Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Good Soya is a soya source manufacturer, is thinking of launching a project with a 3-year lifespan. Currently Good Soya is utilizing a cost

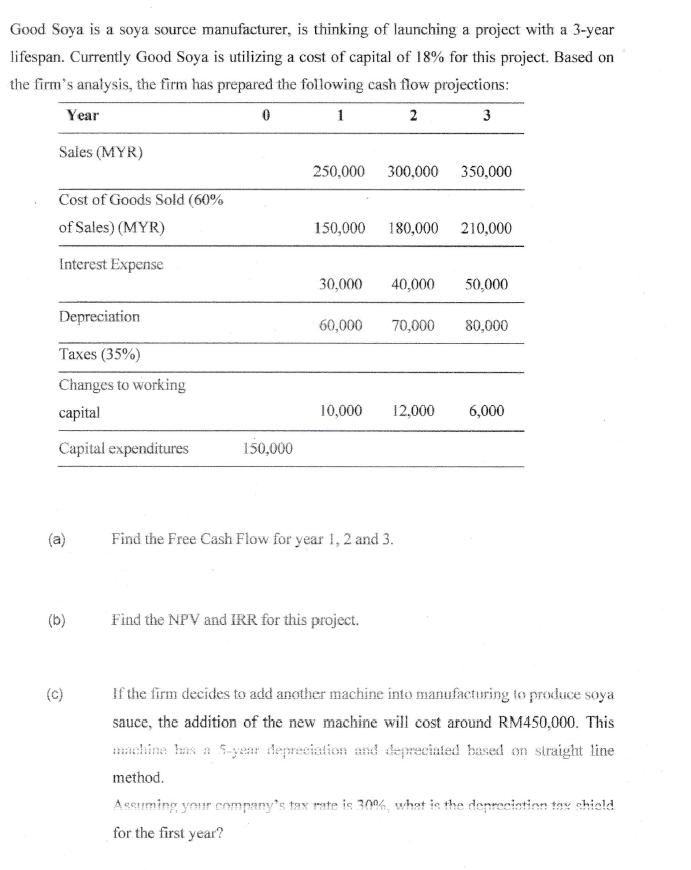

Good Soya is a soya source manufacturer, is thinking of launching a project with a 3-year lifespan. Currently Good Soya is utilizing a cost of capital of 18% for this project. Based on the firm's analysis, the firm has prepared the following cash flow projections: Year 0 1 2 3 Sales (MYR) Cost of Goods Sold (60% of Sales) (MYR) Interest Expense Depreciation Taxes (35%) Changes to working capital Capital expenditures (a) @ 150,000 250,000 300,000 350,000 150,000 180,000 210,000 30,000 40,000 50,000 60,000 70,000 80,000 10,000 12,000 6,000 Find the Free Cash Flow for year 1, 2 and 3. Find the NPV and IRR for this project. (C) If the firm decides to add another machine into manufacturing to produce soya sauce, the addition of the new machine will cost around RM450,000. This machine has a 5-year depreciation and depreciated based on straight line method. Assuming your company's tax rate is 30%, what is the depreciation tax shield for the first year?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the free cash flow FCF for each year we need to subtract the operating expenses from the operating income and then adjust for taxes and c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started