 2019 purch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started