Question

Good Sports, Incorporated, is a private full-line sporting goods retailer. Assume one of the Good Sports stores reported current assets of $91,260 and its

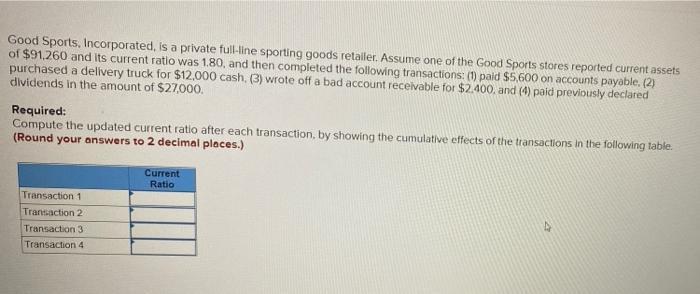

Good Sports, Incorporated, is a private full-line sporting goods retailer. Assume one of the Good Sports stores reported current assets of $91,260 and its current ratio was 1.80, and then completed the following transactions: (1) paid $5,600 on accounts payable. (2) purchased a delivery truck for $12,000 cash, (3) wrote off a bad account receivable for $2.400, and (4) paid previously declared dividends in the amount of $27,000. Required: Compute the updated current ratio after each transaction, by showing the cumulative effects of the transactions in the following table. (Round your answers to 2 decimal places.) Current Ratio Transaction 1 Transaction 2 Transaction 3 Transaction 4

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution I Current assets 91260 Current ratio 16 II ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Financial Accounting

Authors: Fred Phillips, Shana Clor Proell, Robert Libby, Patricia Libby

7th Edition

1265440166, 978-1265440169

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App